(Bloomberg) -- Mario Draghi is about to end an era by halting the European Central Bank’s flagship stimulus program even with an economic outlook that is murky at best.

The ECB president is expected to stick to the plan made six months ago to end bond purchases at 2.6 trillion euros ($3 trillion), arguing that the euro area’s fundamentals are still sound enough to support the buildup of inflation.

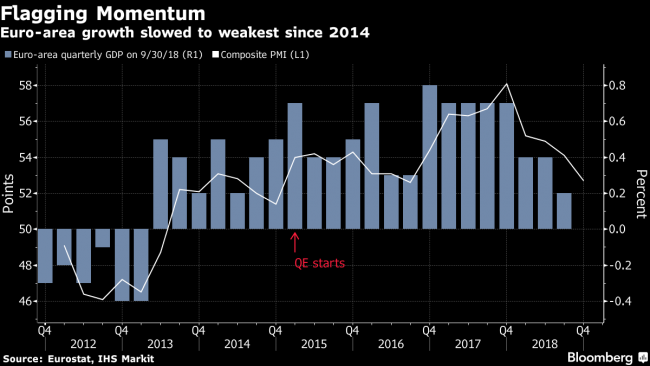

Yet that move -- four years after the U.S. Federal Reserve ended its program -- comes after a sharp weakening in economic data. The ECB’s updated projections are set to show slower momentum, while global trade tensions, Brexit and an Italian fiscal crisis remain threats.

With that backdrop, Draghi is unlikely to drop new hints on when interest rates will start rising, though investors might get an update on the strategy for reinvesting maturing bonds. The ECB will announce its decision at 1:45 p.m. in Frankfurt, and the president will hold a press conference 45 minutes later.

Economic Prospects

Dwindling exports and a slowdown in spending and investment cut the pace of euro-area growth in half last quarter. Since then, data have pointed to persistent weakness.

Economists surveyed by Bloomberg say threats to the outlook have increased since the last policy decision, citing global trade spats and Italian politics as their biggest concerns. Yet policy makers are likely to maintain their assessment that risks are still “broadly balanced,” keeping to their narrative that the economy is facing a temporary blip as it transitions into a pace closer in line with its potential.

Consumer-Price Outlook

While headline inflation has hovered around the ECB’s goal of just below 2 percent for the past seven months, it’s largely driven by energy and set to ease after the recent slide in oil. A gauge stripping out volatile components clocked in at 1 percent in November.

Updated projections will include a first glimpse at price developments in 2021. The number will be crucial for policy makers arguing that the effects of quantitative easing won’t cease with the end of net asset purchases.

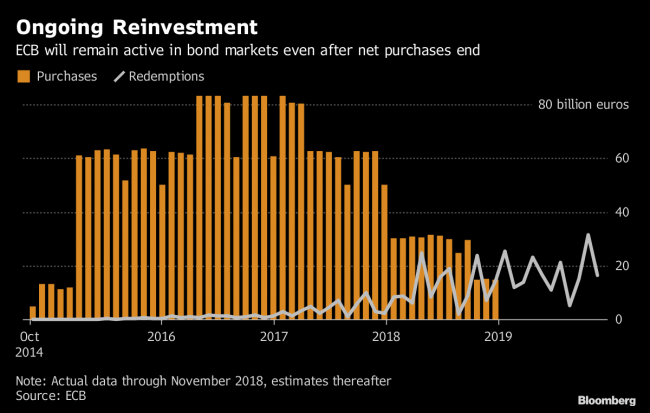

Maturing Debt

Policy makers have spent the past weeks discussing changes to their reinvestment strategy and hinted at an announcement in December.

Economists and investors can expect more clarity on how much flexibility the region’s central banks will allow themselves with regard to time frame, jurisdiction and asset classes in which proceeds from maturing debt will be spent. At the same time, Draghi is unlikely to be forthcoming on the overall duration of reinvestments.

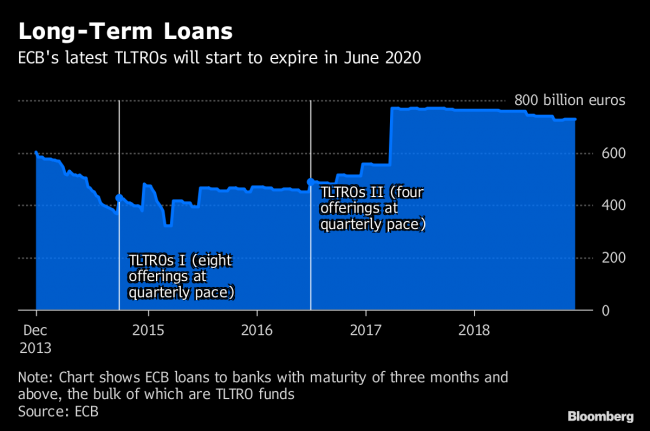

Bank Funding

Since it became clear the ECB would probably end bond purchases, attention shifted to alternative means of support.

Economists see the central bank handing out new long-term loans next year. While an announcement on Thursday is unlikely, Draghi may acknowledge that the Governing Council has discussed the issue and may take a decision in the coming months.

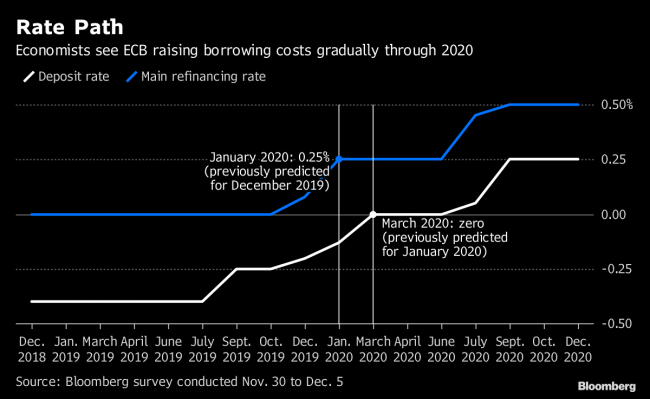

Interest Rates

Policy makers are likely to reiterate their guidance that borrowing costs will remain on hold “at least through the summer of 2019.” While uncertainty surrounding the economic outlook hasn’t changed economists’ prediction for a lift-off in the deposit rate in September next year, it pushed back their forecast for when the rate will reach zero. Investors are pricing the first hike for the first quarter of 2020.