By Ketki Saxena

Investing.com – The Canadian dollar gained against its US counterpart today, rising to its highest level in over two months. The closed the week 0.6% higher against the greenback ahead of a muted rate hike and anticipated pivot from the US federal reserve next week, and as the central bank’s preferred measure of inflation cooled.

Today’s US headline PCE rose 5.0% in the year to December (from 5.5%) and the Core PCE gained 4.4% over the last twelve months (from 4.7%) - although reaction from risk markets remained muted, with bets on the Fed’s next move largely priced in at this stage.

Money markets are pricing in a 25 bps move from the Fed on the first of February, followed by another 25 bps move in March.

The Canadian dollar meanwhile was buoyed by the modest uptick in risk sentiment reflected in equities, and crude prices which remained set for a weekly gain despite today’s decline on stronger than anticipated Russian supply.

However, investors remain optimistic on crude as central banks are set to slow their pace of rate hikes China reopens (and Covid-19 cases and fatalities decline sharply).

"You've got oil prices up, market sentiment improving and continuing to improve, and so overall just a better picture for the global economy and the Canadian dollar," said Eric Theoret, a global macro strategist at Manulife (TSX:MFC) Investment Management.

"That continued improvement (in sentiment) has allowed the CAD to get a bit closer to its fair value."

On a technical level, analysts at FX Live note, the USD/CAD pair “faces the next up barrier at 1.3483 (55-day SMA) followed by 1.3520 (weekly high January 19) and finally 1.3685 (2023 high January 3). On the other hand, the breach of 1.3303 (2023 low January 26) would aim for 1.3225 (monthly low November 15 2022) and then 1.3205 (200-day SMA)”.

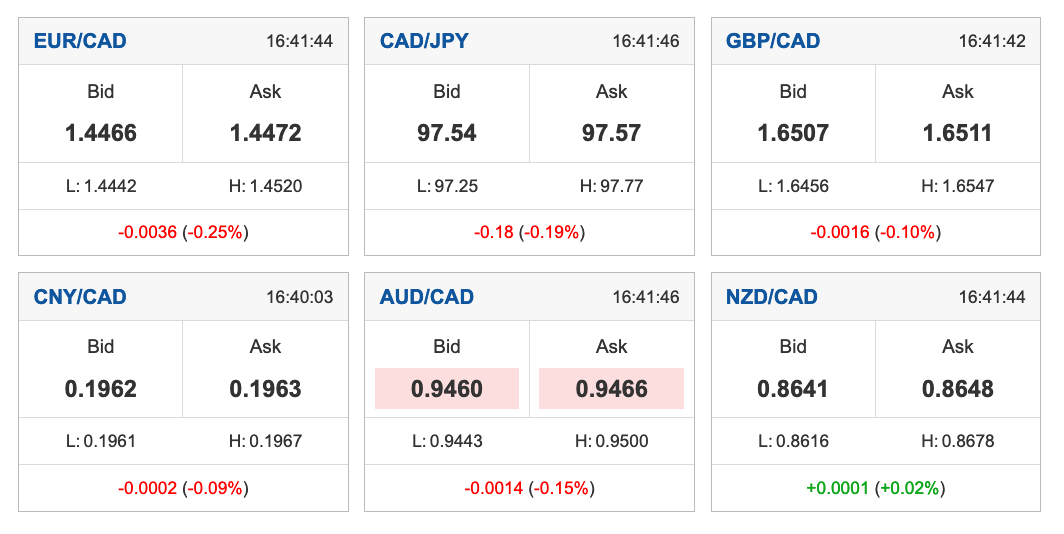

CAD Crosses

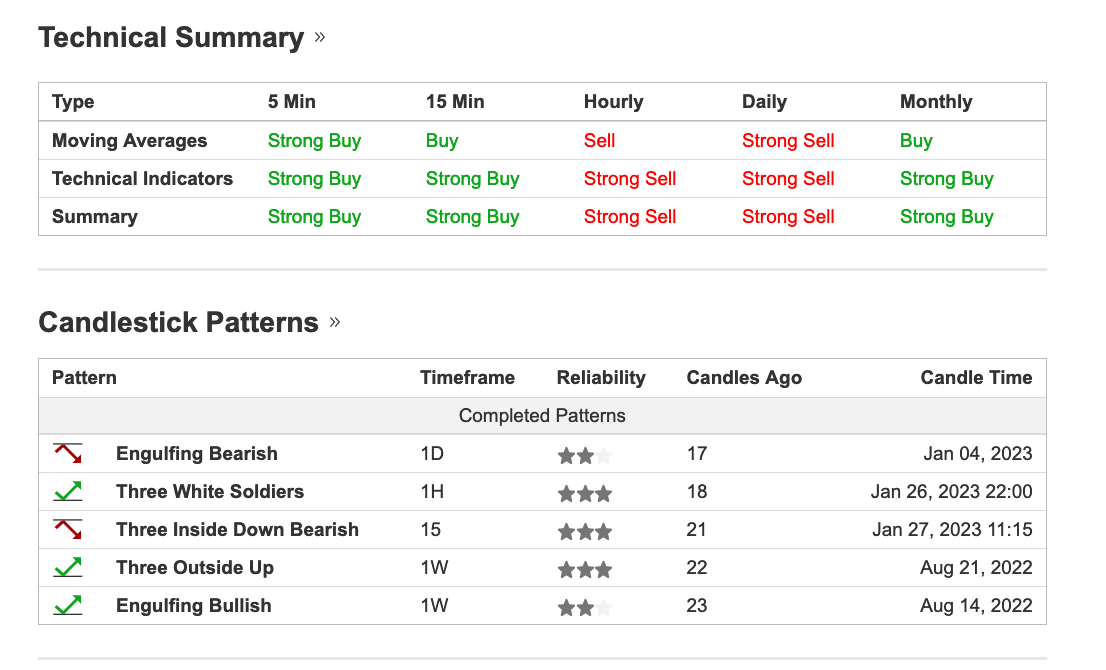

USD/CAD Technical Summary