By Geoffrey Smith

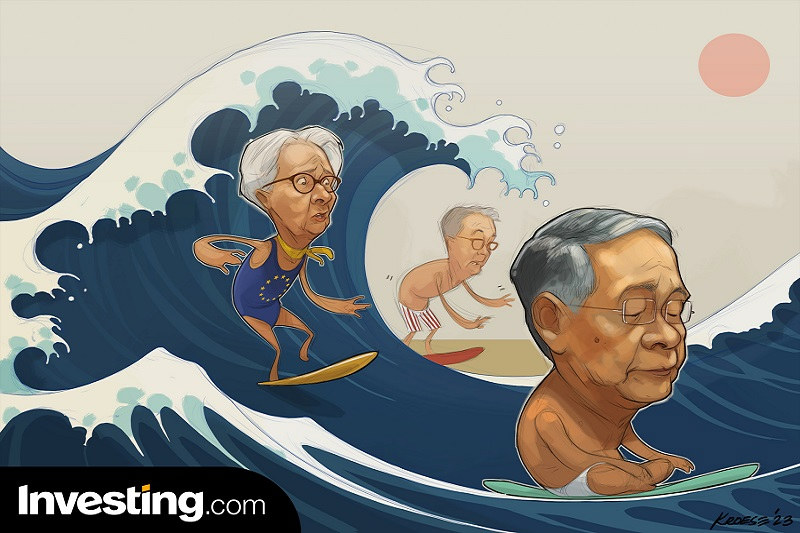

Investing.com -- The world’s most Zen central banker may have the last laugh after all.

The unflappable Haruhiko Kuroda seems all but certain to leave his post as Bank of Japan Governor in two months’ time without raising interest rates or otherwise tightening monetary policy, after reverting to steadfastly dovish type at this week’s policy meeting.

The BoJ defied widespread expectations that it would relax its control of Japanese long-term interest rates, keeping its official target rate for 10-Year government bond yields at 0% and its tolerance bands at 0.5% either side of that. Uniquely among world central banks at a time when inflation is at a 40-year high, its official short-term rate remained below 0%.

The decisions came as a shock to financial markets, who had bet that the BoJ would be forced into tightening policy by a surge in import prices and a collapsing yen. They had seen the widening of its tolerance bands from 25 basis points either side of 0% at December’s meeting as a first crack in the dam, through which an unstoppable torrent of speculative capital would flood, wrecking the BoJ’s strategy.

That may yet happen, but after some alarmingly weak U.S. economic data this week that have taken more steam out of the dollar and the U.S. Treasuries market, it seems unlikely to happen before Kuroda gets his coat.

After all, one doesn’t need to believe in BoJ tightening to be a yen bull. The same end is achieved by the U.S. central bank turning more dovish. It’s enough that the forward curve for dollar rates flattens and then starts to come down.

The main thing is that the rate differential between the two currencies narrows, and that is what is happening: since October, when the USD/JPY hit a 32-year high of nearly 152, the spread between 10-year Japanese and U.S. rates has narrowed by some 80 basis points, driving USD/JPY back down to just over 128, its lowest in eight months.

Francesco Pesole, a foreign exchange strategist with ING, said he sees risks of the dollar falling further, however dovish the BoJ remains.

This threatens to wreck the BoJ’s hopes that a weak yen would generate enough inflation to exorcise Japan’s deflationary demons once and for all, by forcing companies to raise wages to appease their workforces.

The Bank’s new forecasts, released this week, reflect no such belief. From around 3% in the current fiscal year, it expects inflation to sink back below 2% in the year through March 2024, and to stay below that level the year after. Again, almost uniquely among world central banks, those forecasts are below the central bank’s long-term definition of stable prices.

As such, it was inevitable that it should reaffirm its commitment to buying bonds to reflate the economy, saying it will “continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner.”

The only hope that the BoJ allowed itself to voice was that the risks to its forecasts are too skewed to the upside: China’s reopening this year should support the external sector, both through exports of machinery and imports of tourists, all of which should tend to make Japan Inc. a little less neurotic about raising wages. The Japanese labor market is and will remain tight, and inflation expectations have risen.

However, Japan has seen many false dawns before on this front, and skeptics will be entitled to demand more proof before they buy into any ‘new paradigm’ story. With global inflation appearing to have peaked months ago, the biggest single support to Japan’s reflation efforts is weakening. Kuroda may be the last and the most reluctant member of “Team Transitory” when it comes to central banking, but the odds are rising by the day that by the time Japan summons the nerve to raise interest rates, the need to do so may well have passed.