Proactive Investors - The question of whether artificial intelligence (AI) will primarily benefit large caps is being challenged by recent trends in the small-cap sector.

While major AI players like NVIDIA Corp (NASDAQ:NVDA, ETR:NVD) dominate the large-cap space, smaller companies are also experiencing a surge in AI mentions.

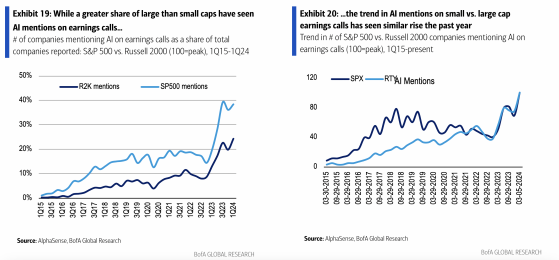

According to Bank of America (NYSE:BAC)'s AI Primer, large caps lead the AI ranking framework, but the proportion of small caps discussing AI on earnings calls is increasing.

Bank of America sees potential for small caps to reap benefits from AI adoption, including enhanced productivity and efficiency that could boost margins. Additionally, smaller AI players have the opportunity to grow into large caps through IPOs or acquisitions.

Over the past year, there has been a notable uptick in AI mentions among small caps, paralleling the trend seen in large caps. This increase extends to AI investment and utilization for productivity enhancement.

While AI-related IPOs currently represent a small fraction of total IPOs, Bank of America suggests that smaller private companies with AI technology could increasingly pursue IPOs, potentially shifting the IPO landscape where small caps typically dominate.

“While the trend in AI mentions on earnings calls had initially accelerated more for large caps, we have seen a similar increase in trend in mentions over the past year for small caps, which has also been true with respect to both AI investment and use of AI to boost productivity,” analysts wrote.

“And while so far IPOs mentioning AI in their business description are a small share of total IPOs, we could increasingly see smaller private companies that have AI technology IPO (where small caps have comprise 90-100% of total IPOs).”

Read more on Proactive Investors CA