It's been no secret that the biggest stock market winners so far this year have been concentrated in the technology sector. Yet recent analysis from David Kostin, chief US equity strategist at Goldman Sachs, is shocking nonetheless.

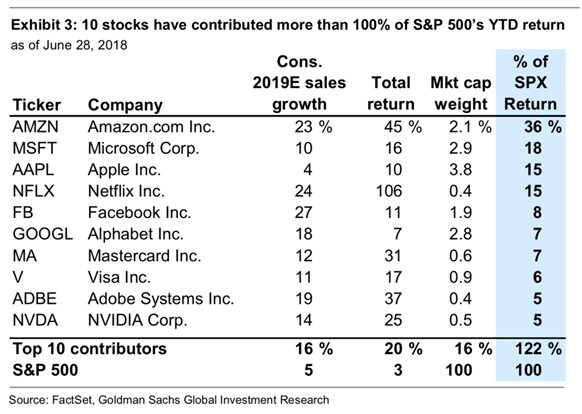

In a note to clients published a week ago, Kostin highlighted that just one stock is responsible for more than a third of the S&P 500’s total return of nearly 3% in the first half 2018: Amazon (NASDAQ:AMZN), whose 48% year-to-date share increase is accountable for 36% of the S&P's total return this year, including dividends.

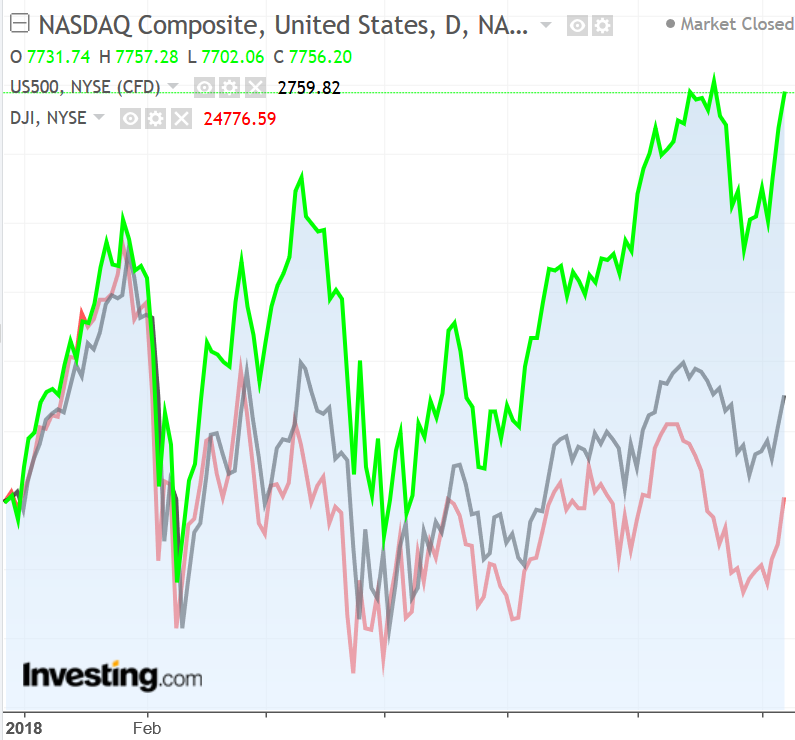

With that data point in mind, it's no surprise then that of all the US major indices, the NASDAQ has been the best-performing major index on Wall Street. The tech-heavy benchmark is up roughly 12% so far this year, followed by the S&P 500, which is up 4%. The Dow meanwhile has lagged behind, up just 0.2% on the year.

Given the performance of the major Wall Street averages, it should probably not come as a surprise just how much of an outlier the tech sector's gains have been. To understand how big a boost the SPX has received from tech shares, add in significant upticks by Microsoft (NASDAQ:MSFT) (+19% YTD), Apple (NASDAQ:AAPL) (+12% YTD), and Netflix (NASDAQ:NFLX) (+118% YTD)—these four names have been responsible for 84% of the index’s total gains so far this year.

If you then tack on Facebook (NASDAQ:FB) (+16% YTD) and Google parent Alphabet (NASDAQ:GOOGL) (+10% YTD), you get to 99% of the S&P 500’s year-to-date increase. Another striking fact: when taking into account the YTD rise in Adobe (+42% YTD) and NVIDIA (NASDAQ:NVDA) (+28%) shares, nearly 110% of the S&P's total upside in 2018 is attributable to just these eight stocks.

These results attest to the continued success of large growth stocks, notes Kostin, who expects strong performance going forward from firms on a stable financial footing. “In contrast with history, many of the companies with the strongest balance sheets today are also the firms with the strongest growth,” he writes.

Looking forward to the second half of the year, service tech stocks, especially the FAANG group—Facebook, Apple, Amazon, Netflix and Google parent Alphabet—may be less directly affected by rising trade restrictions than US tech firms in general. That’s because the FAANGs are mainly focused on software services, so their value chains are less integrated with China than those of hardware producers, which typically have factories inside China, according to Ingvild Borgen Gjerde, an economist at Capital Economics.

Second, most of the FAANGs have little sales exposure to China, as they all face competition from large Chinese rivals that provide the same services and control most of the domestic market, Borgen Gjerde said. However, these names are highly cyclical.

Should a trade war jigger an economic pause, they could still be exposed to a slowdown in growth. “We think that the FAANGs’ revenue growth remains highly dependent on overall growth in the economy, and that once this falls, the FAANGs’ profit growth will fall as well,” the economist said, warning that if trade tensions escalate much further, “the risk increases that this could happen sooner rather than later.”