- Earnings season is in full swing with companies reporting left and right

- Despite modest earnings expectations, some stocks will still outperform significantly

- In this article, we'll take a look at 4 stocks poised to do so

We're right in the heart of earnings season, and amidst the expectations of a modest +0.4-0.5% increase in S&P 500 earnings for the quarter, there's a select group of companies that stand out.

Market analysts are looking at these firms, anticipating quarterly earnings that could be significantly higher, possibly even double what they reported a year ago.

It's a noteworthy situation, especially when you consider the rather lukewarm projected S&P 500 earnings.

These four stocks are among those generating considerable attention during this earnings season. So, let's delve into these stocks' fundamentals and harness the power of the InvestingPro tool for invaluable insights.

1. Royal Caribbean Cruises

Royal Caribbean Cruises (NYSE:RCL) is a worldwide cruise company that operates under the brands Royal Caribbean International, Celebrity Cruises, and Silversea Cruises.

The company was founded in 1968 and is headquartered in Miami, Florida.

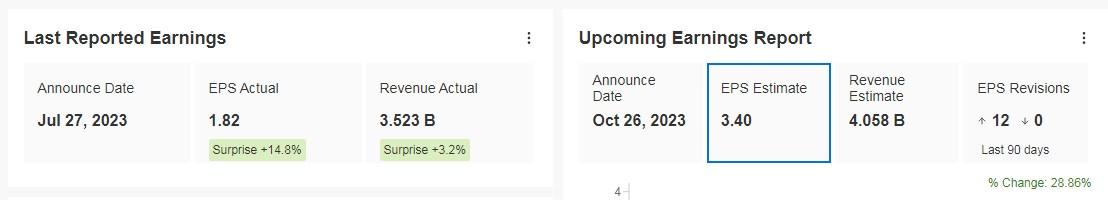

The market expects quarterly year-over-year growth of 1000% and earnings per share of $3.40, which would be a 28.86% improvement for the quarter and a 180.7% improvement for the year.

Source: InvestingPro

In the last 12 months, its shares have risen by +63.44%. It has 23 ratings, of which 16 are buy, 7 are hold and none are sell.

InvestingPro models see potential at $106.93, while the market sees potential at $115.32.

Source: InvestingPro

2. Nvidia

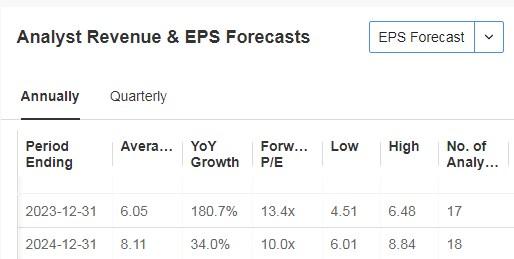

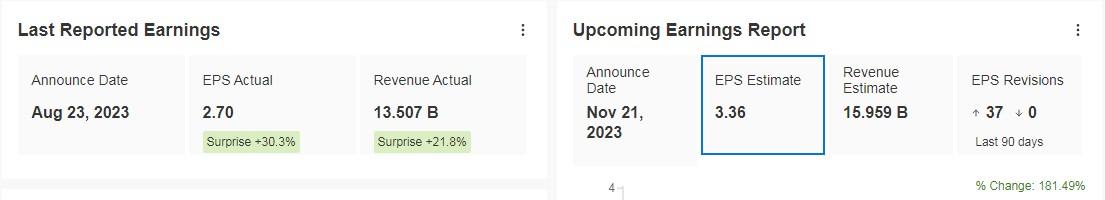

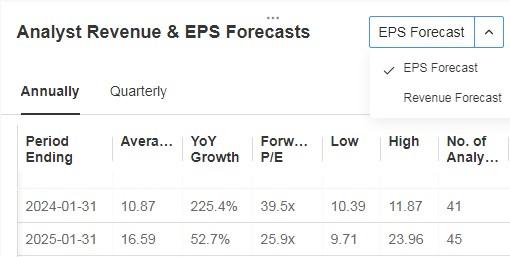

For Nvidia (NASDAQ:NVDA), the market expects quarterly year-on-year growth of 478% and earnings per share of $3.36, which would be an improvement of 181.49% for the quarter and 225.4% for the year. It will present its results on November 21.

Source: InvestingPro

The market sees potential at $643.15. Its shares are up +241.31% in the last 12 months.

Source: InvestingPro

3. Arch Capital

Arch Capital (NASDAQ:ACGL) offers insurance, reinsurance and mortgage insurance, travel insurance, accident insurance coverages, disability and medical plans. It was founded in 1995 and is headquartered in Pembroke, Bermuda.

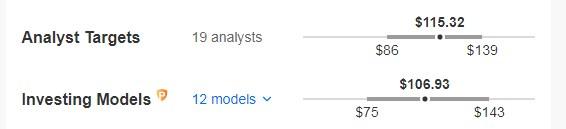

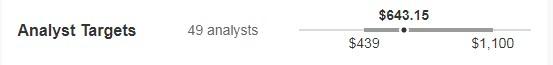

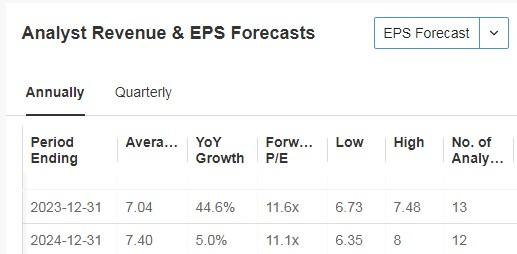

The market expects quarterly year-on-year growth of 461% and earnings per share of $1.57, which would be an improvement of 28.91% for the quarter and 44.6% for the year. It will present its results on October 30.

Source: InvestingPro

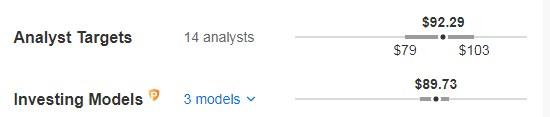

It presents 14 ratings, of which 11 are buy, 3 are hold and none are sell. The shares have risen by +65.91% in the last 12 months.

The market sees potential at $92.29, while InvestingPro models it at $89.73.

Source: InvestingPro

4. Amazon

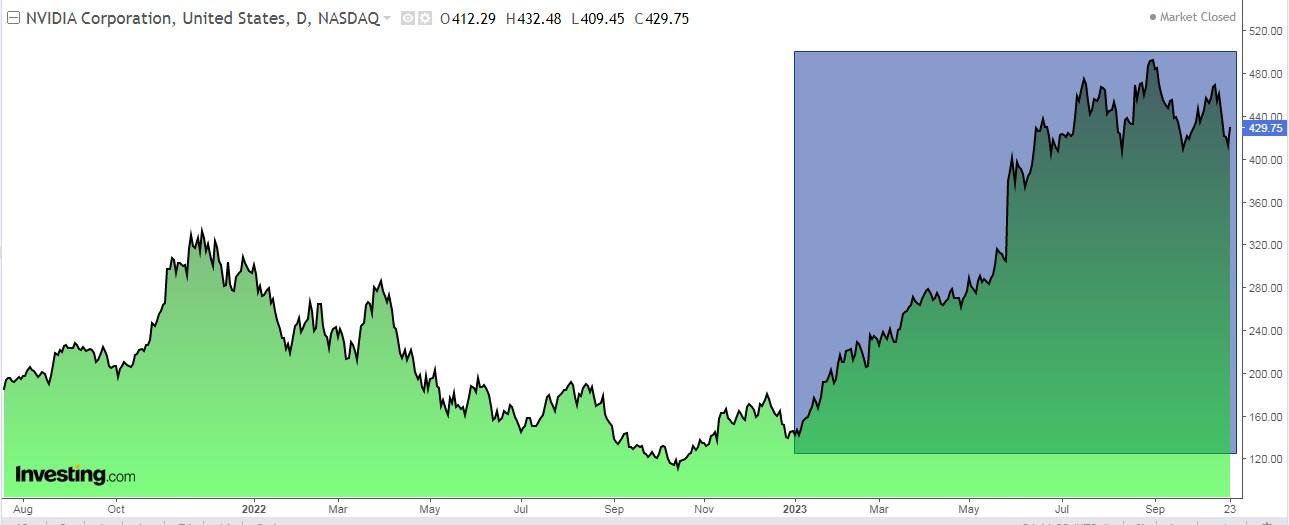

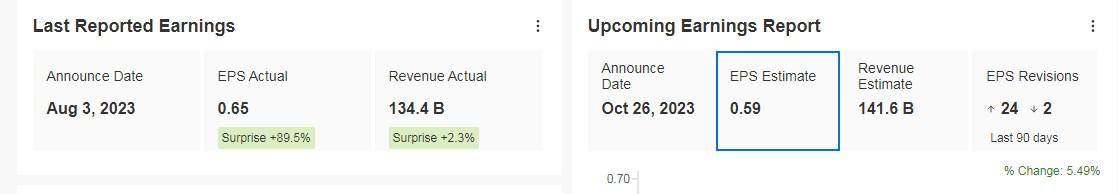

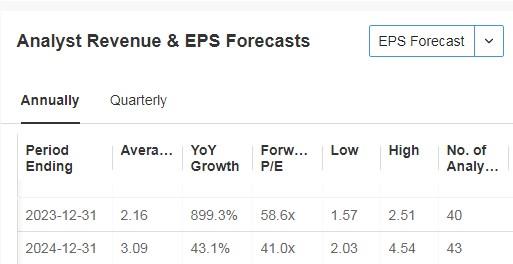

The market expects Amazon (NASDAQ:AMZN) to post quarterly year-on-year growth of 107% and earnings per share of $0.59, which would be a 5.50% improvement for the quarter and a 900% improvement for the year. It reports its results on October 26.

Source: InvestingPro

Its shares are up +5.63% in the last 12 months. The market sees potential at $171.77.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.