Zimmer Biomet Holdings (NYSE:ZBH) is a global leader in orthopedics reconstructive products. The company holds the top spot in the worldwide hips and knees replacement markets. Over the past few years, Zimmer Biomet has gone through several challenges, including the Biomet integration, COVID-19 pandemic, compliance challenges and increasing competitive pressure. I believe Zimmer Biomet has resolved most of the challenges and is well-positioned for sustainable future growth. The market has priced in much pessimism at the current valuation but very little optimism. Therefore, I think Zimmer Biomet is a very attractive opportunity.

Business description and competitive landscape

Zimmer Biomet has existed for almost a century. The company's predecessor, Zimmer, was founded in 1927 in Warsaw, Indiana. In 2015, Zimmer completed the combination with Biomet and subsequently changed its name to Zimmer Biomet Holdings.As of Q3 2024, knee products contributed 41% of Zimmer Biomet's revenue, followed by hip products with 26%, 24% in S.E.T (Sports Medicine, Extremities, Trauma, Craniomaxillofacial and Thoracic), and 8% in other revenue.

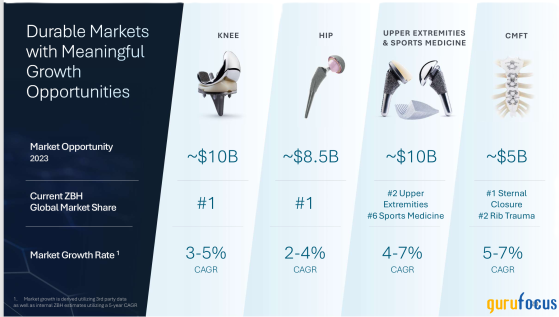

According to Zimmer Biomet's 2024 Investor Day presentation deck, Zimmer Biomet has the largest worldwide market share in knee and hip replacement. In the upper extremities, sports medicine, and CMFT ( craniomaxillofacial and thoracic) markets, Zimmer Biomet is also one of the major players. Zimmer Biomet's dominance in these segments is due to its extensive product portfolio and technologies, developed through significant R&D investments and strategic acquisitions over more than 90 years.

The knee and hip replacement markets are very mature with low single-digit growth rates. Zimmer Biomet has dominated these markets for many years. The S.E.T market is less mature, with a faster growth rate than the knee and hip replacement markets. However, Zimmer Biomet's competitive position in these markets is less strong than that of the knee and hip replacement markets.

Compared to Zimmer Biomet's largest competitors, such as Stryker(NYSE:SYK) and Johnson and Johnson (JNJ), Zimmer Biomet's largest competitive advantage is the surgeon relationships, as Zimmer Biomet has a very loyal group of surgeons. Zimmer Biomet is very good at on-boarding surgeons in their early careers. They carefully maintain these relationships over their long careers through training seminars and involving the surgeons in product design.

Zimmer Biomet's second competitive advantage is its strategic focus on the orthopedics market. Both Stryker and Johnson & Johnson have other major diverse business lines such as cardiovascular or endoscopic products. Zimmer Biomet operates as a pure-play orthopedics company. This focus enables the company to concentrate resources and expertise on the orthopedic market and respond more quickly to market demands and technological changes.

Recent challenges

Zimmer Biomet has faced challenges since Zimmer acquired Biomet. The following table shows that Zimmer Biomet's revenue has remained flatter since FY 2016.Many of the challenges Zimmer Biomet faced resulted from the merger of Zimmer and Biomet in 2015. Zimmer and Biomet had completely different corporate cultures. After the merger, the cultural differences led to internal tension between Zimmer and Biomet employees. Since the merger, Zimmer Biomet has had four warning letters from the FDA since May 2016. These warning letters severely damaged Zimmer Biomet's reputation with the consumer and the federal agency.

Zimmer Biomet made some progress on rebuilding the culture under former CEO Bryan Hanson. Unfortunately, the COVID-19 pandemic hit soon after, and the crisis severely impacted Zimmer Biomet's business. The demand for products was postponed due to the widespread disruptions caused by the pandemic, and the supply chain was also disrupted, leading to significant challenges for the company.

The third challenge Zimmer Biomet has faced is competitive pressure in its core knee and hip market. While still ahead of most of its competitors, Zimmer Biomet has lagged behind Stryker in the robotic surgery technology as Stryker continuously gained market share with its MAKO robots. Zimmer Biomet has tried to catch up with its own ROSA robotic products. It has made very good improvements but ROSA is still inferior to MAKO in terms of technological capabilities.

I believe Zimmer Biomet has made considerable progress in addressing those challenges. The company has cleared all four FDA warning letters. Its supply chain is much more resilient today with a more geographically-balanced supplier base. Management is also committed to a more responsive and adaptive R&D strategy. There are clear signs that Zimmer Biomet has changed in a very positive way.

Valuation analysis

Zimmer Biomet's total revenue for FY 2024 is estimated to be approximately $7.7 billion. Over the past 5 years, the company's revenue has declined at an annual rate of 2.5% due to the aforementioned challenges. However, Zimmer Biomet's revenue growth for the past trailing-twelve-month has accelerated to 6.5%. Given Zimmer Biomet has overcome most of the challenges, I am forecasting mid-single-digit revenue growth over the next 5 years.The company's gross margin has remained mostly stable between 69% and 72% during the past decade. Its net margin had declined and remained low for many years after the Biomet acquisition. However, net margin has recovered to low-teens during FY2023 and the first nine months of FY2024. I expect the company's gross margin and net margin to be stable over the next 5 years.

Based on Wall Street's analysts estimate, Zimmer Biomet is trading at barely 13.4 times forward earnings, while the sector median is 20 times. Zimmer Biomet is trading at a 35% discount to the sector median. While Zimmer Biomet has experienced more challenges than Stryker and Johnson and Johnson, the valuation discount is too big. As a pure-play in orthopedics, Zimmer Biomet should be able to grow faster than Stryker and Johnson and Johnson if the market recovers and accelerates. If Zimmer Biomet can grow faster than its peers, the stock can re-rate to a discount of 15-20% of the sector median P/E multiple, which gives me a price target of $135-145 per share, which is 30-35% above today's price.

In terms of DCF valuation, if we use a 10% discount rate and assume that Zimmer Biomet can grow its earnings at 8% over the next 10 years and 4% afterwards, the implied current intrinsic value per share is $120. At the current price of $106, Zimmer Biomet's stock price has an 11% margin of safety.

Risk analysis

With regard to risks, I am mostly concerned with three risks for Zimmer Biomet.The first is competitive risk, particularly in the core knee and hip market. As I have mentioned above, while Zimmer Biomet remained No.1 in the knee and hip replacement markets, its competitors, especially Stryker, have taken market share from Zimmer Biomet due to technological advancement. Zimmer Biomet needs to be more proactive in innovation and R & D spending.

The second risk is political and regulatory risk. Healthcare spending as a percentage of U.S. GDP has reached an all-time high. Consequently, healthcare companies, particularly medical device manufacturers, have faced increased scrutiny from regulators and policymakers. While Zimmer Biomet may not be large enough to be singled out as a specific target by the government, it could be adversely impacted by regulatory actions targeting the whole orthopedics industry.

The third risk for Zimmer Biomet is reimbursement risk. As value-based payment systems become more prevalent in healthcare, insurance companies such as Humana (NYSE:HUM) and Aetna may not fully reimburse patients for the cost of orthopedic surgeries, which will put pricing pressures on all orthopedic companies, including Zimmer Biomet.

Conclusion

In conclusion, Zimmer Biomet is still the top player in the orthopedics industry, with one of the most comprehensive products offering across different orthopedics end markets. Zimmer Biomet has faced significant challenges in recent years, including the Biomet integration, COVID-19 pandemic, regulatory issues, and competitive pressures. However, with a loyal surgeon base, extensive R&D capabilities, and a strategic focus on growth markets, Zimmer Biomet is well-positioned for sustainable long-term growth. At the current market valuation, Zimmer Biomet is trading at a substantial discount to its peers. I believe the stock has limited downside and considerable upside if investors recognize Zimmer Biomet's strengths and growth potential.This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI