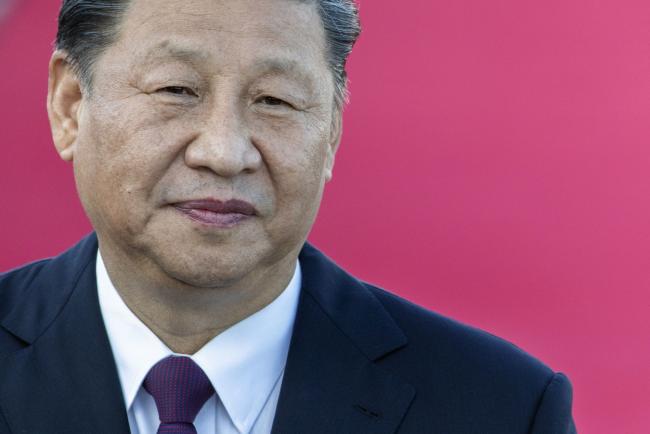

(Bloomberg) -- President Xi Jinping was expected to shore up plans this week to make southern China a global technology hub, including a speech in Shenzhen and meetings with the leaders of Hong Kong and Macau.

Xi was scheduled to deliver an address Wednesday, the official Xinhua News Agency said Monday. The trip was intended to mark the 40th anniversary of the special economic zone that transformed Shenzhen from a sleepy fishing village to a bustling metropolis of more than 13 million people and home to multinational companies including Huawei Technologies Co. and Tencent Holdings (OTC:TCEHY) Ltd.

The Communist Party intends to build Shenzhen into a “socialist pilot zone with Chinese characteristics” over the next five years, Xinhua reported Sunday, publishing an outline of the plan. China will push forward cooperation between Shenzhen and Hong Kong to a “higher level” to strengthen the key role in the Greater Bay Area, said Xinhua without offering more details.

Shenzhen will host a trial on the digital yuan and push forward with international cooperation, Xinhua reported. Chinese shares listed in Hong Kong were set for their biggest gain since early July on optimism that Xi could unveil plans to further open the nation’s economy to foreign investment. The Hang Seng China Enterprises Index rose 2% as of 11:22 a.m. local time.

Xi’s Shenzhen trip, which had been speculated about by Hong Kong media in the run-up to the anniversary, was reported Sunday by the South China Morning Post. Hong Kong Chief Executive Carrie Lam called a briefing at 11:30 a.m., in which she could discuss details of her trip and how it might affect plans for her annual policy address also scheduled for Wednesday.

The trip comes as China seeks to bolster plans to better integrate Shenzhen, the surrounding province of Guangdong and the former colonies of Hong Kong and Macau into what it calls the “Greater Bay Area.” The ambitious effort faces new challenges amid trade and security disputes with the U.S., anxiety over the new security law in Hong Kong and travel restrictions prompted by the pandemic.

The reports suggests a prominent role for the Greater Bay Area in China’s next five-year development, which is expected to be approved by lawmakers next year in Beijing. Top party leaders were scheduled to convene on Oct. 26 to discuss an outline for the five-year plan.

Chinese equities listed in Hong Kong have underperformed their mainland peers this year, with the Hang Seng China gauge down 12%, versus a 17% rally for the CSI 300 Index of key stocks listed in Shanghai and Shenzhen. China Telecom (NYSE:CHA) Corp. rose as much as 7.3% on Monday and China Citic Bank Corp. added 4.7%.

©2020 Bloomberg L.P.