Investing.com -- Piper Sandler analysts highlighted a promising shift for Bitcoin miners in a note Wednesday, emphasizing the substantial earnings potential in pivoting towards AI and High-Performance Computing (HPC) data center deals.

The analysts note that Bitcoin miners are still in the "early innings" of this transition, but the economic benefits are too significant to ignore.

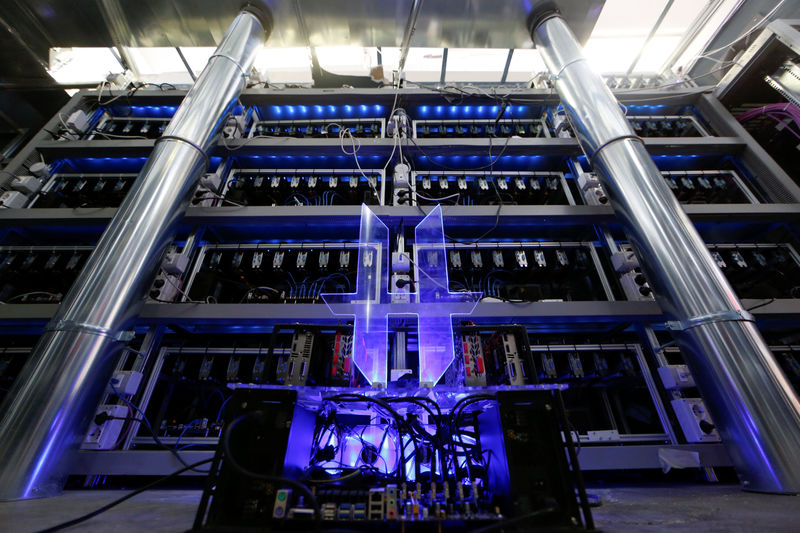

The firm underscores the growing pressure on miners to diversify their operations by converting mining sites or dedicating approved power authorizations to AI/HPC data center tenants.

This trend is said to be driven by "significantly more attractive economics versus the core mining business."

Piper Sandler points to deals from the previous year, such as Core Scientific/CoreWeave and TeraWulf/Core42, as early indicators, with expectations for more announcements in 2025 involving major players like Galaxy Digital (TSX:GLXY), Riot Platforms (NASDAQ:RIOT), and HUT 8.

A key advantage for Bitcoin miners lies in their "approved access to power," which is highly attractive to AI companies, according to Piper.

Both Bitcoin mining and AI model training are power-intensive, and the existing infrastructure of Bitcoin miners is said to offer a faster and more efficient solution for AI companies, bypassing the lengthy process of building and gaining approval for new sites.

Piper Sandler estimates that AI/HPC data center contracts could potentially triple miner EBITDA at certain sites.

The note also provides an overview of potential sites for companies like RIOT, HUT, GLXY, and MARA, detailing power authorizations and possible economic outcomes of AI/HPC deals.

While not all Bitcoin miners are currently pursuing these opportunities, the analysts suggest that those who do could see a significant boost in their financial performance.