Kalkine Media -

A government-endorsed retirement account known as Registered Retirement Savings Plan (RRSP) allows Canadians to set savings aside for the long term, as its name represents. With this, retirees can leverage some tax benefits alongside holding their mutual funds, stocks, and bonds.Highlights

- With RRSP, Canadians can save money tax-free and leverage many other benefits.

- Canadian Natural has shown a 3-year dividend growth rate of 13.61 per cent.

- BCE (TSX:BCE) delivered a quarterly dividend of C$ 0.92 per share to its stockholders.

Let's look at two TSX-listed stocks that RRSP investors can flick through this season:

Canadian Natural Resources Limited (TSX: TSX:CNQ) As western Canada's one of the leading oil and natural gas producers, Canadian Natural Resources Limited caters to a portfolio of light-to-heavy oil, synthetic oil, natural gas liquids, bitumen, and natural gas.

In the last 3-years, the company has shown a dividend growth rate of 13.61 per cent and had a dividend yield of 4.426 per cent as of writing.

Officials from Canadian Natural have stated that the company's 2022 capital investment projection, around C$ 4.9 billion, has increased by 41 per cent from 2021, excluding acquisitions. In the process, Canadian Natural boosted its dividend and paid special dividends of over C$ 4.9 billion to its stockholders. The dividend payments increased significantly from the previous year by 127 per cent.

The firm decided to raise its cash payout by 13 per cent to C$ 0.85 per common share from C$ 0.75 per common share during the third quarter of 2022. Additionally, this Canadian oil and gas company earned C$ 5.2 billion in adjusted funds flow compared to C$ 3,634 million in Q3 2021. At the time of writing, the CNQ stock was up over eight per cent year-to-date (YTD).

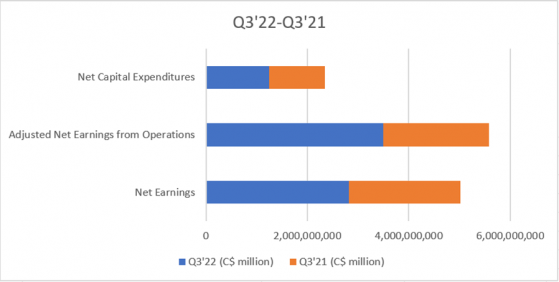

Canadian Natural's other financials are showcased below:

© 2023 Krish Capital Pty. Ltd.

BCE Inc. (TSX: BCE) One of the leading Canadian communications companies, BCE Inc., provides services like wireless, broadband, television, and landline phones across Canada.

With over 10 million customers, BCE reported that its wireline division earned 54 per cent of the company's overall EBITDA for 2021, followed by its wireless segment with 39% and the media segment with 6 per cent.

BCE's dividend for the last quarter was C$ 0.92 per share, with a dividend yield of 5.89 per cent. Additionally, the company mentioned an EPS of C$ 3.09 with a P/E ratio of 20.2.

BCE's wholly owned subsidiary Bell recently informed the market of launching faster internet speeds as well as faster mobile technology in Atlantic Canada. With this, Bell aims to bring the next evolution of Wi-Fi advancement, enabling customers to stream, learn, work, and play games on any or all of their household devices simultaneously with lower latency.

Commenting on this, Glen LeBlanc, CFO of Bell and Vice Chair, Atlantic said:

© 2023 Krish Capital Pty. Ltd.

Besides, BCE announced that it would change its existing C$ 3.5 billion committed credit facilities to a sustainability-linked loan (SLL). According to company officials, this SLL is in line with BCE's ESG strategy and performance and will contribute to a more sustainable and profitable future. The BCE stock was up by 4.4 per cent YTD.

Bottom Line Before choosing to invest in any stocks, one should conduct thorough market research given how volatile the stock market has been during 2022.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.