Wingstop (NASDAQ:WING) is an exciting fast-casual franchise that is expanding quickly across the globe. Based on my analysis, the stock is likely to deliver a 25% or higher compound annual growth rate in its price over the next three years. Moreover, the investment has approximately a 25% margin of safety, based on my model. There are risks related to the high valuation multiples and a financial strategy hinged on debt (including a negative equity position at present), but I have analyzed the company as a three-year holding and consider it highly probable that it will continue to thrive in this timeframe.

Operational and financial analysisWingstop, one of the worlds fastest-growing fast-casual restaurants, has its origins in Garland, Texas, and has now become renowned in over 1,500 locations worldwide. It has achieved significant success recently in the United Kingdom (TADAWUL:4280), where it now has 39 outlets, with plans to open 15 more.

Wingstop also operates a digital-only restaurant called Thighstop, which cleverly addresses the higher prices caused by chicken wing shortages by offering customers fried thighs as an alternative to Wingstops traditional offerings. By utilizing ghost kitchens, Thighstop requires minimal operational changes and no additional physical stores.

Wingstop faces many direct competitors in the chicken wings, fast-casual, and fast-food markets, including Buffalo Wild Wings, Popeyes Louisiana Kitchen, Chipotle Mexican Grill (NYSE:NYSE:CMG), and Kentucky Fried Chicken. Wingstop is differentiated by its novel approach to bold flavors, clever aviation themes at its restaurants, and its heavy focus on online ordering for competitive prices. However, the companys moat is arguably not very wide, given that it has no patents or totally unique, durable competitive advantage.

What I like about the business is that it is easy to understand and therefore easy to track operationally and financially. Bill Ackman has famously stated that he has made a lot of money from restaurants, and that he loves to invest in them because they are simple to understand. This takes a lot of the stress out of the investment analysis process, as well as helps in ascertaining a suitable entry and exit point.

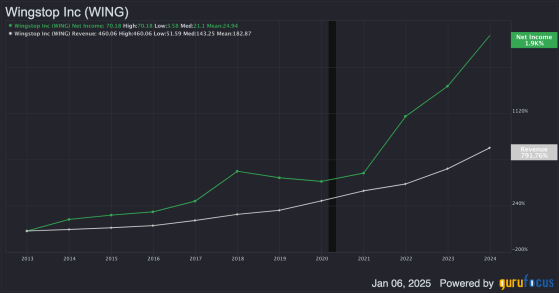

Wingstop has a three-year revenue growth rate of 23% and a three-year earnings per share (EPS) without non-recurring items growth rate of 35%. This growth looks set to continue, with consensus estimates suggesting a future three-year revenue growth rate of 24% and a future three-year EPS without non-recurring items growth rate of 31%. Given this, the price-to-sales ratio appears approximately fair, currently at 14.2 compared to 13.4 as a 10-year median.

Management looks quite robustthe President and Chief Executive Officer, Michael J. Skipworth, previously held senior positions at Cardinal Logistics and worked as part of the audit and assurance practice for KPMG. Another notable member of the team is Marisa J. Carona, the Senior Vice President and Chief U.S. Franchise Operations Officer. Carona previously led strategic initiatives at 7-Eleven and began her career as an engineer, holding leadership roles at Lockheed Martin (NYSE:LMT).

Valuation analysisFor my valuation model, I will be using a period of three years, as I expect this to be the highest alpha opportunity for the stock due to current growth momentum and potential future saturation factors.

Wingstop has trailing 12-month revenues of $591 million, and I find it likely that this will increase at a 20% compound annual growth rate over the next two years, based on previous growth and aligning with consensus estimates. The result of my forecast is an estimated revenue of $1,021.25 million for Wingstop in December 2027.

The companys net margin has been expanding, from 13.75% as a 10-year median to 17% today. If this trend increases over the next three years, I find it plausible that its net margin rises to 19%. This could especially be supported by more focus on digital operations and ghost kitchens. The result of my forecast is a net income of $194.04 million for Wingstop in December 2027.

The companys shares outstanding have been increasing at a compound annual growth rate of 0.2% over the past five years. If this trend continues over the next three years due to further share issuance, the company will have 29.58 million shares outstanding in December 2027. Therefore, I estimate that the company will have an earnings per share of $6.56.

I mentioned that I think the companys valuation multiples are approximately fair right now, using the price-to-sales ratio as a proxy to gauge this. However, some multiple expansion may be warranted due to higher earnings growth compared to revenue growth. If the company trades at a price-to-earnings ratio of 87.5 in December 2027 (which is a conservative estimate, as its current price-to-earnings ratio is 83.2), the stock will be worth $573.98. As the current stock price is $285.27, the implied three-year compound annual growth rate is 26.24%.

Wingstops weighted average cost of capital is 14.99%, with an equity weight of 91.93% and a debt weight of 8.07%, where equity costs 16.13% and debt costs 2.68% after tax. When discounting my estimate for the companys December 2027 stock price back to the present day over three years using the weighted average cost of capital as the discount rate, the implied intrinsic value is $377.50. As the current stock price is $285.27, the implied margin of safety for investment is 24.43%.

Risk analysisThe main risk with this investment thesis is that the companys valuation multiples are very high. Though these are likely sustainable, they open up the potential for more severe volatility in the case of an operational or macroeconomic crisis. Therefore, I consider Wingstop stock to be a good investment at a moderate weight in portfolios. No more than 7.5% appears reasonable to me.

Adding to the operational risk is that to sustain growth, the company is opening many hundreds of stores per year, which requires flawless execution. Any troubles with new target locations not yielding expected returns could lead to underperformance in guidance. Moreover, the associated expenses with readjusting if any locations fail to meet required results could compress the net margin or at least hamper its expansion. As an example of what can go wrong, Wingstop in Tamarac, Florida, was shut down in 2023 after inspectors found 22 violations, including pest issues and unsanitary conditions.

Wingstop also has negative equity due to a securitized financing strategy that allows it to focus more on share buybacks and liquidity enhancement. The company can confidently meet its interest payments, with an interest coverage ratio of 7.77, but the financial strategy comes with risks. For example, in the case of an economic downturn or amid inflationary pressures, it could struggle to meet its debt obligations if reduced revenues or increased costs compress margins. Moreover, as the company does not own the real estate its franchises operate in, its financial structure is dependent on intangible assets like franchise royalties to secure additional financing, which makes it more vulnerable to disruptions.

ConclusionBased on my valuation model, Wingstop has a margin of safety for investment in its stock price of 25%, with a likely three-year stock price compound annual growth rate of over 25%. Therefore, I am highly bullish on Wingstop stock. However, I believe it deserves only a small allocation in portfolios due to its high valuation multiples and debt structure, which present vulnerabilities conducive to heavy volatility in the case of an operational or macroeconomic crisis. Nonetheless, I believe the next three years will be relatively stable for Wingstop, and growth will resume steadily, with a moderate expansion in its price-to-earnings ratio.

This content was originally published on Gurufocus.com