- Alibaba's stock has surged recently but faces potential declines amid market volatility.

- Analysts are divided on the stock's future, with some expecting a significant upside based on fundamentals.

- Upcoming earnings reports and government fiscal policies will be crucial for the company's trajectory.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Investors have been eagerly awaiting a significant jump in Alibaba (NYSE:BABA) shares for some time now. The e-commerce giant gained more than 60% between July and October, rising from $72 to $117 per share. The stock is down about 2% at the time of writing.

The recent dip immediately raised alarm bells, particularly given the stock’s recent performance. Despite solid fundamentals, the Chinese e-commerce giant continues to trade at about two-thirds below the $300 peak it reached in 2020.

Source: Investing.com - Data as of October 9, 2024

In a years-long bearish phase, many investors, worried about China’s anemic growth, have also lost hope in Alibaba, selling before the latest rise.

In contrast, Michael Burry, known for his foresight, made a significant bet on China just before the last major bounce

For many investors, BABA, much like Chinese equities in general, remains a source of frustration.

Recent Surge and Subsequent Decline

The retail company's fortunes are closely tied to those of its home country.

The late September rally was fueled by the PBOC's stimulus, which was well-received as the market appreciated China’s willingness to inject liquidity into its economy.

However, following a recent government press conference that failed to convince analysts, the stock experienced a downturn. The entire Hang Seng fell sharply, dropping 9.46% after a strong performance on Tuesday.

The reality is that sustaining a Bazooka of this magnitude necessitates structural fiscal measures. However, Beijing has only conveyed confidence in China's recovery, leaving investors disappointed.

Beijing's Course Correction: Will It Be Enough?

The coming days will be crucial. According to Morgan Stanley, the finance ministry is expected to correct its course soon by holding another conference to outline the People's Republic's economic development plan in detail. If this does not occur, the risk of a further, more severe decline in Chinese equities could materialize.

The World Bank shares this view, indicating that without adequate reforms, the recent maneuvers may have only a temporary impact, predicting that the Dragon's growth could fall to 4.3% in 2025.

"In the short term," explains Mark Dowding, Fixed Income CIO, RBC (TSX:RY) BlueBay AM, " the combination of monetary and fiscal easing measures has helped give the sense that Beijing wants to draw a line in the sand and is committed to easing fiscal policy and doing 'whatever it takes' to support economic activity."

However, the expert continues:

"From a medium- to long-term perspective, we would caution that unless fiscal policy succeeds in boosting consumption, a policy push that seeks to stimulate exports may soon begin to run out."

In summary, after promising words, decisive action is now required. This applies equally to Alibaba.

Fair Value and Target (NYSE:TGT) Price of BABA

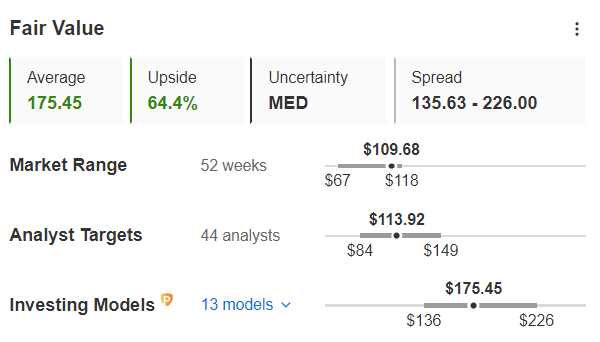

The fundamentals for growth are strong. According to InvestingPro's Fair Value analysis, the stock remains significantly undervalued, with an upside potential of 64.4% from its closing price of $109.68 on October 8.

Fair Value and Target Price of BABA as of October 9, 2024.

However, the 44 analysts surveyed by InvestingPro are decidedly more cautious, projecting a more modest upside, with an average target price set at $113.92 per share—only 3.6% higher than the current price.

Notably, several major brokers have recently decided to bet on the stock. Analysts at Macquarie predict further economic interventions in 2025 by Beijing that could benefit e-commerce stocks, with Alibaba leading the pack. Macquarie has raised its rating from "neutral" to "outperform," increasing the target price from $79.70 to $145. Similarly, HSBC and Goldman Sachs have set target prices at $134, indicating confidence in Alibaba's potential.

Earnings on the Horizon

As investors await clarity on China's fiscal strategies, the next significant event for BABA is on November 14, when the company will announce its quarterly earnings. In the current uncertain macroeconomic environment, meeting market expectations may prove challenging.

Revenue estimates are at $33.916 billion, reflecting a 9.4% year-over-year increase. However, earnings per share are expected to decline, with consensus predicting EPS of $2.10, down from $2.29 in the previous quarter.

Conclusion

Alibaba demonstrates a strong will, backed by a substantial share buyback plan and the introduction of dividends in 2024. With ample free cash flow to cover expenses, the fundamentals are promising. However, tangible results are now required.

In the meantime, investors should anticipate volatility, which may present attractive entry opportunities.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.