I wouldn't be surprised if the market gets worse than it currently is, it has already happened; but the opposite would not surprise me either, that is if it returned to all-time highs in a short time.

I cannot predict where stocks will be between now and the end of the year, but I can act on the movement they will make (it's called strategy and scenario analysis).

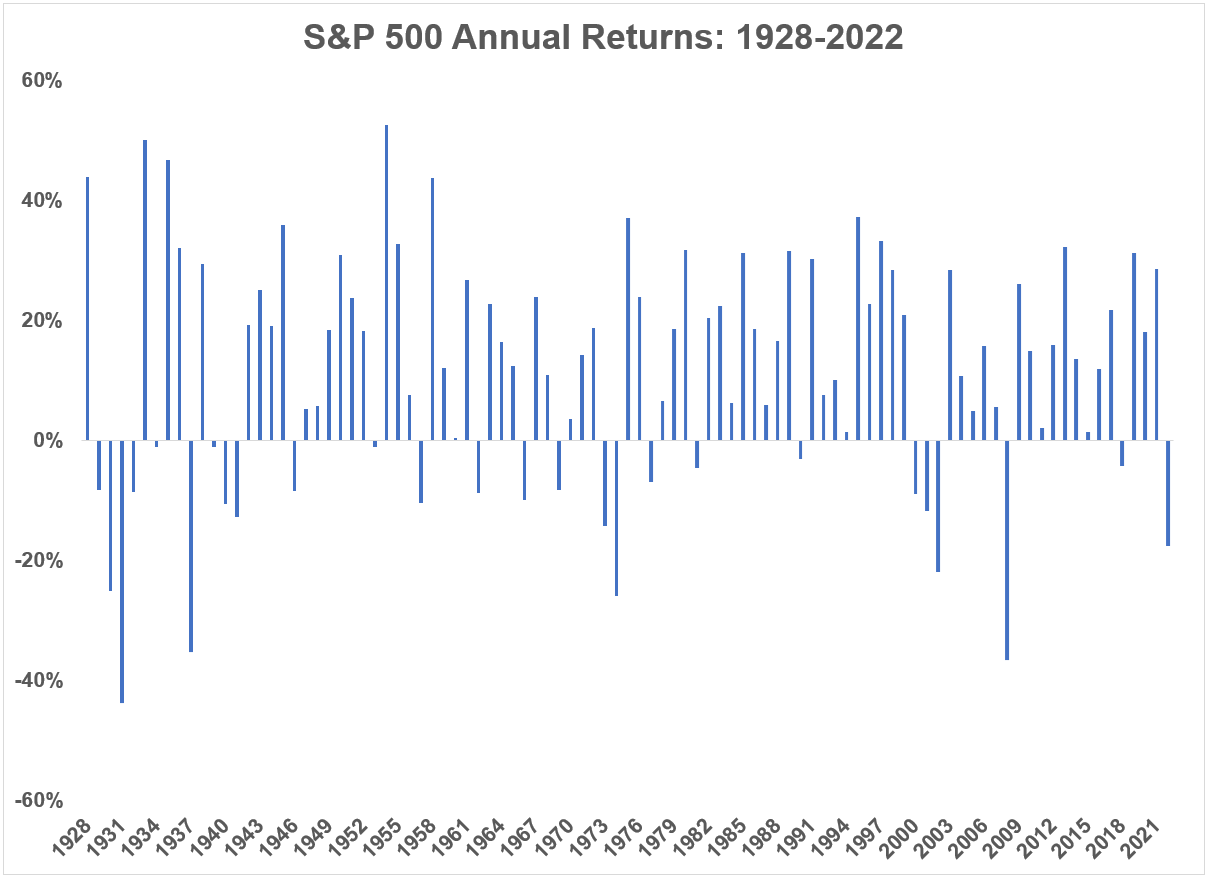

What you see above is the (negative) performance since the beginning of the year of the S&P 500 index. As you can see, only in 6 out of 93 years has performance been worse. This is of course assuming that the year closes like this (with performance down about 20%).

Is this a good thing or not? It depends on how we see it.

Going into even more detail, we also note that 2 years of decline (assuming this is how 2022 ends) has happened 4 times in 93 years.

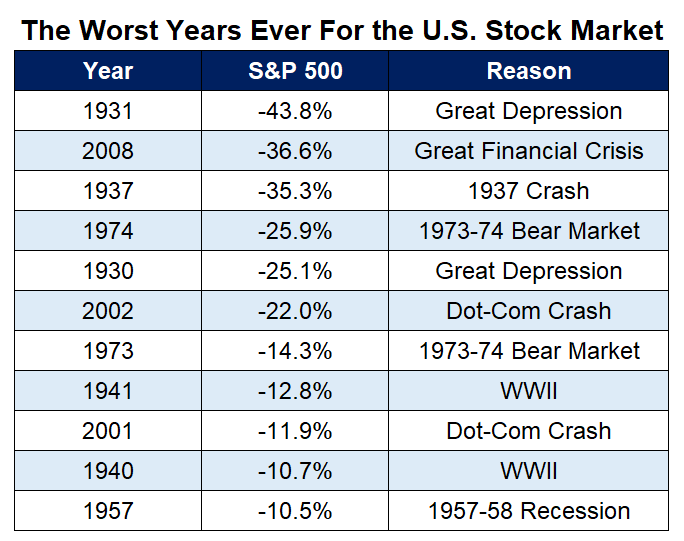

In the table above, we see the performance for individual years in detail. The worst year for the S&P 500 index was 1931, with a performance of -43.8%. The second worst year was 2008, -36.6%. So I refer back to the first lines above...why not already plan a strategy with certain stocks in the portfolio (or with my cash) assuming a 'worst case' of -40% total?

I could also be 'taken by surprise' and we could have the worst year in history (maybe it goes -50%, unlikely but not impossible), and then what? How much can it change for me if I am already positioned for -40%?

We have to get used to these situations. They are an intrinsic and natural and NORMAL part of the markets. They do NOT always go up every year, but they always go up over time between ups and downs.

Yes, it is true, there is the possibility of a recession, inflation, central banks' axes rising, the conflict in Ukraine, falling profits, so what?

Hasn't this already happened over the last 100 years? There have even been two world wars, sooner or later the markets will rise again, but then there will be few left to take advantage of the strong recovery that will come.

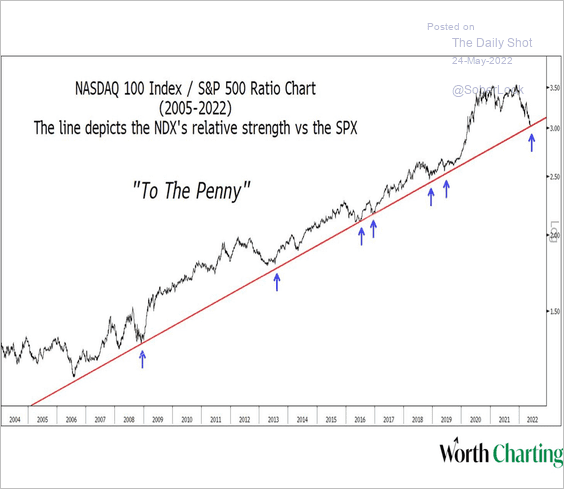

The NASDAQ Composite, the most heavily penalised since the beginning of the year, is also facing one of its worst periods ever.

Suffices to say that, at around -30% from the highs, it is one of the worst declines (only 2001 and 2008 did worse).

But again, it depends on which way we look at things. The relative strength of the S&P 500 index has touched a historically important dynamic support, we will see if there will be a rebound this time as well.

Until next time!

***

If you find my analyses useful and would like to receive updates when I publish them in real time, click on the FOLLOW button on my profile!

"This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any type of asset, is valued from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with you."

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI