By Geoffrey Smith

Investing.com -- Congress confirms Joe Biden as president-elect; Donald Trump backs down on leaving the White House after his supporters trashed the Capitol. Weekly jobless claims and monthly trade balance data are due; Alibaba and Tencent head for the U.S.’s naughty list, and oil consolidates above $50. Here’s what you need to know in financial markets on Thursday, January 7th.

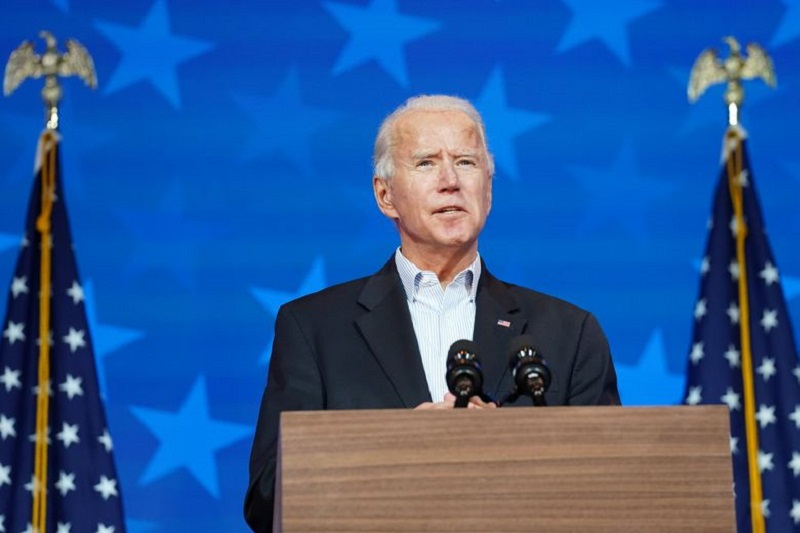

1. Biden confirmed, Trump promises to go quietly

Congress confirmed the election of Joe Biden as duly-elected president, paving the way for his inauguration on January 20th. Donald Trump said via a spokesman that he would guarantee an orderly transition of power.

The developments came after Trump’s supporters, many of them armed, stormed the Capitol in an unprecedented episode that left four people dead. Police reported “in excess of 52 arrests”. Biden called the incident “an insurrection”. In a video message subsequently taken down by Twitter, Trump repeated his support for the rioters, telling them: “We love you very much.”

Republican Congressmen and Senators continued to challenge the electoral results submitted by the states - even after the riot - repeating allegations that have been dismissed as unsubstantiated in over 60 legal cases by U.S. courts. A YouGov poll indicated that 45% of Republican voters supported the rioters’ action.

2. Dollar, Treasuries trim losses after Senate-driven sell-off

The dollar and U.S. Treasury bonds trimmed their losses after the Democratic Party’s apparent victory in both of the Georgia Senate runoffs handed control of the upper chamber back to the party after six years.

Both had sold off on Wednesday in anticipation that Biden will be able to push through a more progressive agenda once inaugurated, given that vice-president Kamala Harris will have the casting vote in a Senate split 50-50.

By 6:30 AM ET (1130 GMT), the dollar index, which tracks the greenback against a basket of advanced economy currencies, was up 0.4% at 89.877, while the 10-Year bond yield was at 1.04%, down from a high of 1.07% (prices and yields move inversely).

Dollar-debasement trades, reflected in the price of various crypto-currencies, continued unabated. Bitcoin topped $37,175 with a 7.8% gain and Ethereum rose 6.6% to a three-year high of $1,225.

3. Stocks set to open higher on stimulus prospects; jobless claims eyed

U.S. stock markets are poised to open higher again, as the prospect of further stimulus from both the government and the Federal Reserve banishes any concerns about the stability of U.S. democracy and the rule of law.

By 6:30 AM ET, Dow Jones Futures were up 62 points, or 0.2%, while S&P 500 Futures were up 0.3% and NASDAQ Futures were up 0.6%.

The market’s attention early on is likely to be focused on jobless claims for last week, which are due at 8:30 AM ET. Initial jobless claims are expected to rise to 800,000 from 787,000, while continuing claims are seen edging down by some 20,000 to 5.200 million. The ISM non-manufacturing survey is also due, as are the last trade balance figures of the Trump presidency. They’re expected to show a deficit of $65 billion in November, around 30% wider than when he took office.

4. Alibaba and Tencent head toward U.S. blacklist

The U.S. is considering extending a U.S. stock market ban on Chinese companies to Internet giants Alibaba (NYSE:BABA) and Tencent (OTC:TCEHY), according to The Wall Street Journal, in what would represent a further severing of the financial ties between China and U.S. capital markets.

The news came a day after the New York Stock Exchange again changed tack and went ahead with the delisting of three big Chinese telecom companies.

Alibaba and Tencent are China’s two most valuable private companies, with a combined value of over $1.3 trillion. Both sets of ADRs fell over 4% in late trading in New York on Wednesday. The move would come at a particularly painful time for Alibaba, whose founder Jack Ma is coming under increasing pressure from Chinese regulators over the activities of Alibaba’s financial services affiliate Ant Group.

5. Oil consolidates after EIA data

Crude oil prices consolidated above $50, still enjoying the support from Saudi Arabia’s unexpected decision to cut production unilaterally by 1 million barrels a day in February and March.

The move represents a return, if only temporary, to acting as the world’s swing producer, a role it has tried many times in the past to shed, but one that it is repeatedly forced to assume given its unparalleled production capacity and low operating costs.

By 6:40 AM, U.S. crude futures were up 0.3% at $50.76 a barrel, while Brent was down 0.3% at $54.16 a barrel. Concerns about the near-term outlook for demand were alleviated by a bigger-than-expected drop of 8 million barrels in U.S. inventories last week, according to government data.