Investing.com — Another one of our AI-powered stock picks is rallying big time this month. After rising 5.6% on Friday, Marathon Digital Holdings (NASDAQ:MARA) is up an incredible 32% in May alone and looks poised to continue to rally.

This adds to the list of eight 20%+ winners in the month that our premium users had access to for less than $9 before they went on to rally.

Just to name a few other stocks in our May list gaining big:

- Vistra Energy Corp (NYSE:VST) +32.9% in May.

- NAPCO Security Technologies (NASDAQ:NSSC) +25% in May.

- Perficient Inc (NASDAQ:PRFT) +56.2% in May.

And several others...

MARA was one of the greatest winners from the Ethereum rally early last week and should likely keep on profiting from higher interest in the sector. The technical setup for the stock also shows great promise, possibly presenting a dip-buying opportunity when the stock starts the day lower today.

Now, honestly, what was the last time you notched so many 20%+ gainers in a single month? I'm never never is the answer...

Don't worry about it, none of us have done it by ourselves either.

However, thanks to the latest advances in AI computing, you can now compete toe-to-toe with the big funds for only $9 a month.

Unlike everything out there, our strategies are forward-looking and not just a momentum indicator.

By the way, next week, our predictive AI will rebalance again, providing its users with a fresh set of 50+ top new winners for June.

Subscribe now and get the best picks for the month ahead before anyone else.

Still not convinced? Check out these real-world statistics then:

Among our AI's 90 picks for May, 70%+ are in the green, prompting pushing our strategies to solid numbers against the benchmark indexes.

Our flagship Tech Titans is up 13.7% in May so far, smashing the already solid 5.7% jump from the S&P 500. This has increased the strategy's performance since the official launch in October to an amazing +71.05%.

That's how our AI managed to crush the market by a very wide margin since the official launch in October last year. In fact, these are the gains you would have notched since October by following our AI picks (numbers as of premarket today):

- Beat the S&P 500: +31.85%

- Dominate the Dow: +17.49%

- Tech Titans: +71.05%

- Top Value Stocks: +34.03%

- Mid-cap Movers: +18.89%

That's against the following gain from the benchmark indexes during the same period:

- S&P 500: +15.45%

- Dow Jones Industrial Average: +7.79%

- Nasdaq Composite: +18.29%

This is not a backtest; this is real-world performance, unfolded in real time to our users.

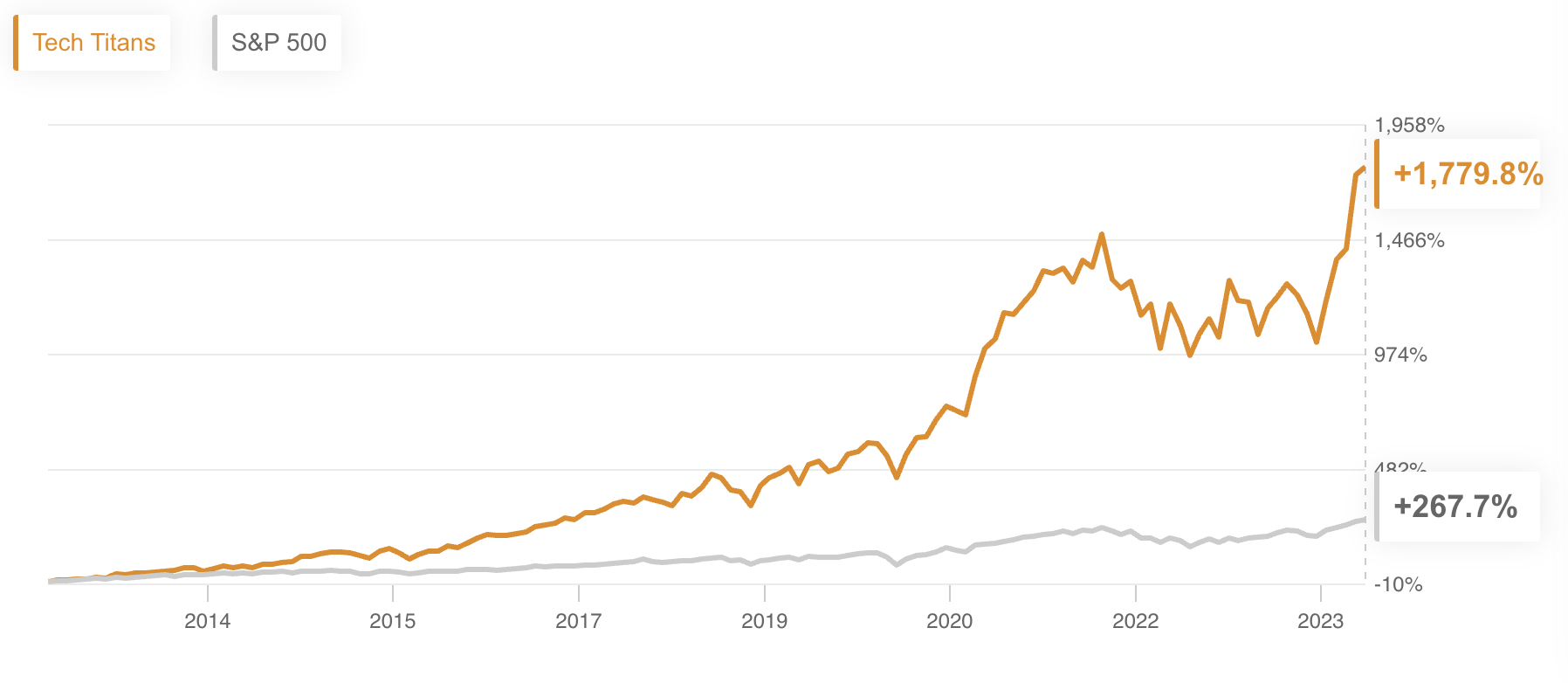

In fact, our backtest suggests that going for the long run will give you even heftier gains. See in the chart below for reference:

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,879,800K by now.

With our AI's next month's portfolio rebalancing just around the corner, will you keep on guessing or have an insight into the winners for June?

For less than $9 a month, that decision has never been easier.

Join now and never miss another bull market again!

*And since you made it all the way to the bottom of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS20242.