- Pinterest stock is down more than 28.5% since the start of this year.

- Declining monthly average user numbers are creating headwinds.

- Long-term investors could consider buying shares at these levels.

Shareholders in the online discovery platform Pinterest (NYSE:PINS) have seen the value of their investment drop approximately 65% over the past 52 weeks and 28.5% so far this year. By comparison, the Global X Social Media ETF (NASDAQ:SOCL) has dropped 32.4% in the past year and 18.5% since January.

Most other social media stocks have also performed poorly so far in 2022. Meta Platforms (NASDAQ:FB), Twitter (NYSE:TWTR) and Snap (NYSE:SNAP) are all down 31.4%, 9.1% and 19.8%, respectively.

On Apr. 14, 2021, shares in the visual search and social media platform went over $88, hitting a record high. However, recently, on Mar. 15, they hit a 52-week low of $21.92. Readers may wonder if this is a bottom for PINS stock, at least for now.

How Recent Metrics Came In

Launched in 2010, Pinterest went public in April 2019. Over the past decade, the platform has become one of the most important social media names.

Looking at social media platforms' market share, Pinterest commands a slice of more than 6.1%. Moreover, its website currently ranks number 28 in the US and 30 in the world.

Management released Q4 and FY21 figures on Feb. 3 which were better than estimates overall. Although monthly active users decreased 6% to 431 million, the average revenue per user (ARPU) increased 23%.

Therefore, the company achieved 20% year-over-year top-line growth and reported $847 million in quarterly revenues in the last quarter. Net income for the quarter was $339 million, or 49 cents per diluted share vs. 43 cents a year ago.

On the results, CEO Ben Silbermann said:

“We took important steps in 2021 with the launch of our foundational technology to deliver a video-first publishing platform. And, I’m proud to say that for the first time, we surpassed $2 billion in revenue for the year—growing 52% over the previous year—and reached our first full year of GAAP profitability.”

Prior to the release of the quarterly results, PINS stock was around $24.50. Now, it is changing hands for $25.90, while the market capitalization stands at $17.1 billion.

Next Move In PINS Stock

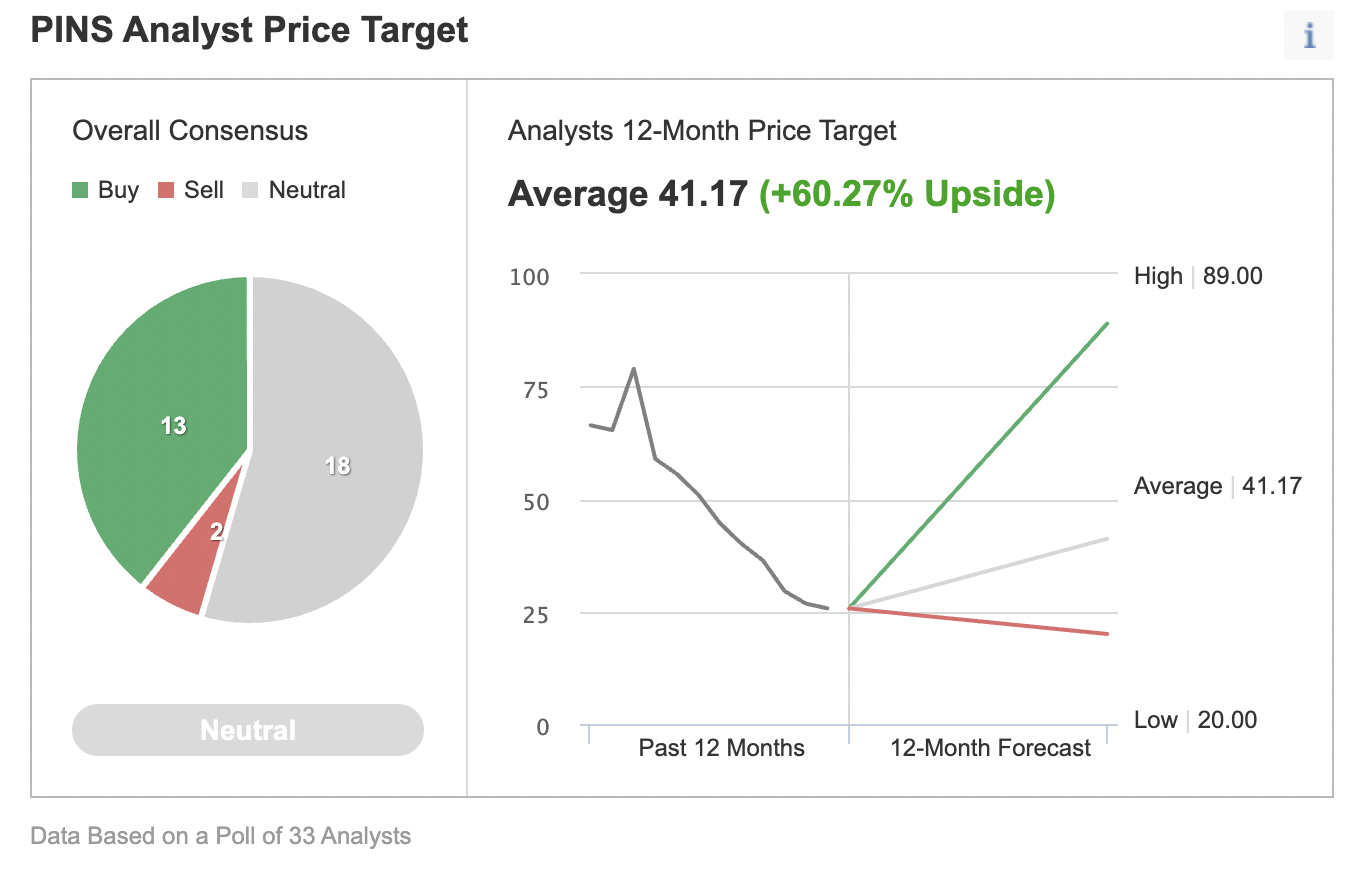

Among 33 analysts polled via Investing.com, PINS shares have a “neutral” rating, with an average 12-month price target of $41.17. Such a move would imply an increase of well over 58% from the current level. The target range is between $20 and $89.

Source: Investing.com

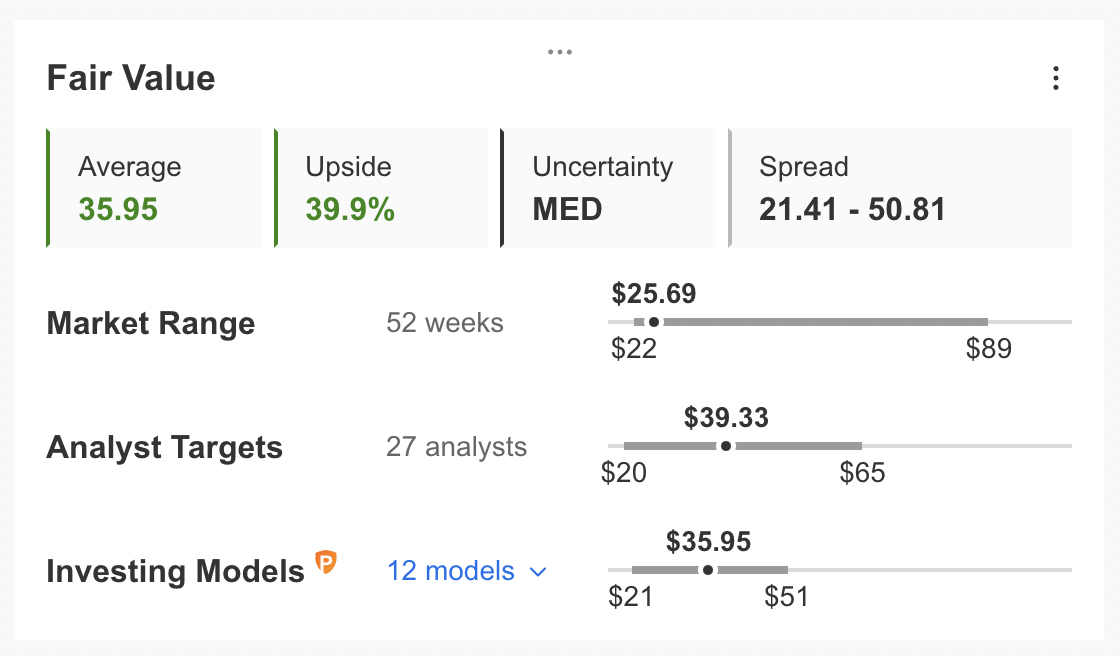

Meanwhile according to a number of valuation models, including P/E or P/S multiples or terminal values, the average fair value for Pinterest stock stands at $35.95.

Source: InvestingPro

In other words, fundamental valuations suggest the shares could increase by about 38%.

We can also look at Pinterest’s financial health as determined by ranking more than 100 factors against peers in the communication services sector.

For instance, in terms of growth and profit, Pinterest scores 4 out of 5. Its overall score of 4 points is a great performance ranking.

At present, Pinterest’s P/E, P/B and P/S ratios are 54.0x, 5.6x and 6.6x, respectively. Comparable metrics for peers stand at 8.5x, 5.2x and 7.7x, respectively.

Finally, readers who watch technical charts might be interested to know that a number of Pinterest’s long-term oscillators are oversold. Although they can stay extended for weeks—if not months—the decline in PINS shares could also be coming to an end.

Our expectation is for PINS to find strong support at around $25. Although the shares might initially dip below it, they are likely to bounce back before too long. Afterward, it would likely trade sideways between $25 and $28 while it establishes a new base.

Adding Pinterest Stock To Portfolios

Pinterest bulls who are not concerned about short-term volatility could consider investing now. The target price would be $35.95, as forecast by valuation models.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has PINS stock as a holding. Examples include:

- Global X Social Media ETF (NASDAQ:SOCL)

- Renaissance IPO ETF (NYSE:IPO)

- American Customer Satisfaction ETF (NYSE:ACSI)

- SPDR® S&P Internet ETF (NYSE:XWEB)

- SoFi Gig Economy ETF (NASDAQ:GIGE)

Investors who are long-term bullish on PINS but concerned about short-term volatility might also use options. For instance, they could put together a covered call position, using in-the-money (ITM) options. Let’s look at an example.

Covered Calls On PINS Stock

Intraday Price: $25.90

A call option is ITM if the market price (here, $25.90) is above the strike price ($25).

So, the investor would buy (or already own) 100 shares of Pinterest stock at $25.90 and, at the same time, sell a PINS June 17 25-strike call option. This option is currently offered at a price (or premium) of $3.40.

An option buyer would have to pay $3.40 X 100 (or $340) in premium to the option seller. This call option will stop trading on Friday, June 17.

Assuming a trader would now enter this covered call trade at $25.90, the maximum return at expiration would be $250, i.e., $340 - (($25.90 - $25) X 100), excluding trading commissions and costs.

On expiration day, if the stock closes below the strike price, the option would not get exercised, but would instead expire worthless. Then, the stock owner with the covered call position gets to keep the stock and the money (premium) s/he was paid for selling the option.

At expiration, this trade would break even at a PINS stock price of $22.50 (i.e., $25 - $2.50), excluding trading commissions and costs.

Another way to think of this break-even price is to subtract the call option premium ($3.40) from the underlying PINS stock price when we initiated the covered call (i.e., $25.90).

On June 17, if PINS stock closes below $22.50, the trade would start losing money within this covered call setup.

Bottom Line

Pinterest stock has come under significant pressure in recent months. However, Wall Street is still bullish on the social media player.

The exact market timing of when PINS shares could take a breather is difficult to determine, even for professional traders. But options strategies, like covered calls, provide tools that might prepare for sideways moves or even further drops in price.