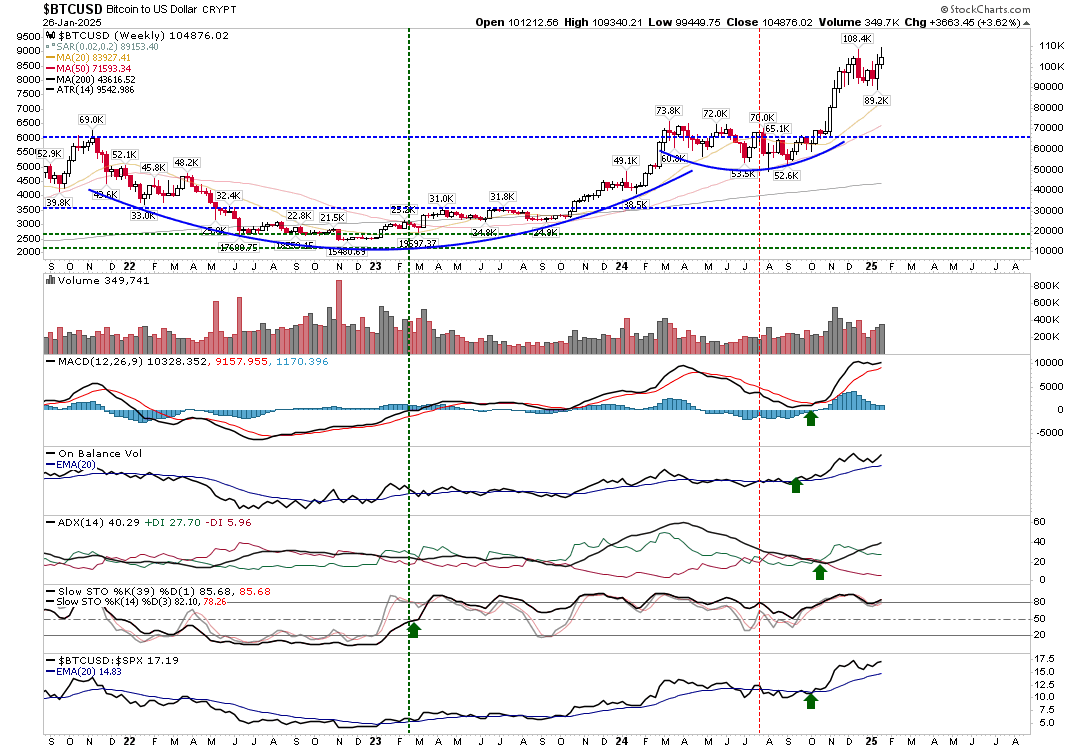

Bitcoin continues its post-election run with the December pullback coming to an end. The emergence from a picture-perfect cup-and-handle pattern opens up 130K as an upside - and very reachable - target.

During last week, after Thursday's big wins for markets, it was going to be hard for Friday to deliver a follow-through. Instead, we got some pullback, but nothing to suggest double tops are a risk.

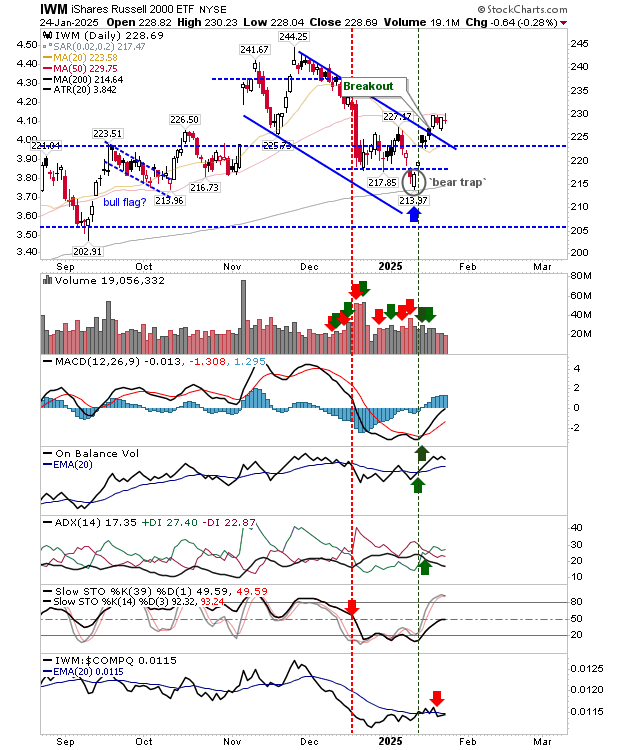

For this week, I will be looking for the Russell 2000 to push through its 50-day MA, which I suspect it will do on a decent 'white' candlestick and will offer a good day trade opportunity.

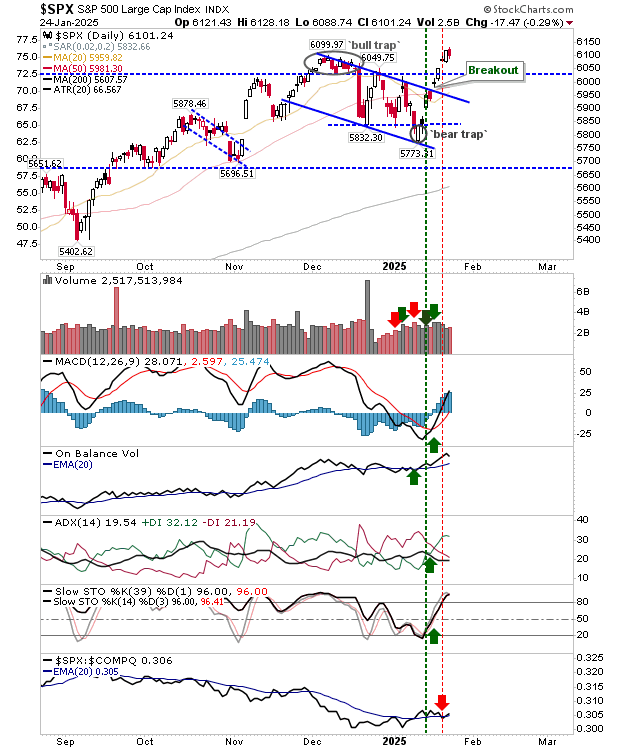

The S&P 500 managed to post a new closing high on Thursday but gave back some of these gains on Friday on higher volume distribution.

While such action is considered "bearish cloud cover", I wouldn't be shorting the index. Look for buyers to step in when the index gets back to 6,000.

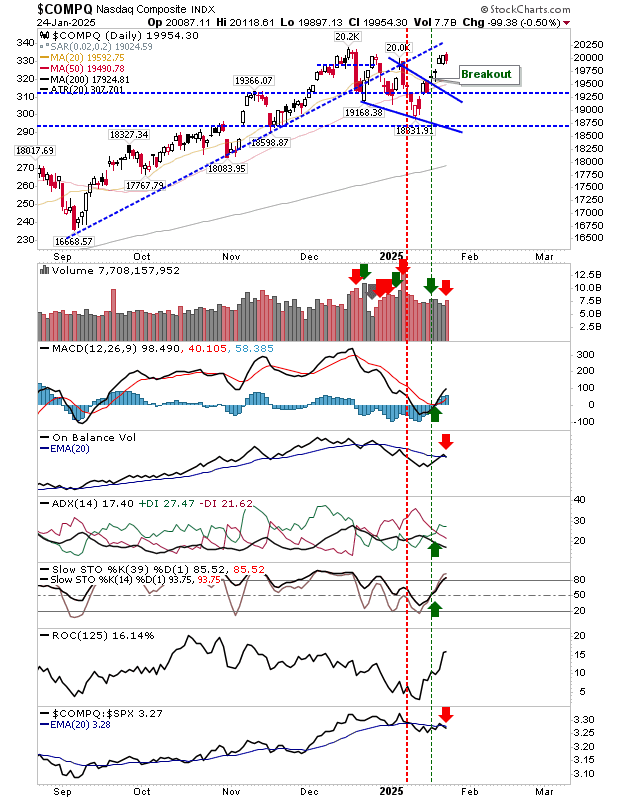

The Nasdaq threatened to push past 20K but was pegged back on Friday. Volume climbed to register as distribution.

Technicals are mixed with On-Balance-Volume and relative performance against the S&P on bearish 'sell' triggers. However, the Tuesday breakout gap is holding, and if it can hold tomorrow (i.e. not close), then bright days lie ahead.

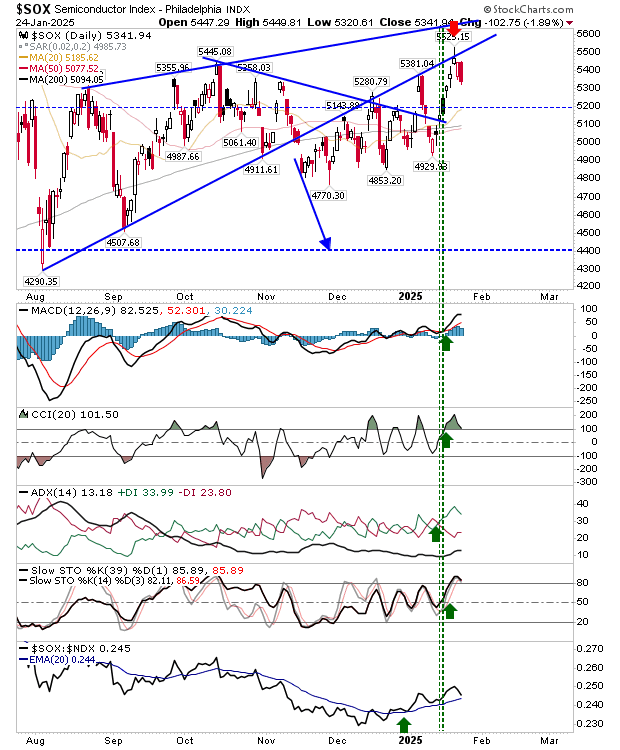

The Semiconductor Index (SOX) pushed into the bearish wedge zone and attempted to break past 5,450 but was ultimately pegged back. Further downside looks likely, but it's done well to get this far.

For today, look for the Russell 2000 (IWM) to push past the 50-day MA and perhaps another advance for Bitcoin. The Semiconductor Index is the one most likely to experience a down day.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.