(Bloomberg View) -- In response to U.S. President Donald Trump's threatened tariffs on European imports such as steel, aluminum and cars, the European Union is threatening to slap a 25 percent duty on jeans, cosmetics, bourbon and Harley Davidson motorcycles. This is an intentionally cartoonish list of U.S. staples designed to portray Trump's attempt at a trade war as a farce. And indeed, if Trump were serious about fixing the U.S. trade imbalance with Europe, these tariffs are the last thing he should want. Instead, he should ask statisticians from both sides to sit down together and work out what's really behind the imbalance.

According to EU data, in 2016, the U.S. imported some 5 billion euros ($5.55 billion at that year's average exchange rate) worth of European steel. The reverse flow was worth about 1 billion euros. U.S. aluminum imports from Europe amounted to about $500 million. These are tiny numbers given the scale of EU-U.S. trade in goods, worth about 600 billion euros in 2016. If Trump decides to hit cars with tariffs too, that would be more important: The EU's surplus from trading in "automotive products" with the U.S. is a whopping 35.9 billion euros.

Obviously, even if high tariffs are imposed at both ends, all trade in these goods -- especially in German-and British-made luxury cars -- won't cease. Real-life damage from the tariffs probably wouldn't even cover the discrepancy between EU and U.S. statistics on mutual trade.

According to the U.S. Census Bureau, the goods trade deficit with the EU reached $146.7 billion in 2016. According to the EU, its surplus with the U.S. that year reached 112.9 billion euros. At the average exchange rate for 2016, 1.11 euros to the dollar, that's $125.3 billion. There's a $21.4 billion "asymmetry" in the data, enough to cover the U.S. steel and aluminum trade deficit four times over.

The accounting differences are even more pronounced when it comes to services. Both parties claim a surplus in mutual services trade. The problem appears to be mostly with construction, personal, cultural and recreational services, which the U.S. counts simply as "general business services" and, compared with the EU, underestimates.

The asymmetries have existed for years, and experts still have no clear idea of their exact sources. All other arguments about the destructiveness of trade wars aside, there's not much point waging a trade war whose effects would probably be smaller than these statistical discrepancies. It's a bit like sending soldiers to seize a disputed territory that is pictured differently on the warring sides' maps.

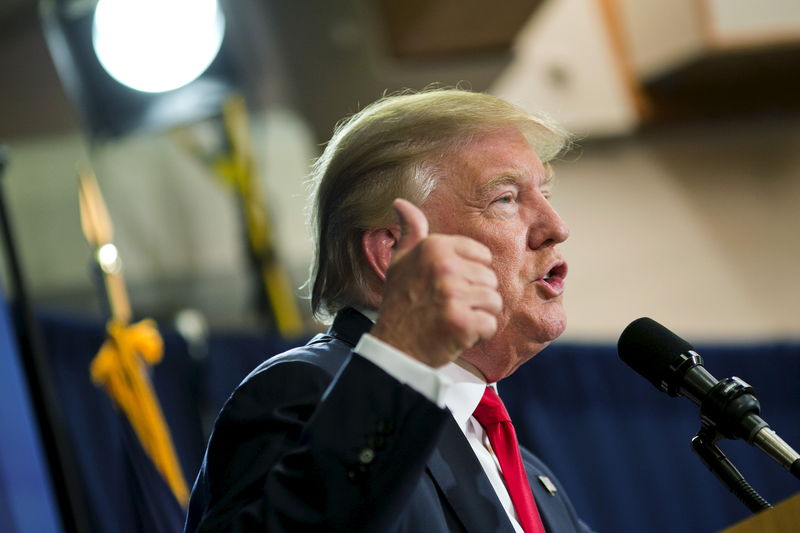

Obviously, statistical anomalies don't hurt anyone; tariffs do. And a nerdish conversation about trade statistics wouldn't help Trump keep his election promises and play to his base. This U.S. president has never let facts get in his way, and so the EU is preparing a farcical response that also ignores the facts and simply shows Trump that Europeans can easily switch to local jeans brands and drink scotch, cognac, grappa or schnapps instead of bourbon. Wars are frequently fought for reasons that defy common sense, and "damn the consequences" could be written on most belligerent parties' banners.

And yet it would make sense, before decisions are made on moves and countermoves, for the parties to conduct an official joint analysis of their mutual trade flows. It might indeed transpire then that certain industries operate under unfair terms of trade; in that case, deals -- which Trump supposedly likes even more than wars -- could be made. It might also turn out that the imbalances in some industries compensate for those in others. And the sides might also come to a joint conclusion that some of the imbalances have nothing to do with the terms of trade, but only with undeniable competitive advantages (although such a discussion about cars might eventually move to a pub and run beyond its closing time).

Bilateral asymmetries also exist in U.S. trade data with other partners. But the EU is ideally suited for a clarification exercise: Its members are U.S. allies, and the EU's powerful trade apparatus is full of experts familiar with U.S. methodology. Removing the deficit discrepancies -- and perhaps boosting the U.S. trade balance in the process -- would be a worthier result for the U.S. administration than a row with Europe over steel and Levi's.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Leonid Bershidsky is a Bloomberg View columnist. He was the founding editor of the Russian business daily Vedomosti and founded the opinion website Slon.ru.