By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The European Central Bank meets Thursday and the euro is trading strongly ahead of the monetary policy announcement. The sell-off in May took the currency pair from a high above 1.1600 to a low of 1.10975 with the decline in EUR/USD stopping right at the 200-day SMA.

Given the steepness of euro's decline, there are 3 compelling reasons to buy euros

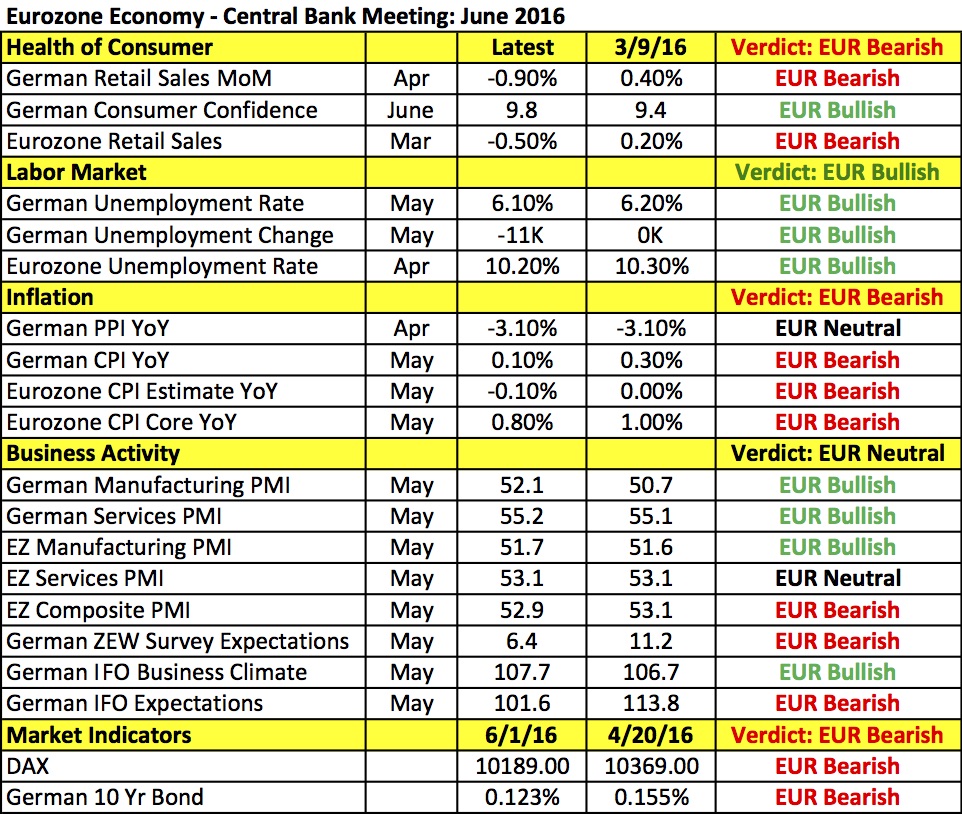

1. ECB Could Upgrade its Growth Forecasts – On Wednesday morning the OECD raised its GDP forecasts for the Eurozone to 1.6% from 1.4% and, if a similar move is made by the European Central Bank Thursday, we could see new highs in the euro. No one expects the ECB to change monetary policy and with the TLTRO and corporate bond-buying program still in queue, the central bank will want to give current stimulus measures more time to work. We’ve also seen mixed performance in the Eurozone economy since the last meeting in April. Consumer spending in Germany and the Eurozone as a whole weakened, price pressures fell, economic activity in the Eurozone slowed according to the Composite PMI index and market measures declined. Yet we see German confidence on the rise, German manufacturing and service-sector activity accelerate and, most importantly, the German unemployment rate fell to its lowest level on record. Which tells us that the Eurozone’s largest economy is performing well enough for the central bank to consider raising its GDP forecast. Also, ECB President Draghi’s tone is always important and if we are wrong and the ECB lowers its GDP forecast with Draghi expressing renewed concern about the peripheral economy, EUR/USD will tank.

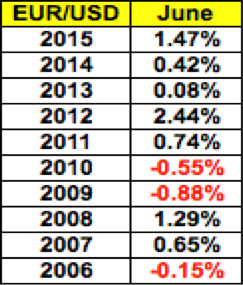

2. Seasonality – As we saw May, seasonality can have a significant impact on a currency. For the past 6 years, the EUR/USD lost value in May and 2016 was no exception. However taking a look at the table below, euro tends to have a positive seasonal bias in the month of June. We suspect that the rallies are mostly driven by short covering or profit taking, 2 factors that could very well affect EUR/USD this week if the ECB is less dovish or Friday’s U.S. labor-market report falls short of expectations.

3. German – U.S. Yield Spread and Expectations for Fed Tightening – The 2-year German – U.S. yield spread also shows signs of a bottom as expectations for a U.S. rate hike in June or July fall. Fed fund futures show the market pricing in only a 22% chance of tightening in June, down from 30% on Friday and a 53% chance of a hike in July, down from 54%.

The U.S. dollar traded lower against most of the major currencies on Thursday despite the surprise increase in U.S. manufacturing activity. The national ISM manufacturing index rose to 51.3 from 50.8, completely contradicting the decline in the Philadelphia Fed, Empire State and Chicago PMI. This third straight month of expansion was driven by higher prices paid, supplier deliveries and customer inventories. The tone of the Fed’s Beige Book was mixed. While tight job markets were widely noted, the districts saw “modest economic growth” compared to the continued expansion reported in April. Wednesday's USD/JPY endured a rollercoaster ride, falling as low as 109.05 after Prime Minister Abe delayed the sales-tax hike and manufacturing activity contracted at its fastest pace in more than 3 years. The plunge in the Nikkei drove the yen higher and the sell-off in USD/JPY continued into the early North American trading session. However with a stronger ISM and Beige Book, the pair ended the day well off its lows. We expect USD/JPY to recapture 110 as the focus shifts to U.S. jobs on Thursday with ADP, Challenger job cuts and jobless claims scheduled for release.

USD/CAD will also be in play with oil inventories and an OPEC meeting on the calendar. OPEC members remain deeply divided and Iraq’s OPEC envoy recently said there is no specific production proposal on the agenda. There was some talk on Wednesday that a new output ceiling could be considered but there was no verification of the headline. The recent recovery in oil prices also reduces the desire for a production cut.

The Australian dollar gave up earlier gains to end the day only marginally higher against the greenback. Tuesday night’s Chinese PMI numbers were better than expected and Australia reported the strongest GDP growth in 4 years, which reduces the chance of further easing by the RBA. The New Zealand dollar on the other hand ended the day near its highs as dairy prices surged for the second auction in a row. There are no economic reports expected from New Zealand but trade and retail sales figures are due from Australia.

Sterling extended its losses versus the greenback despite a sharp increase in the manufacturing PMI index. After contracting in April, manufacturing activity expanded slightly in May. However with house prices falling, mortgage approvals dropping and the OECD slashing U.K. growth forecasts, the PMI numbers were largely ignored.