-

The stock market surged as Indexes hit record highs, driven by Nvidia's remarkable rise above the $3 trillion market cap.

-

Expectations of an interest rate cut from the Federal Reserve have fueled this bullish trend, supported by weaker recent economic data.

-

Amid this market momentum, tools like the InvestingPro fair value index can help investors identify high-potential stocks.

-

Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The U.S. stock market roared higher yesterday, with the S&P 500 and Nasdaq blasting through previous records. All eyes were on Nvidia (NASDAQ:NVDA), which rocketed to a staggering $3 trillion market cap, joining the exclusive club alongside Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT).

This bullish dominance is fueled by expectations of an imminent interest rate cut from the Federal Reserve. Weaker economic data in recent weeks has increased the odds of a September rate cut, with the current probability of over 50%.

Within this bull market, however, it's crucial to identify companies with high upside potential. Tools like the InvestingPro fair value index can help you spot these hidden gems.

1. Rio Tinto (LON:RIO) - Profit From the Copper Price Surge

Copper prices have been on a tear in recent months, and mining giant Rio Tinto (NYSE:RIO) is feeling the positive effects. As the world's third-largest mining conglomerate with copper as a core business, Rio Tinto's stock price surged in April and May, mirroring the rise in copper prices.

Despite a recent price correction, copper holds strong potential for continued growth in the mid-to-long term. The expected surge in demand from renewable energy, electric vehicles, and even traditional sectors fuels this bullish outlook.

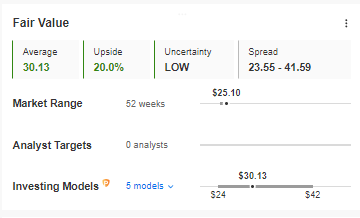

Rio Tinto is well-positioned to capitalize on this trend. The company is actively planning to increase production from existing mines, as confirmed by Director Bold Baatar at the World Copper Conference. Additionally, analysts see a potential 22% upside for Rio Tinto based on fair value assessments.

2. JP Morgan Chase - A Solid Dividend Play

JPMorgan Chase & Co (NYSE:JPM), the undisputed heavyweight of US banking with a market capitalization of around $4.1 billion, thrives on its economies of scale and diverse product portfolio. This potent combination allows them to adapt to changing market conditions.

Source: InvestingPro

JPMorgan Chase's resilience is further proven by its ability to navigate crises with confidence. Beyond these strengths, the company boasts a remarkable track record of uninterrupted dividend payments for over 50 years, coupled with a consistently high fair value ratio – a clear indicator of its financial health.

3. Johnson & Johnson - A Potential Opportunity?

Johnson & Johnson (NYSE:JNJ) has been a major underperformer on the stock market recently. However, this decline could be an opportunity in disguise for investors seeking a solid company with strong growth potential.

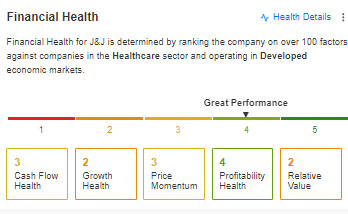

The company boasts impressive fundamentals. Their Return on Equity (ROE) ratio significantly outperforms the industry average, indicating efficient management and strong profitability. Additionally, the company's financial health remains exceptional, with a score of 4 out of 5 on a financial health index.

Source: InvestingPro

Technically, a breakout above $155 per share could be a strong signal for a trend reversal, suggesting the stock price may be poised to climb. On the other hand, support remains near the previously tested lows of $143.

Considering the company's robust fundamentals, healthy financial state, and potential for a trend reversal, the recent slump might be an attractive entry point for investors seeking long-term value.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.