Despite its status as a global communications platform, Twitter (NYSE:TWTR) has failed to unlock its true value. While the San Francisco-based micro-blogging firm posted its first real yearly profit in 2018, its shares continued to underperform.

Other social network companies such as Facebook (NASDAQ:FB), now doing business as Meta Platforms, and Snap (NYSE:SNAP) have seen explosive growth during the pandemic, but Twitter struggled on devising a clear path to take advantage of its massive global reach.

During the past two years, Twitter stock gained just 45% compared with Snap’s more than 200% vault higher. Twitter shares closed on Monday at $44.45, about 40% below where they were at the stock's March peak.

One major reason for this underperformance: unlike its bigger social media rivals, Twitter has failed to make much money from direct response advertising, which thrived during the pandemic as small businesses rushed to increase their social media presence after lockdowns. Twitter relied more on big brand advertising which still makes up 85% of its total sales.

A significant signal that the company is now listening to its investors occurred last week when Twitter’s co-founder and CEO Jack Dorsey announced he is stepping down from his leadership role. His departure comes after investors’ unease over his simultaneous involvement with digital payments company Square (NYSE:SQ) which he also co-founded and where he continues to remain CEO.

His split duties and outside hobbies drew criticism, and last year activist investor Elliott Management Corp. pushed for changes at Twitter.

Dorsey’s departure elevated Parag Agrawal as the new CEO from his previous role as chief technology officer. However, this change has so far failed to excite investors. Since the Nov. 29 announcement of Dorsey’s exit, Twitter shares have fallen 10%, accelerating its plunge this year.

No Quick Fixes

The market’s risk-aversion during the current Omicron uncertainty may have played a role in this downward trend for TWTR, but it’s clear that the company's turnaround won’t materialize quickly. Truist Securities analyst Youssef Squali, in a note last week, said:

“user growth, engagement and the commercialization of the platform have proven much more difficult to nail.”

Even with new leadership, Squali advised investors to be patient. He added:

“Product innovation is the type of heavy lifting, which is likely to take years not quarters to materially affect the revenue trajectory.”

For some investors, Twitter’s stock offers a buying opportunity now that the company has new CEO Agrawal’s undivided attention. As CTO he was instrumental in the company’s new monetization efforts and his appointment as CEO could further speed up this process. Cathie Wood’s ARK Investment Management bought 1.1 million shares of Twitter last week after a selloff.

As well, in recent months, Twitter has made a number of moves as part of its push to double revenue by the end of 2023 and grow its user base to 315 million daily active users from the current 211 million. These initiatives include Twitter Spaces, a new feature that allows live audio conversations.

In addition, Twitter's recently acquired newsletter platform Revue is allowing content creators to publish and monetize newsletters. Another monetization project the company is working on is a monthly subscription product called Super Follows, which will let people charge their followers for exclusive content, like tweets, newsletters or access to audio conversations.

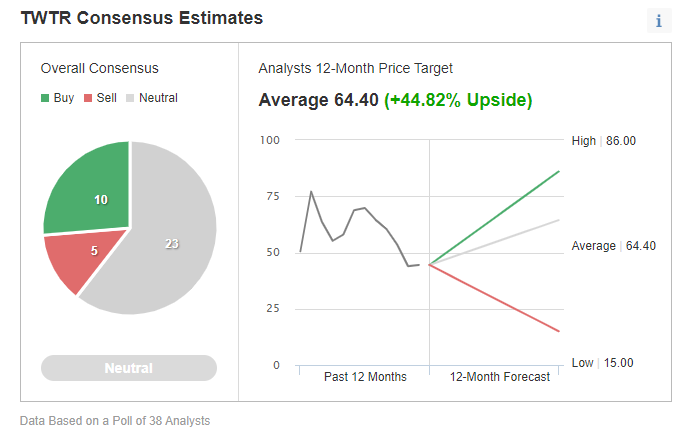

Analysts’ consensus price estimates on the stock indicate that Twitter might have significant upside value as it weathers this bearish spell.

Chart: Investing.com

According to Investing.com, among 38 analysts polled, Twitter shares have about 45% upside in the next 12 months from the stock's current price. However the majority of responses provided a neutral rating on TWTR.

Bottom Line

Twitter has an ambitious multiyear plan to increase the company’s reach and value for shareholders. After Dorsey’s departure, that plan will likely accelerate, making room for the stock price to catch up.

In our view, the current dip could prove a good buying opportunity for long-term investors.