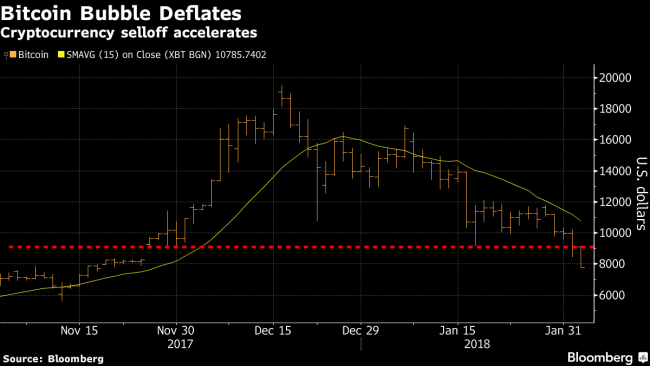

(Bloomberg) -- Bitcoin whipsawed investors, falling below $8,000 for the first time since November before recovering most of today’s losses, as a miserable 2018 continued for cryptocurrencies, with investors confronting a mounting list of concerns about the future of the industry.

Since reaching a record high of $19,511 on Dec. 18 shortly after the introduction of regulated futures contracts in the U.S., Bitcoin has wiped out more than half its value amid waves of negative news. Setbacks included escalating regulatory threats from authorities around the world including India, South Korea, China and the U.S., a record $500 million heist at Japanese exchange Coincheck Inc., fears of price manipulation and Facebook’s ban on cryptocurrency ads.

Japanese authorities raided Coincheck’s offices Friday morning, a week after the robbery, hauling out documents and computers as evidence. The inspection was conducted to ensure security for users, Finance Minister Taro Aso said.

“Bitcoin is in trouble,” Lukman Otunuga, a research analyst at foreign exchange broker Forextime Ltd, wrote in a note Friday. “Price action suggests that bears are clearly in control, with further losses on the cards as jitters over regulation erode investor appetite further.”

The largest digital currency dropped as much as 16 percent to $7,643, before trading at $8,715 at 9:52 a.m. in New York, according to consolidated Bloomberg pricing. Bitcoin is down 21 percent on the week. Rival coins Ripple, Ether and Litecoin tumbled at least 18 percent as losses continued to spread across cryptocurrencies.

Nouriel Roubini of Roubini Macro Associates said Bitcoin is the “mother of all bubbles,” and its bubble is now bursting, speaking in an interview on Bloomberg Television. He said “virtually every” Group of