BRDY ETF November Surge Recalls 2021 Flashback

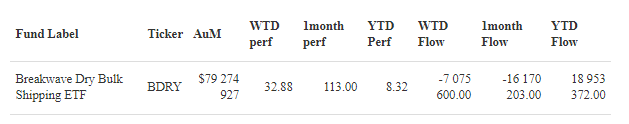

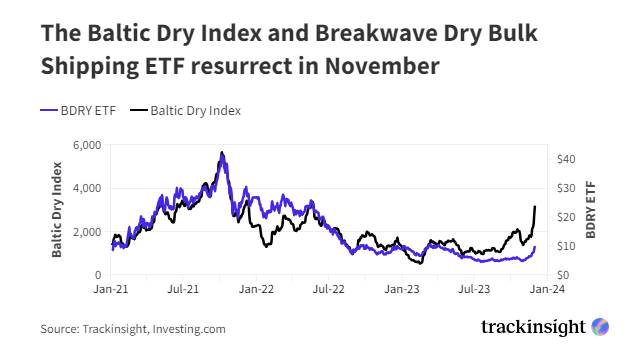

In a remarkable rebound, the Breakwave Dry Bulk Shipping ETF (BDRY) recaptured its 2021 peak performance with a significant 90% increase over the past month. As the only freight futures exchange-traded product focusing exclusively on dry bulk shipping, BDRY provides investors with targeted exposure through a portfolio of near-dated freight futures contracts on dry bulk indices. After soaring in 2021 with returns of over 280% - driven largely by the global supply chain crisis - BDRY had experienced a downturn, shedding over 80% of its value from its October 2021 high. This decline was attributed to factors including China's post-COVID economic recovery and an oversupply in shipping as global restrictions eased.

Though not directly tracking it, BDRY is closely tied to the Baltic Dry Index (BDI), a key metric for sea transportation of raw materials, which recently hit an 18-month high of 3,192. The BDI, reported by the Baltic Exchange in London, aggregates shipping rates of various dry bulk carriers such as Capesize, Panamax, and Supramax vessels, each specialized in transporting commodities like iron ore, coal, and grains.

Drivers of the Baltic Dry Index and BDRY ETF Surge

Yiannis Parganas, head of research at Intermodal, attributes the resurgence of the Baltic Dry Index (BDI) to a “very tight tonnage list in the Atlantic for both capsizes and medium-sized vessels, which is leading to these unprecedented levels”. Jefferies analyst Omar Nokta added that a boost in seasonal demand for iron ore and the expanding bauxite trade have propelled the Capesize index to a two-year peak, significantly elevating the average earnings for these types of vessels.

Funds Specific Data