The base metals sector has seen a slightly upward momentum in the past month. On Friday, the sector was up 6.5 per cent and that contributed significantly to the gain of 281.66 points in Canada’s main stock market index.Highlights

The S&P/TSX Materials Index grew 0.47 per cent month-to-date (MTD). The sector witnessed an upward movement despite all the fluctuation in its surroundings. Although the sector rose but investors should still be careful while selecting their stocks. The stocks that you select should be in sync with your portfolio need. Also, look for stocks that may provide you with the significant returns in the future.

Base metals have a wide usage in the industrial or commercial businesses as compared to the precious metals.

These factors are crucial to the growth of the sector overall. Reportedly, three-year total return on the sector was reported at 19.43 per cent. Now let us look at some of the base metals stocks and understand their financials.

For Q2 2022, the net earnings for the company were reported at C$ 419 million compared to C$ 385 million in Q2 2021. The net debt decreased to C$ 5,339 million from C$ 5,815 million for the same comparative period. There was a reduction in the EBITDA too C$ 906 million from C$ 1,180 million.

For Q2 2022, the cash flows from operating activities rose to C$ 904 million, an increase of C$ 238 million from Q1 2022.

First Quantum Minerals Ltd. announced a semi-annual dividend of C$ 0.16 with a dividend yield of 1.198 per cent. The EPS was reported at C$ 2.49.

The net income as of June 30, 2022, was reported at US$ 196.5 million compared to US$ 175.3 million on June 30, 2021. The adjusted EBITDA also witnessed an increase and was reported at US$ 301.2 million against US$ 290 million for the same comparative period.

The revenue for Franco-Nevada Corporation also rose to US$ 352.3 million from US$ 347.1 million at the same time previous year.

As of June 30, 2022, the cash and cash equivalents (CCE) increased and were posted at US$ 910.6 million from US$ 539.3 million as of December 31, 2021.

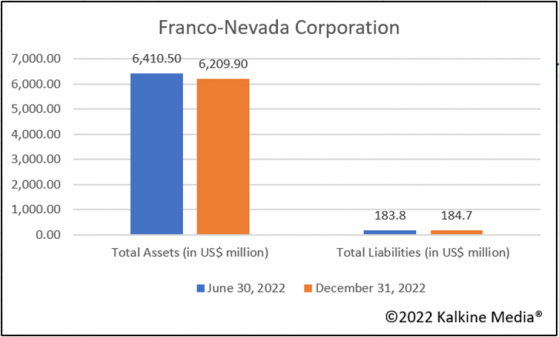

The Earnings per share (EPS) was US$ 5.07 with a price-to-earnings (P/E) ratio of 32.60. US$ 0.32 was reported as the quarterly dividend to its shareholders. The below graphs depict the total assets and liabilities in two different timelines.

As of June 30, 2022, the net earnings decreased to US$ 149.07 million from US$ 166.12 million as on June 30, 2021. There was a decrease in the cash generated from operating activities as well. It was reported at US$ 206.35 million from US$ 216.41 million as at the same time of the previous year.

The total assets for Wheaton Precious Metals Corp. were reported at US$ 6,448.69 million in Q2 2022 compared to US$ 6,470.03 million in Q1 2022.

As on June 30, 2022, the revenue by the company was reported at US$ 1,581.05 million compared to US$ 984.65 million as of June 30, 2021. The net income increased to US$ 275.84 million against US$ 196.39 million for the same period.

There was an increase in the cash and cash equivalents for Agnico Eagle Mines Limited, which were posted at US$ 1,006.85 million from US$ 277.670 million.

Ivanhoe Mines reported a profit of US$ 351.5 million for Q2 2022 as against a loss of US$ 108.6 million for the same period in 2021.

As of June 30, 2022, the total assets increased to US$ 3,509.98 million from US$ 3,218.2 million as of December 31, 2022. Simultaneously, the liabilities decreased to US$ 733.9 million from US$ 841.2 million for the same comparative period.

As of June 30, 2022, there was a decrease in the cash and cash equivalents which were reported at US$ 507.14 million from US$ 644.45 million in the same quarter of the previous year.

Bottom Line Stock market is unpredictable and especially the base metal stocks. Before proceeding in the sector, there must be an effective and risk-proof plan and understanding. Look for the overall market dynamics and the factors that come into play while selecting your stocks.

This will facilitate making effective investment decisions. In your base metal stocks, there are several aspects to consider, such as shareholder’s dividend, return, and overall validation. All these collectively help to fill up your portfolio with the right stocks.

Base metals are widely used and hence benefit the long-term investors. Further, recent developments on the renewable and clean technology sector may positively impact the overall sector and the market. Instead of focusing in one direction, consider the overall picture and be vigilant while filling up your portfolio.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.