WTI Crude Oil Non-Commercial Positions:

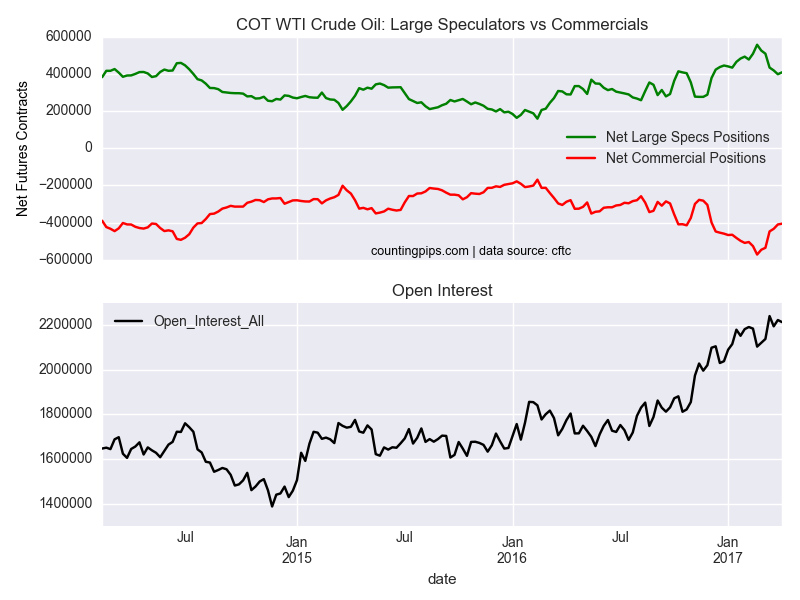

Large speculators and traders increased their net positions in the WTI crude oil futures markets last week following five straight weeks of declines, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial contracts of WTI crude futures, traded by large speculators and hedge funds, totaled a net position of 408,382 contracts in the data reported through April 4th. This was a weekly gain of 10,302 contracts from the previous week which had a total of 398,080 net contracts.

The latest data was the first time speculators have increased their weekly net positions since the record high long position registered on February 21st when speculators were net long by +556,607 contracts.

WTI Crude Oil Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -405,772 contracts last week. This is a weekly change of 4,317 contracts from the total net of -410,089 contracts reported the previous week.

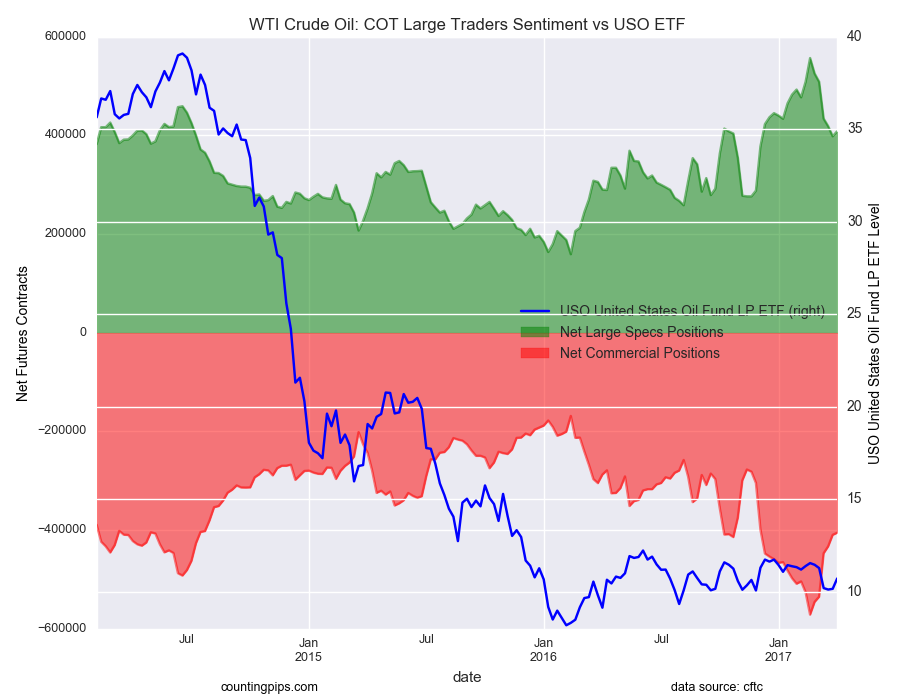

USO Crude Oil ETF(NYSE:USO):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude Oil ETF, which tracks the price of WTI crude oil, closed at approximately $10.71 which was a rise of $0.56 from the previous close of $10.15, according to ETF market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the previous Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).