Kalkine Media -

Companies with a market share of between $2 billion to $10 billion are considered mid-cap stocks. As its name suggests, a mid-cap company is halfway between large-cap (market cap over $10 billion) and small-cap (market cap between $300 million to $2 billion) corporations.Highlights

- Companies with a market capitalization of $2 billion to $10 billion are called mid-cap stocks.

- In the fourth quarter of 2022, Allkem’s Olaroz lithium facility generated record quarterly revenue of US$ 151 million.

- Premium Brands achieved a record C$ 1.62 billion in revenue in Q3’22.

The general phenomenon shows that mid-cap stocks offer a balance of growth and stability. However, there’s no guarantee in an equity market due to its fluctuating nature.

Having said that, let’s see how these three TSX-listed mid-cap stocks have been performing lately:

Allkem Limited (TSX: AKE) Formerly known as Orocobre Limited, Allkem Limited operates as an industrial chemical and mineral exploration company. The company generates a huge chunk of its revenue from its Mt Cattlin exploration site in Ravensthorpe, Australia.

With a market capitalization of approximately C$ 8.3 billion, Allkem Limited has delivered a 17.09 per cent return on equity and a 10.75 per cent return on its assets.

For the December 2022 quarter, the Allkem group generated revenue of US$ 265 million and a gross operation cash margin of around US$ 218 million. The group had US$ 552 million cash in hand as of December 31, 2022, a US$ 105 million increase from the previous quarter.

Allkem’s Olaroz Lithium facility produced record 4,253 tonnes of lithium carbonate in the December’22 quarter, a 17 per cent increase from the same period last year. At the same time, lithium carbonate sales also generated record quarterly revenue for Allkem of about US$ 151 million with a gross cash margin of 90 per cent.

Premium Brands Holdings Corporation (TSX: PBH) With operations in Canada, the US, and Italy, Premium Brands Holdings is a specialty food manufacturing and distribution business. The group generates two-thirds of its revenue from its food manufacturing business; the rest is divided among the distribution, wholesale, and corporate segments.

The company has a total market share of about C$ 4.1 billion and has delivered a 3-year dividend growth rate of 8.71 per cent, with earnings per share (EPS) of C$ 3.76. Premium Brands also declared a cash dividend of C$ 0.70 per share for its shareholders for the fourth quarter of 2022.

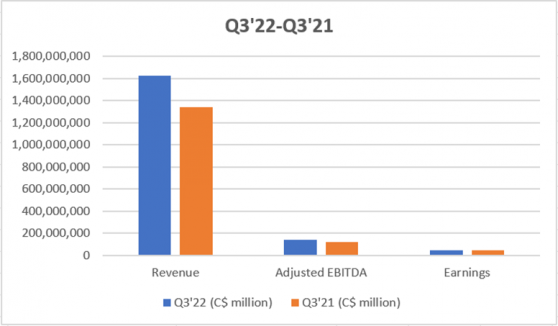

This specialty food business generated record revenue for its third quarter of 2022 of C$ 1.62 billion; this was 21 per cent higher than the same period last year. Not only revenue, adjusted EBITDA and adjusted EPS also reached record highs of C$ 141.2 million (15.2 per cent up from pcp) and C$ 1.37 per share (3 per cent increase from pcp), respectively, for Q3’22.

The company’s financials are in the table below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Brookfield Renewable Corporation (TSX: BEP.UN) The flagship renewable power segment of Brookfield Asset Management (TSX:BN), Brookfield Renewable Corporation is a leading publicly-traded, pure-play renewable energy company. The company has hydroelectric, utility-scale solar, storage, and wind facilities across North America, South America, Asia, and Europe.

Brookfield Renewable paid its shareholders a cash dividend of C$ 0.32 per share in December 2022, with an annualized dividend yield of 4.242 per cent. The company has a total market share of approximately C$ 7.1 billion.

This renewable energy company generated funds from operations of C$ 243 million for the third quarter of 2022, up from C$ 210 million in Q3’21. Out of C$ 243 million, C$ 130 million were contributed by the company’s hydroelectric segment, with wind and solar facilities contributing a total of C$ 147 million.

Bottom Line Although the stock market appears to be circling back from interest rate hikes and inflationary pressures from the previous year; however, nothing is certain. Therefore, it is advised to conduct thorough research before putting your money in equities.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.