By Marco Aquino

LIMA (Reuters) -Peruvian copper production is expected to remain flat in 2025 for the third straight year, according to the country's top mining association and industry analysts, as declining ore grades and a lack of new projects cap output.

The South American country is a global copper powerhouse, ranking third in production behind Chile and the Democratic Republic of the Congo, which unseated Peru from second place in 2023.

Yet poorer ore grades after years of extraction are making it more difficult for miners to maintain output levels, just as a major copper supply deficit is looming in the next decade due to anticipated demand for electric vehicles, renewable energy and data centers.

The expected gap has put pressure on some of the world's biggest miners to secure more supply through massive acquisitions, such as BHP's $49 billion bid for Anglo American (LON:AAL) that was rejected this year.

Copper prices on the London Metal Exchange began the year just above $8,580 a metric ton, and after falling from a record high of more than $11,000 a ton in May are now at about $8,869 a ton.

Peru's top mining association SNMPE expects the country's 2025 copper output to hit around 2.8 million metric tons, matching 2023 and what is expected for 2024, as miners contend with poorer-quality resources and development bottlenecks for new projects.

"By 2025, Peruvian copper production is expected to be similar to this year's expected 2.8 million tons," said Victor Gobitz, SNMPE's head, in an interview last week.

Peru's mining ministry has not issued a 2025 forecast and did not respond to a request for comment.

Juan Carlos Ortiz, vice president of Peru's Institute of Mining Engineers, said he expected flat production given the lack of new projects.

"We are going to repeat the copper production of 2024," said Ortiz, who is also vice president of operations at Minas Buenaventura.

A dramatic turnaround is looking unlikely anytime soon. Peru's last new mine was Anglo American's $5.5 billion Quellaveco, which opened in 2022 with expected annual capacity of 300,000 tons.

It currently accounts for more than 10% of domestic output.

BOOSTING PRODUCTION

At best, Peru could get a bump from Southern Copper's Tia Maria project, with production expected in 2027, and Teck Resources (TSX:TECKa)' Zafranal, forecast for 2029. Together, they would add about 150,000 tons of annual output.

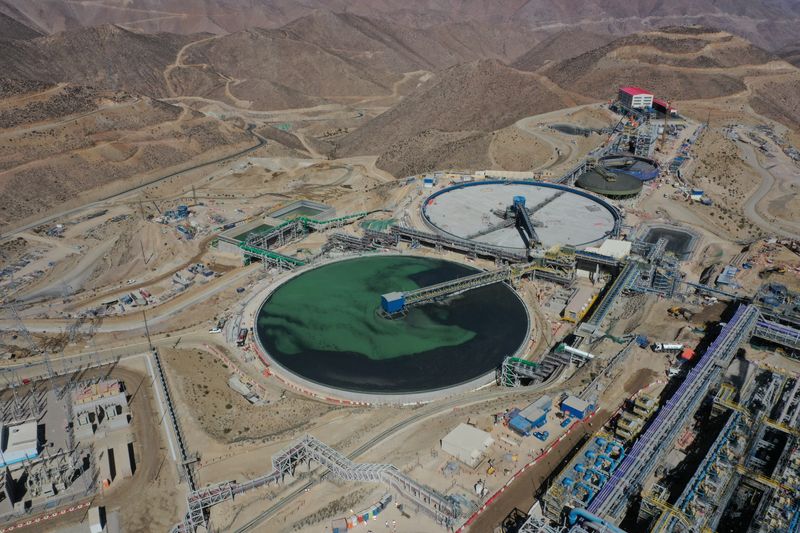

Miners are also working to boost their processing capacity to compensate for poorer ore grades.

Most of the $3.8 billion invested in the sector so far this year was for concentrator plants and equipment, representing a 2% increase from last year.

As well, energy use at copper mines increased 2.3% year-over-year through October, according to private power sector body COES.

"What matters now is that work continues," Gobitz said, referring to small projects such as Tia Maria, Zafranal and mine expansions. "We're not seeing a project like Quellaveco."

Of Peru's 10 biggest copper mines, seven reported lower production through October, the latest month with official data available, compared to last year.

At the largest, Freeport McMoRan's Cerro Verde, production fell 5.4% year-on-year through October. Freeport previously told investors it expected lower ore grades to affect 2024 sales volumes.

"Annual production will vary with ore grades, but Cerro Verde's 2024 operating rates have been strong," Freeport spokeswoman Linda Hayes said.

She added that most of Cerro Verde's spending is for operational improvements, and urged Peru's government to streamline regulatory processes and encourage exploration.

Despite Peru's struggles, it may have a chance to recoup its No. 2 global spot from its African rival. By the end of August, Congo's production fell nearly 6% from 2023, leaving room for Peru - down less than 1% - to pull slightly ahead.