- Recent bullish momentum on Wall Street aided by a dovish Fed suggests the rally could continue in 2024.

- Nvidia has continued its bullish trend with a 240% annual return. However, the technical and fundamental factors indicate more upside next year.

- Meanwhile, Bank of New York Mellon and Procter & Gamble could test or even break above all-time highs next year.

In recent days, the bullish momentum on Wall Street has sustained, marked by the Nasdaq hitting new all-time highs, and a similar breakthrough for the S&P 500 is imminent.

The Federal Reserve's latest meeting, further fueled optimism with its dovish tone. Despite keeping interest rates unchanged, the statement suggests that the US is at the end of the interest rate hike cycle.

Though not officially confirmed by Jerome Powell, the likelihood of a pivot starting around March with possible rate reductions throughout next year is gaining traction.

Against this backdrop, the stock market has retained the potential for a continued rally. In this piece, we will try and analyze the stocks that could feed off this positive momentum and keep rallying in 2024.

1. Nvidia: Chipmaker's Bullish Trend Could Sustain Next Year

The past year has been tremendous for Nvidia Corporation (NASDAQ:NVDA), as evidenced by an annual return of almost 240%.

Despite such a dynamic northward movement, there are still no indications suggesting that the trend could end.

One potential signal is the current technical situation, which points to a possible top breakout from the consolidation that has been going on more or less since early July.

The prospects for further development of artificial intelligence projects look interesting.

According to CEO Jensen Huang, the company is expected to invest in the range of $1 trillion in data centers over the next four years to upgrade general computing to accelerated computing infrastructure.

On top of that, the Nvidia-Amazon cooperation on innovative customer solutions using generative artificial intelligence is intensifying.

This cooperation can take the AI segment to even higher levels by providing the companies with synergies and leadership positions in the recently launched race for supremacy in the artificial intelligence industry.

2. Can Bank of New York Mellon Stock Test All-Time Highs in 2024?

Bank of New York Mellon (NYSE:BK), which was formed through the merger of Bank of New York and Mellon Financial Corporation in 2007, is currently the largest depository bank in the world.

The combination of a global return in risk appetite and very strong Q3 2023 results has resulted in a dynamic upward momentum that is currently testing an important resistance area located in the $52 per share price region.

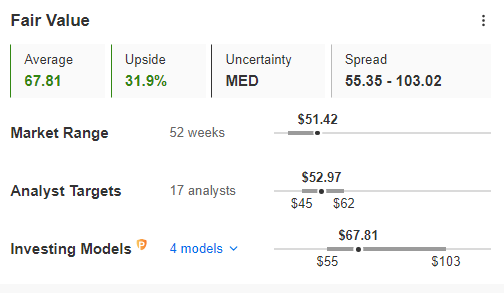

Still, despite the near-vertical upward movement, BNYM maintains a high fair value index, which suggests the potential for an upside of more than 30%.

Source: InvestingPro

The realization of this scenario would mean breaking out of new all-time highs, thus piercing the previous peaks of late 2021 and early 2022.

3. Procter & Gamble Stock Remains a Gem for Dividend Hunters

Procter & Gamble (NYSE:PG) is a company that needs no further introduction to investors focused on typical dividend companies.

Suffice it to point out that the U.S. consumer goods giant has consistently paid dividends for 67 years in a row, so it's hard to assume that next year will be any different.

For several months, the company's price has been stuck within a consolidation, the lower limit of which is being tested again, and so far buyers are managing to defend it.

Assuming the price remains within the sideways trend, the target for buyers is the upper band falling in the price area of $158 per share. If it is broken, then the way is opened for an attack on the historical high in the area of $165 per share.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.