- U.S. inflation data, Fed rate hike expectations, more earnings in focus.

- Roblox stock is a buy ahead of Q2 results, due Tuesday.

- Rivian shares set to struggle amid ongoing headwinds.

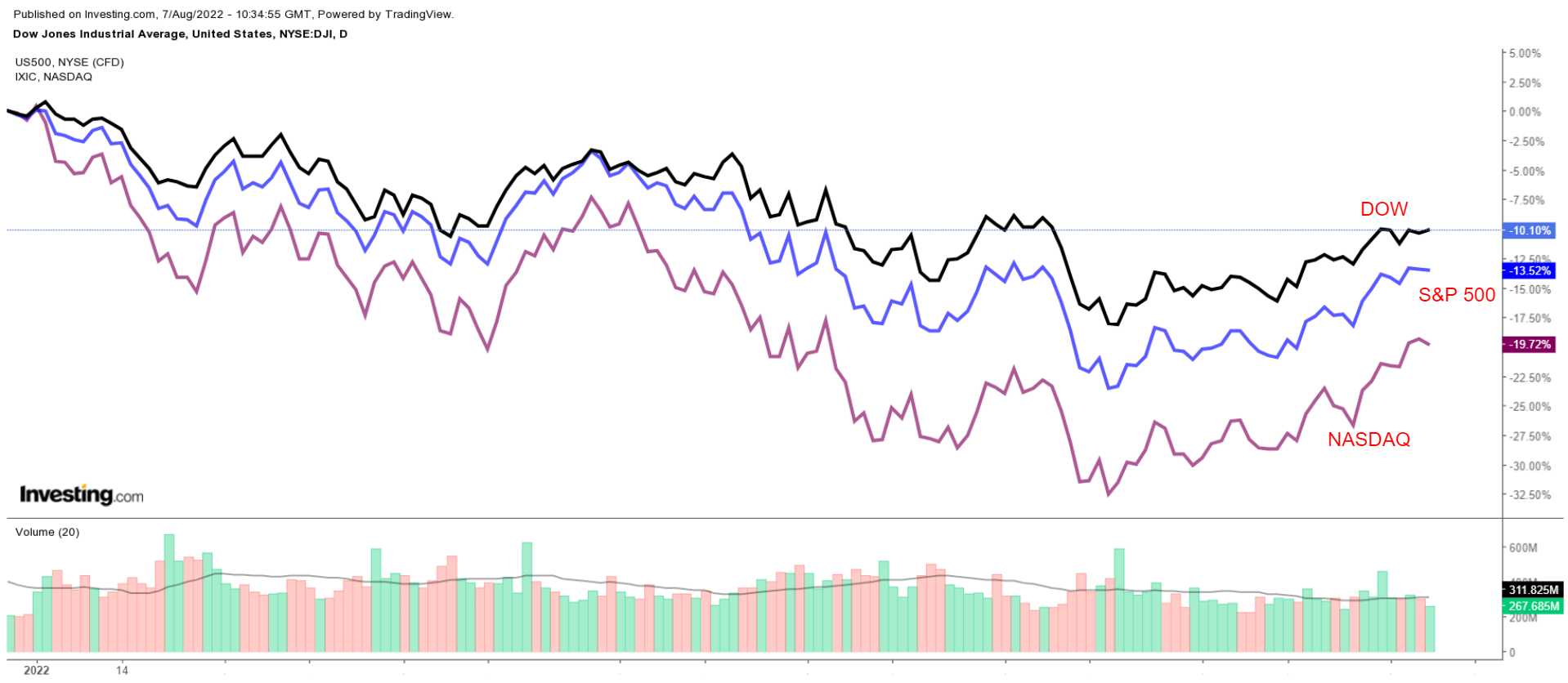

Stocks on Wall Street ended mostly lower on Friday after better-than-expected July jobs data renewed fears that the Federal Reserve will raise rates even more aggressively than already expected in the months ahead.

For the week, the blue-chip Dow Jones Industrial Average declined 0.1%, while the benchmark S&P 500 and technology-heavy Nasdaq Composite tacked on 0.4% and 2.2% respectively.

Source: Investing.com

Focus now shifts to U.S. inflation data due next week, with annual consumer prices expected to jump by 8.7% in July after a 9.1% rise in June.

Meanwhile, earnings from notable companies such as Disney (NYSE:DIS), Palantir (NYSE:PLTR), Coinbase (NASDAQ:COIN), Upstart (NASDAQ:UPST), and Tyson Foods (NYSE:TSN) are on the agenda as the Q2 earnings season begins to wind down.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another that could see further downside.

Remember though, our time frame is just for the upcoming week.

Stock To Buy: Roblox

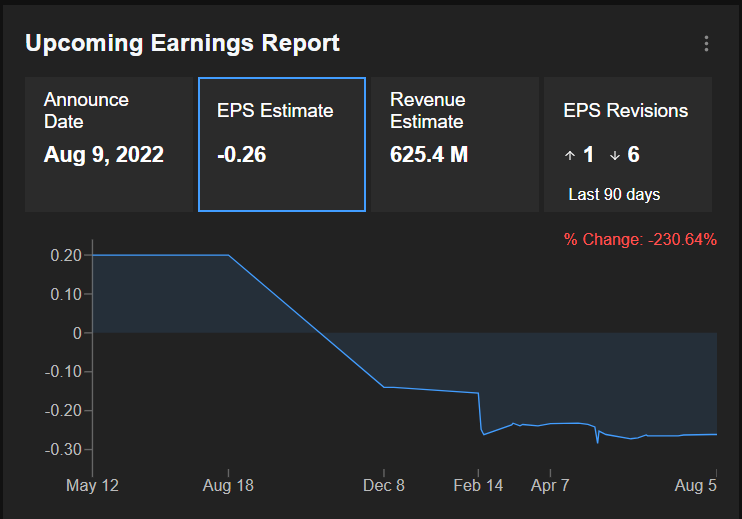

Roblox (NYSE:RBLX), which has seen its shares stage an impressive recovery since they fell to their lowest level on record a few months ago, could see further buying activity this week as the digital entertainment company is forecast to deliver better-than-expected second quarter results after the closing bell on Tuesday, Aug. 9.

Based on moves in the options market, traders are pricing in a sizable swing for RBLX shares following the report, with a possible implied move of 14.6% in either direction.

Source: InvestingPro+

Consensus estimates call for the San Mateo, Calif.-based gaming platform provider to report a loss per share of $0.26, compared with a loss of $0.25 per share in the year-ago period. Revenue is forecast to dip approximately 6% year over year to $625.4 million.

Beyond the top-and-bottom line numbers, Roblox’s update regarding average daily active users (DAUs) will be in focus. The key metric - composed mainly of teens and preteen users - rose 28% from a year earlier to 54.1 million in the last quarter.

Investors will also pay close attention to growth in bookings, which is a form of adjusted revenue preferred by videogame analysts.

Source: Investing.com

After soaring to an all-time high of $141.60 in November 2021, RBLX stock tumbled rapidly to a low of $21.65 on May 10.

Shares have since rebounded by an astonishing 127.5% to end at $49.24 on Friday amid indications of increasing engagement on its online gaming platform, which helped ease fears of a slowdown in its core business.

At current valuations, the videogame firm, which allows users to easily develop games and interact in 3D virtual worlds, has a market cap of $29.2 billion.

Despite the recent bounce, Roblox shares are still down about 52% year to date and are approximately 65% below their record peak as investors have dumped unprofitable tech companies with expensive valuations in reaction to the Federal Reserve’s aggressive monetary-tightening plans.

Stock To Dump: Rivian Automotive

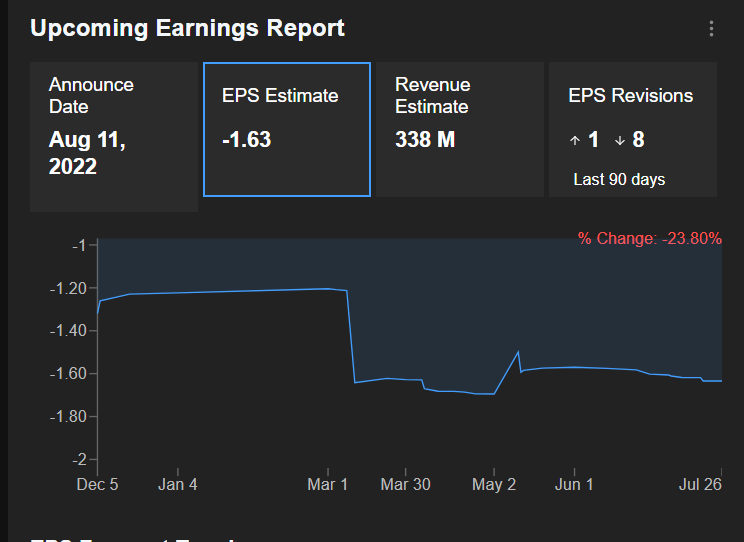

Rivian Automotive's (NASDAQ:RIVN) stock is expected to suffer a challenging week as investors brace for disappointing financial results from the electric-truck startup, which are likely to reveal another quarterly loss.

Options traders are pricing in a big move for RIVN shares following the results, with a possible implied move of 11.8% in either direction.

Source: InvestingPro+

The Irvine, Calif.-based electric-vehicle maker - which announced last month that it will reduce its workforce by 6% due to high inflation, rising interest rates, and an increase in parts prices - is scheduled to report earnings for the fourth time as a public company after the closing bell on Thursday, August 11.

As such, it faces no year-over-year comparisons.

Consensus expectations call for a loss of $1.63 per share for the second quarter, while revenue is forecast to clock in at $338.0 million.

In addition, investors will pay close attention to comments from Rivian’s management regarding their sales outlook for the rest of the year amid a challenging macroeconomic environment.

Rivian recently warned that planned revisions to tax credits in President Joe Biden’s climate and healthcare spending package would put it at a disadvantage to more established competitors, such as Tesla (NASDAQ:TSLA) and General Motors (NYSE:GM).

The EV startup specifically takes issue with a proposed measure that would make any electric-vehicle model selling for more than $80,000 ineligible for the federal subsidy.

The company is lobbying Congress, hoping to convince them to add a two-year transition period to the new tax credit structure.

Without the tax credit, Rivian’s electric vehicles would become more costly for U.S. consumers, which could negatively impact demand and sales.

Source: Investing.com

Year to date, Rivian shares have crashed by roughly 66% as investors have fled from high-growth non-profitable companies with rich valuations that are most sensitive to rising rates and accelerating inflation.

RIVN stock sank to its lowest level on record at $19.25 on May 11; it has since jumped by 85% to stage a modest rebound, ending Friday’s session at $35.67.

At current levels, the EV company - which is still about 80% away from its all-time high of $179.47 touched shortly after its IPO in November 2021 - has a market cap of $32.1 billion.

Disclosure: At the time of writing, Jesse has no position in any stocks mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »