Investing.com - Here are the top five things you need to know in financial markets on Thursday, June 8:

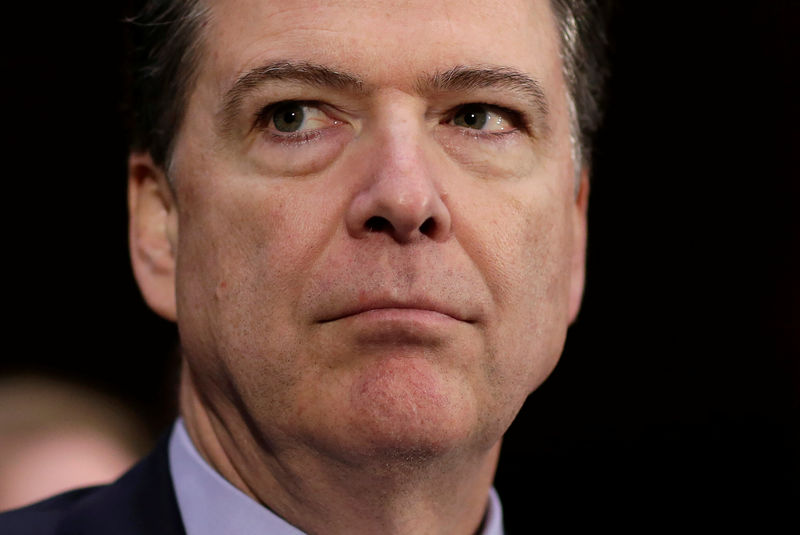

1. Comey testimony in focus

Former FBI director James Comey is scheduled to testify before the Senate Intelligence Committee on Russia's alleged meddling in the 2016 U.S. election at 10:00AM ET (1400GMT) Thursday, marking the first time he publicly speaks since being fired from his post last month.

Comey is expected to be asked about conversations in which President Donald Trump is reported to have pressured him to drop an investigation into former national security adviser Michael Flynn, whose ties to Russia are under scrutiny.

In written testimony released on Wednesday, Comey quoted Trump as telling him the Russia investigation was a "cloud" impairing his ability to operate as president.

The dollar index stood at 96.71 in early New York morning trade, within sight of Wednesday's seven-month low of 96.45.

Investors are fearful that the Trump administration may be further damaged by any revelations that could emerge during the testimony, which could dampen already flagging momentum for the White House economic agenda.

2. ECB policy meeting eyed

The European Central Bank will hold its policy meeting in the Estonian capital of Tallinn on Thursday, with the policy announcement due at 7:45AM ET (1145 GMT), followed by President Mario Draghi's news conference 45 minutes after the announcement at 8:30AM ET (1230 GMT).

With no policy change expected, market players are focusing on how the central bank may alter its economic assessment and policy guidance.

According to sources familiar with the matter, the ECB is likely to nudge up its forecasts for economic growth in the euro zone but trim its estimates for inflation.

The euro traded at 1.1253 against the greenback, not far from its seven-month high of 1.1285 touched earlier this month.

3. Voters head to the polls in the U.K. general election

Britons will head to the polls on Thursday, with voters set to elect 650 members to the Lower House of Parliament from which a government will be formed. Results are expected late in the evening after the market closes.

A final flurry of opinion polls on Wednesday gave Prime Minister Theresa May's Conservative Party a lead between 5 and 12 percentage points over the main opposition Labour Party, suggesting she would increase her majority.

However, British opinion polls have had a relatively poor track record recently, raising expectations that the election outcome could again spring a surprise.

The pound rose to a two-week high of 1.2978 against the dollar, before falling back to 1.2965, little changed on the day.

4. China May exports, imports speed up

China reported stronger-than-anticipated exports and imports for May, official data showed Thursday, suggesting the economy is holding up better than expected.

Exports rose 8.7% from a year earlier, above forecasts for a gain of 7.0%, while imports expanded 14.8%, beating expectations for an 8.5% increase, official data showed on Thursday.

That left the country with a trade surplus of $40.81 billion for the month, the General Administration of Customs said.

5. Oil bounces back after suffering worst day in 2 weeks

Oil prices edged higher on Thursday, one day after settling at their lowest level in about a month after data showed that U.S. crude stockpiles unexpectedly climbed for the first time in nine weeks.

U.S. crude was at $46.03 a barrel, up 31 cents, or around 0.7%. It ended down more than 5% on Wednesday after hitting its lowest since May 9 at $45.65.

Brent tacked on 34 cents to $48.40. The global benchmark touched $47.96 in the prior session, a level not seen since May 5.