- ECB's potential rate cut could boost certain sectors and make Europe a prime investment region.

- Look for defensive stocks and European equities to outperform with lower borrowing costs.

- We reveal 3 undervalued stocks poised for significant growth in this new economic environment.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The European Central Bank is poised to cut interest rates for the first time since 2019 tomorrow. While the exact size of the cut remains uncertain, analysts predict a potential decrease of 150 basis points by the end of 2025, with rates settling around 2% in the long term.

This shift in monetary policy begs the question: is it time to adjust your investment portfolio for a lower-rate environment?

Lower Rates, Higher Growth Potential for Certain Sectors

Historically, defensive sectors have thrived in low-interest-rate scenarios. Lower borrowing costs and debt relief can boost company earnings. Strong financial performance translates to rising stock prices, rewarding investors. Additionally, as interest rates fall, the yields on government bonds become less attractive. This makes companies with consistent, high-dividend payouts more appealing to investors seeking better returns.

Europe May Shine in a Lower-Rate World

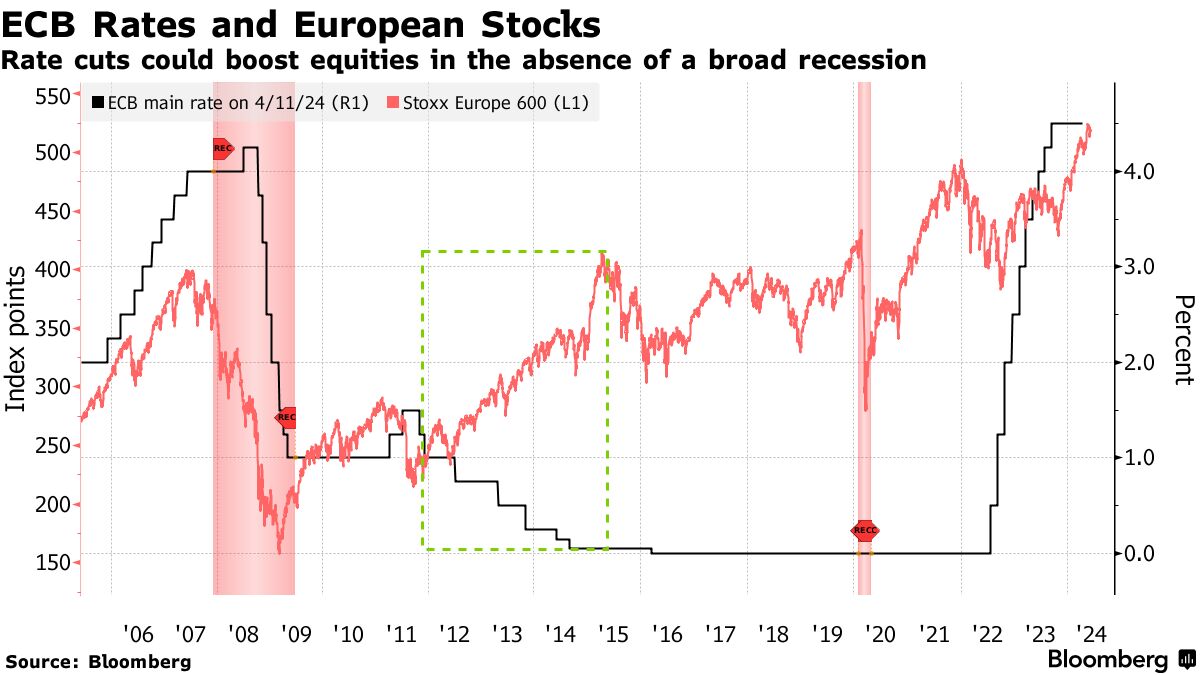

Citigroup analysts believe the ECB's projected long-term rate of 2% positions European equities for strong performance. This higher rate compared to the past decade favors cyclical and value-oriented markets like Europe. Citigroup draws a parallel to the pre-crisis era, where European stocks consistently outperformed the US market. With cyclical equities poised to benefit, Europe stands to gain significantly in a world with lower interest rates.

Back in March, the Wall Street broker boosted its year-end target for the STOXX 600 index by 6% to 540 (up from 510). Their rationale? They believe European equities tend to trade higher during rate-cutting cycles.

This theory seems to hold water based on historical data. The chart above, prepared by Bloomberg, shows how European stocks thrived from 2011 to 2015 when interest rates were cut – as long as a deep recession wasn't present.

The Takeaway: Rebalance for Growth

The ECB's move toward lower interest rates presents an opportunity to recalibrate your portfolio. Consider prioritizing defensive sectors that benefit from lower borrowing costs and explore European equities, which may outperform in this new monetary landscape. Below, we will delve deeper into identifying the top 3 stocks with the greatest growth potential as interest rates fall.

3 Undervalued Stocks Poised for Growth After ECB Rate Cut

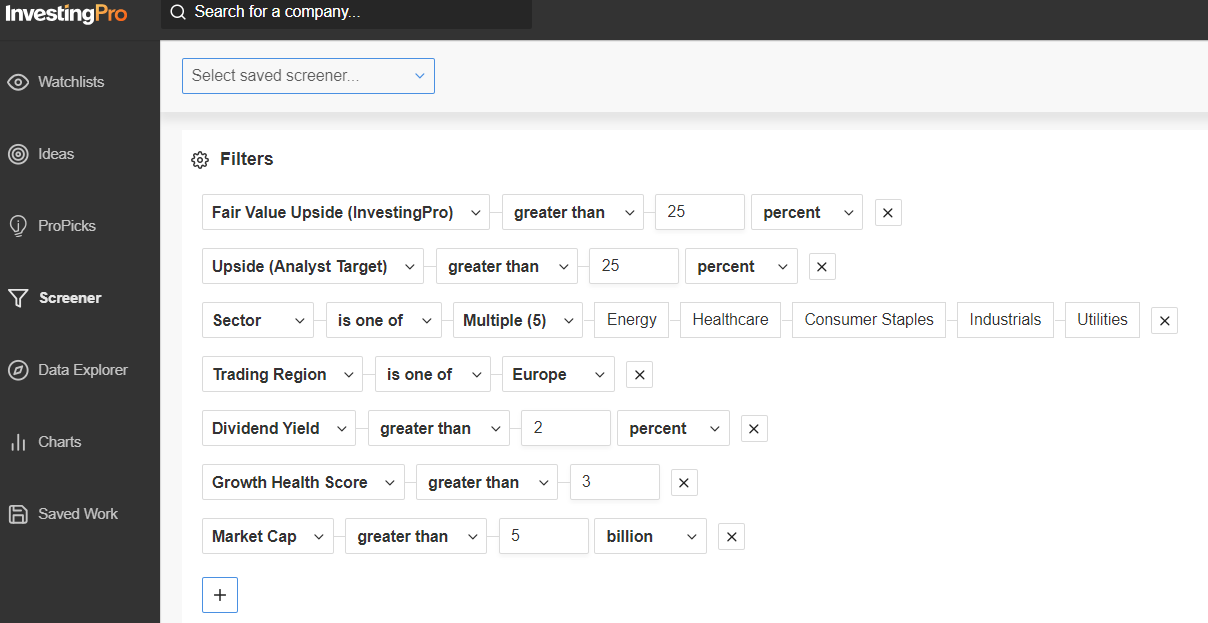

The ECB's interest rate cut creates opportunities in specific sectors and regions. Using InvestingPro's stock screener, we can find undervalued stocks that are well-positioned to benefit.

We focused on sectors likely to experience earnings growth and applied filters for healthy financials (3 out of 5 or higher) and attractive dividend yields.

Source: InvestingPro

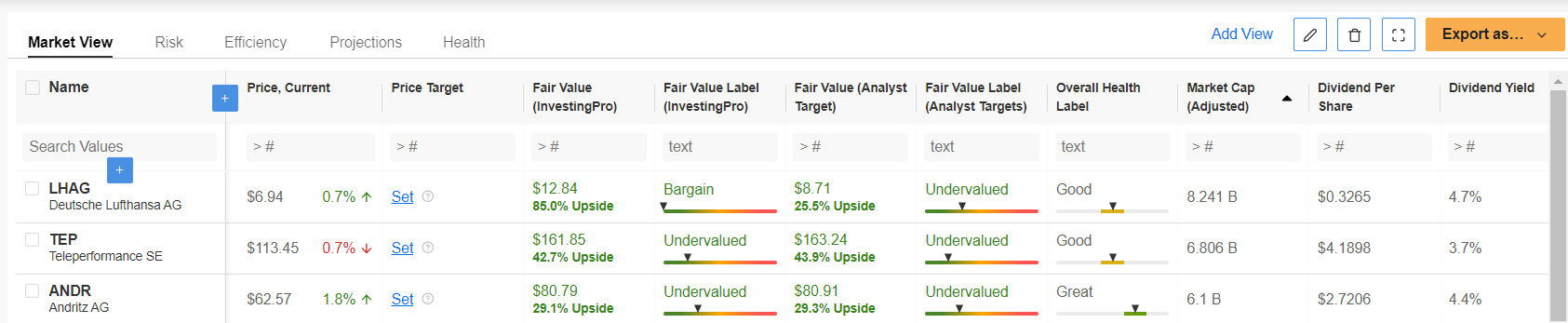

Here are the top 3 picks:

Source: InvestingPro

1. Deutsche Lufthansa (ETR:LHAG)

Deutsche Lufthansa (OTC:DLAKY) is the leading German airline in Europe, Lufthansa boasts an 85% upside potential based on Fair Value. Analysts also expect a 25.5% increase in the stock price over the next 12 months. With a healthy financial status (3/5) and a solid dividend yield of 4.7%, Lufthansa is a compelling investment opportunity.

2. Teleperformance

Teleperformance (OTC:TLPFY) is a global leader in customer service, technical support, and other outsourced services. Teleperformance offers a potential upside of 42.7% according to Fair Value, with analysts predicting a similar growth of 43.9%. The company has a healthy financial status (3/5) and provides a 3.7% dividend yield.

3. Andritz

Andritz (OTC:ADRZY) focused on plant construction, Andritz has an intrinsic value 29.1% higher than its current price based on Fair Value. This aligns closely with analysts' target price for the stock in the next 12 months ($80.79). Andritz boasts an excellent financial health rating (4/5) and offers a 4.4% dividend yield.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.