Investing.com - Even though the U.S. economy has dodged this year's expected recession in a scenario of historically high interest rates, and with disinflation underway, analysts at Vanguard see a "soft landing" as unlikely.

What's more, in a report on the outlook for 2024 they consign that the last leg on the downward path of inflation toward the 2% target will be the most difficult.

"The last mile on the road to 2% inflation will be the most difficult. In the coming year, we expect a combination of below-trend growth, rising unemployment and slowing wage growth," they warn.

Vanguard explains that the cooling will occur as the labor market eases, mainly due to higher-than-expected labor supply growth.

This would lead to the U.S. economy showing growth of only 0.5%, significantly below the 2.5 to 3% range they expect for all of 2023.

With this scenario, strategists have a more moderate outlook on the initiation of interest rate cuts by the Federal Reserve (Fed) relative to market expectations.

"We expect the Fed to initiate monetary policy discussion in the second half of 2024, and we expect the policy rate to fall below 4% by the end of 2024," they comment.

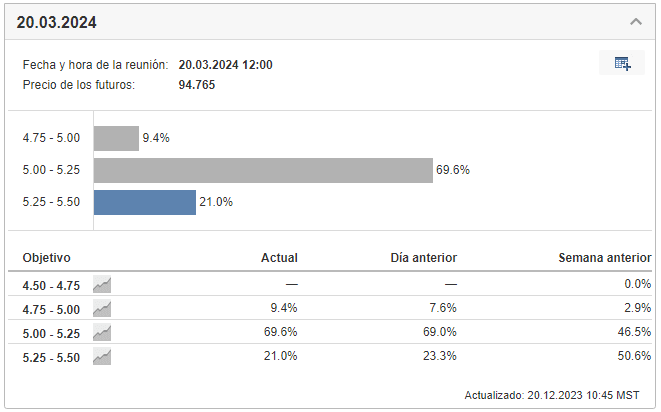

In contrast, markets assign a nearly 70% probability that the central bank will lower interest rates as early as March 2024, as seen at Investing.com Fed Rate Barometer, based on fed funds futures prices.

Source: Investing.com's Fed Rate Barometer.

Why did the U.S. economy surprise in 2023?

Contrary to expectations a year ago, the U.S. economy has shown resilience, described as "exceptional" by Vanguard analysts, since the Federal Reserve began raising interest rates early last year to combat inflation.

It is worth remembering that since March 2022 until now, funding rates have accumulated increases of 525 basis points (bp).

This, they refer in their analysis, is due to various measures that have offset the impact of monetary policy, including pandemic-era fiscal support for households and recent industrial policy legislation.

"Consumer resilience and fiscal policy are behind this outperformance. A strong labor market that has averaged more than 225,000 monthly job creations in 2023 has driven above-trend growth in real incomes. This has added to household balance sheets, which were already stronger due to fiscal support received during the COVID-19 pandemic," they note.

To this they add that the Bipartisan Infrastructure Act, the CHIPS Act and the Inflation Reduction Act have further supported growth through private and public investment.

"The U.S. economy is outperforming expectations at this stage of the monetary policy firming cycle. Our analysis suggests that, but for the offsets, the economy would have grown in the near 0.0% range in 2023 instead of growing between 2.5% and 3%," they comment.

_

Translated from Spanish using DeepL.