(Bloomberg) -- Follow @Brexit, sign up to our Brexit Bulletin, and tell us your Brexit story.

The pound rallied to the highest since July after U.K. Prime Minister Boris Johnson emphasized he wanted to get a Brexit deal before next month’s deadline.

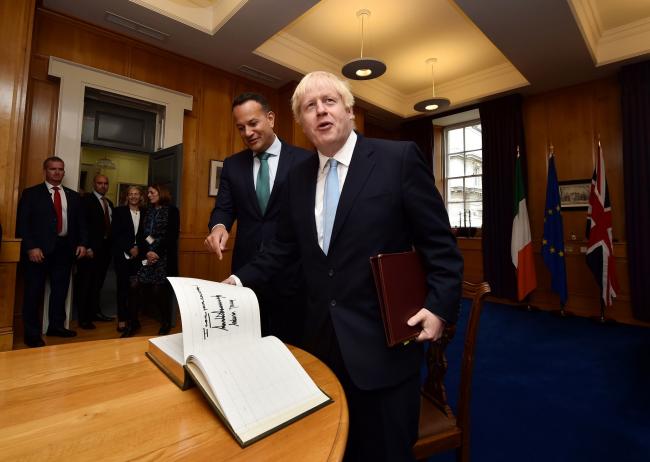

Sterling led gains in the Group-of-10 after Johnson said at a press conference with his Irish counterpart Leo Varadkar that he would “overwhelmingly prefer” to get a deal by October. The currency had already been bolstered by better-than-expected data that eased concerns that the U.K. may be facing a pre-Brexit recession.

The pound has rallied this month to recoup most of its losses since Johnson came to power, as the U.K. Parliament has intervened to force him to seek another extension to the Brexit deadline. That has led traders to rush to cover short positions built up on fears he would drive through a no-deal Brexit on Oct. 31.

“A lot of negatives are in the price of the pound and the recent short-squeeze may continue for now,” said Valentin Marinov, head of Group-of-10 currency strategy at Credit Agricole (PA:CAGR) SA. “We expect the Brexit delay bill to get a royal approval and thus push the risk of a no-deal Brexit beyond the fourth quarter of 2019.”

The pound gained 0.8% to $1.2385 by 11:30 a.m. in London, the highest since July 29. The currency rose 0.7% to 89.17 pence per euro. U.K. government bonds were among the main losers in Europe, with 10-year yields up five basis points to 0.56%.