Yesterday’s news that US companies accelerated hiring in June strengthens confidence that the Federal Reserve will continue to lift interest rates to tame inflation. Equity risk factors with the strongest gains this year may be vulnerable if a renewed hawkish monetary policy unfolds.

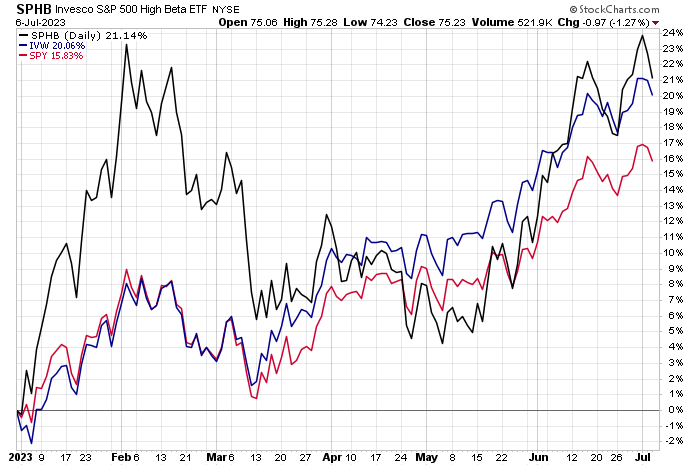

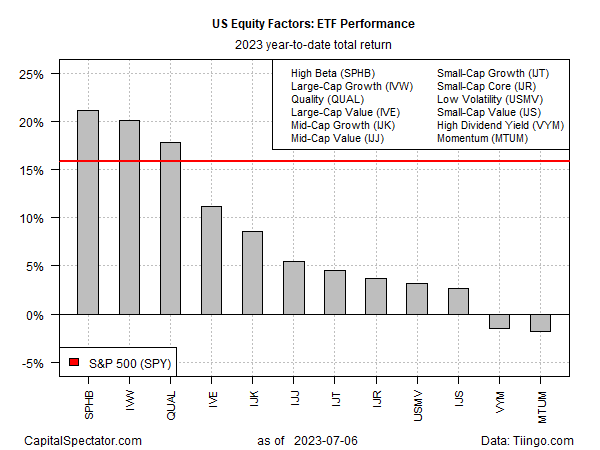

Using a set of ETF proxies shows that Invesco Invesco S&P 500® High Beta ETF (NYSE:SPHB) is currently leading the field so far in 2023 with a strong 21.1% return, as of Thursday’s close (July 6). The iShares Core S&P 500 ETF (NYSE:IVV) is a close second via a 20.1% rally. The broad US stock market, by comparison, is up 15.9%, based on SPDR® S&P 500 (NYSE:SPY).

The risk of red ink has already arrived for 2023 for a handful of equity factors. Although most risk factors are posting year-to-date gains, high dividend yield (Vanguard High Dividend Yield Index Fund ETF Shares (NYSE:VYM)) and momentum (iShares MSCI USA Momentum Factor ETF (NYSE:MTUM)) are the exceptions. Both funds have been stumbling all year, alternating between modest/flat results and losses.

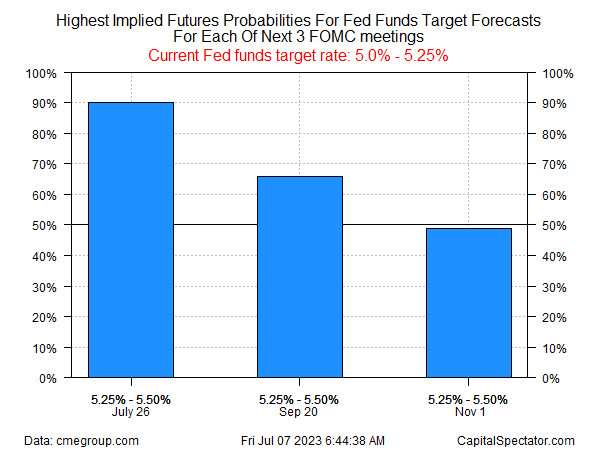

Market expectations have been pointing toward another quarter-point rate hike at the next FOMC meeting on July 26, following a pause at June’s meeting, based on Fed funds futures. The main change after yesterday’s hot jobs data: the crowd is now considering a higher chance that the Federal Reserve will continue to lift rates later in the year. Although the implied probabilities still favor a one-and-done forecast, confidence has faded that rates will peak after the July 26 meeting.

A key variable is how today’s US payrolls report for June from the Labor Department compares. As of this writing (roughly 90 minutes ahead of the 8:30 am Eastern release), economists are looking for a softer but still solid increase in hiring, according to Econoday.com’s consensus point forecast. If the numbers show a strong upside surprise, in line with the ADP (NASDAQ:ADP) report, the hawkish outlook for Fed policy will strengthen, creating more headwinds for the highest-flying equity factors.