- In the following article, we'll explore why neither the overall market nor the Magnificent 7 are in a speculative bubble.

- Feeling dizzy amidst all this potential upside? I'll introduce you to a defensive investment strategy along with some illustrative examples.

- April is the best month of the year for energy stocks. Let's delve into how to capitalize on opportunities in this sector.

- Do you invest in the stock market and want to get the most out of your portfolio? Try InvestingPro! Sign up HERE & NOW for less than $9 a month and start outperforming now!

The S&P 500 has surged by +9.7% in the initial 56 business days of 2024. This marks the 15th best start to a year since 1928.

Here's a breakdown of those years and the corresponding gains in the first 56 days:

- Year 1930: +13.2%.

- Year 1931: +16.6%.

- Year 1936: +12%.

- Año 1943: +12.4%.

- Year 1961: +11.3%.

- Year 1967: +12.3%.

- Year 1975: +21.6%.

- Year 1976: +11.7%.

- Year 1986: +10.4%.

- Year 1987: +24.4%.

- Year 1991: +11%.

- Year 1998: +13.9%.

- Year 2012: +10.7%.

- Year 2019: +11.7%.

- Current year (2024): +9.7%.

What's intriguing is that out of those 14 years is that, in 11 of them, the S&P 500 kept on extending gains after the great start.

It's only in 1930, 1931, and 1987 that a different scenario played out. In all other years, it rose extensively, with increases ranging from the least at +2.4% (2012) and +4.3% (1986) to the most substantial at +15.4% (2019) and +14.8% (1936).

All of this leads us to the question of whether the market is in a bubble, a concern on many investors' minds.

Specifically, the fear revolves around the Magnificent 7 (Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), Nvidia (NASDAQ:NVDA), and Tesla (NASDAQ:TSLA).

Before addressing this, let's delve into what constitutes a speculative bubble and examine some famous examples. Then we'll tackle the question head-on.

A speculative bubble emerges when market prices experience significant and rapid increases, surpassing the intrinsic value of that market. This doesn't imply that rising prices lack justification, but rather signifies an exceptionally swift ascent.

When the robust demand abruptly dissipates, it typically triggers the bursting of the bubble, causing prices to plummet steeply (with the same intensity as their ascent), often resulting in the loss of all accumulated value.

Bubbles are fueled by the misguided notion of perpetual price escalation, an irrational belief that prompts investors to make increasingly aggressive purchases they wouldn't consider in different circumstances.

Among the famous bubbles we have:

- The tulip bubble of the 17th century saw a frenzy for exotic tulips in Holland, driving prices to such extremes that people even sold their houses to purchase tulip bulbs.

- The South Sea (NYSE:SE) Bubble in the early 18th century involved the South Sea Company monopolizing trade with the Spanish colonies in Latin America. As rumors circulated about the advantages of its expeditions, the company's share value skyrocketed from 128 pounds to 1,000 pounds within just seven months.

The railroad bubbles of the 1840s marked a period of speculative excess surrounding investments in railroad companies.

- The '29 bubble, preceding the biggest crash in Wall Street history during the 1920s, saw a speculative frenzy that drew thousands into the stock market.

- The dot-com bubble between 1997 and 2000 witnessed a surge in Internet-related stocks. However, in March 2000, the Nasdaq index hit 5132 points before plummeting, leading to closures, bankruptcies, and substantial investor losses.

The subprime mortgage crisis of 2008 stemmed from U.S. banks issuing high-interest loans to individuals lacking financial stability. These loans were bundled into complex financial products and sold, eventually triggering a global economic crisis.

- Prices often fell by more than 90% and rarely recovered or could take decades to recover. It took Japan's Nikkei 40 years to return to new highs, while many tech bubble stocks will never recover their losses.

- During the tech bubble, companies simply added "dot.com" to their names and saw their stock prices skyrocket without any rational justification for such surges, let alone for buying at such exorbitant prices.

Conversely, when we look at the Magnificent 7 today, we observe that these companies are generating substantial profits. Consequently, the high demand for their shares is understandable given their strong corporate performance.

Another aspect reflecting the current reality is the Price-Earnings Ratio (P/E). During the technology bubble, numerous companies boasted P/E ratios of 100 or more.

In contrast, as of today, the 12-month ratio for the S&P 500 stands at 26. Moreover, the 5-year average is 23, and the 10-year average is 21. This indicates that while the S&P 500 is slightly pricier than usual, it is far from being in a bubble.

Afraid of so much upside? How to invest defensively

Well, we have just seen that the market is not immersed in a speculative bubble, but that does not mean that there are not many investors afraid to buy so high.

That's okay, there's a remedy for everything. You can trade defensively. Here's a classic way to do it:

You can consider investing in companies that have consistently raised their dividends over the past five years. This indicates strong performance and favorable fundamentals. Here are some examples:

Investor Sentiment (AAII)

- Bullish sentiment, indicating expectations for stock prices to rise over the next six months, currently stands at 43.2%, exceeding its historical average of 37.5%.

- Conversely, bearish sentiment, suggesting expectations for stock prices to decline over the next six months, is at 27.2%, which is lower than its historical average of 31%.

April is a very good month for energy stocks.

We are very close to entering April, the best month of the year for U.S. energy stocks.

Over the past 33 years, April has consistently showcased this sector's outperformance, averaging nearly +2% above the S&P 500.

Following closely behind, September and February trail with gains of approximately +1% and +0.75%, respectively.

The worst months are November, July and August.

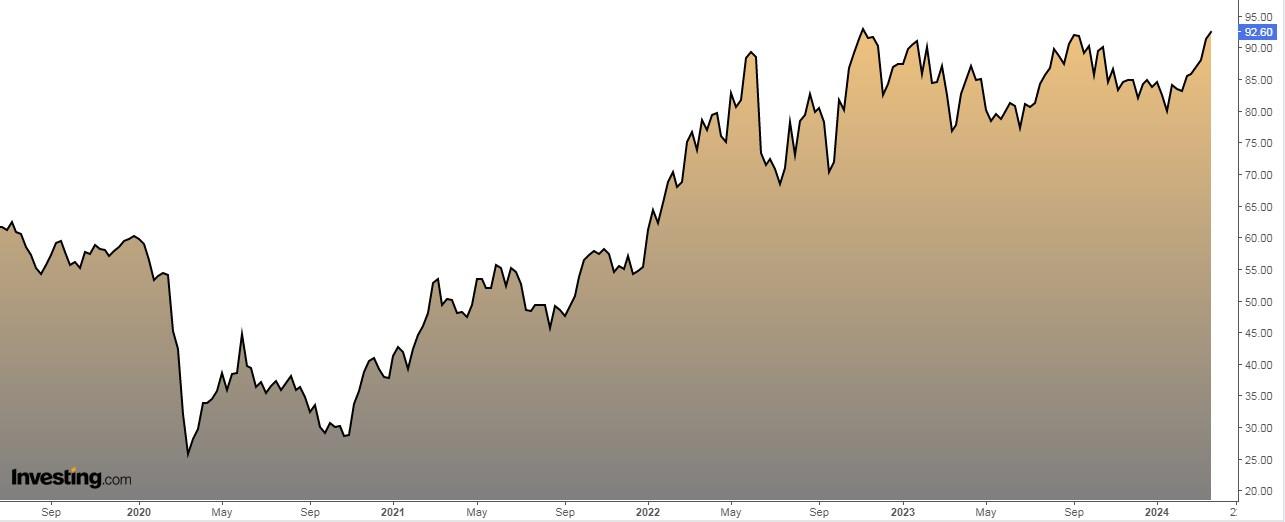

And how can one invest in this sector? One option is through the Energy Select Sector SPDR Fund, an ETF that mirrors the energy sector of the S&P 500 index. With over $26 billion in assets under management, it provides a convenient vehicle for gaining exposure to the energy sector.

------

When and how to enter or exit the stock market, try InvestingPro, take advantage of it HERE and NOW! Click HERE, choose the plan you want for 1 or 2 years and take advantage of your DISCOUNTS. Get from 10% to 50% by applying the code INVESTINGPRO1. Don't wait any longer!

With it you will get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a large amount of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your OFFER HERE!