This is probably going to be a dull week in terms of newsflow. Yesterday, we had Barkin and Williams from the Fed talking, and Barkin was more Hawkish on the rate outlook than Williams, although Williams wasn’t as dovish as he has been in the past. Today will be Kashkari’s, and he has undoubtedly been on the more hawkish side of things, so I expect that again today.

The 2-year rate rose yesterday by almost two bps and back to 4.84%. For now, the 2-year remains in an uptrend despite last week’s declines. That has not changed, even though the bull flag failed.

The dollar started the day lower but finished higher, holding above the 105 support level.

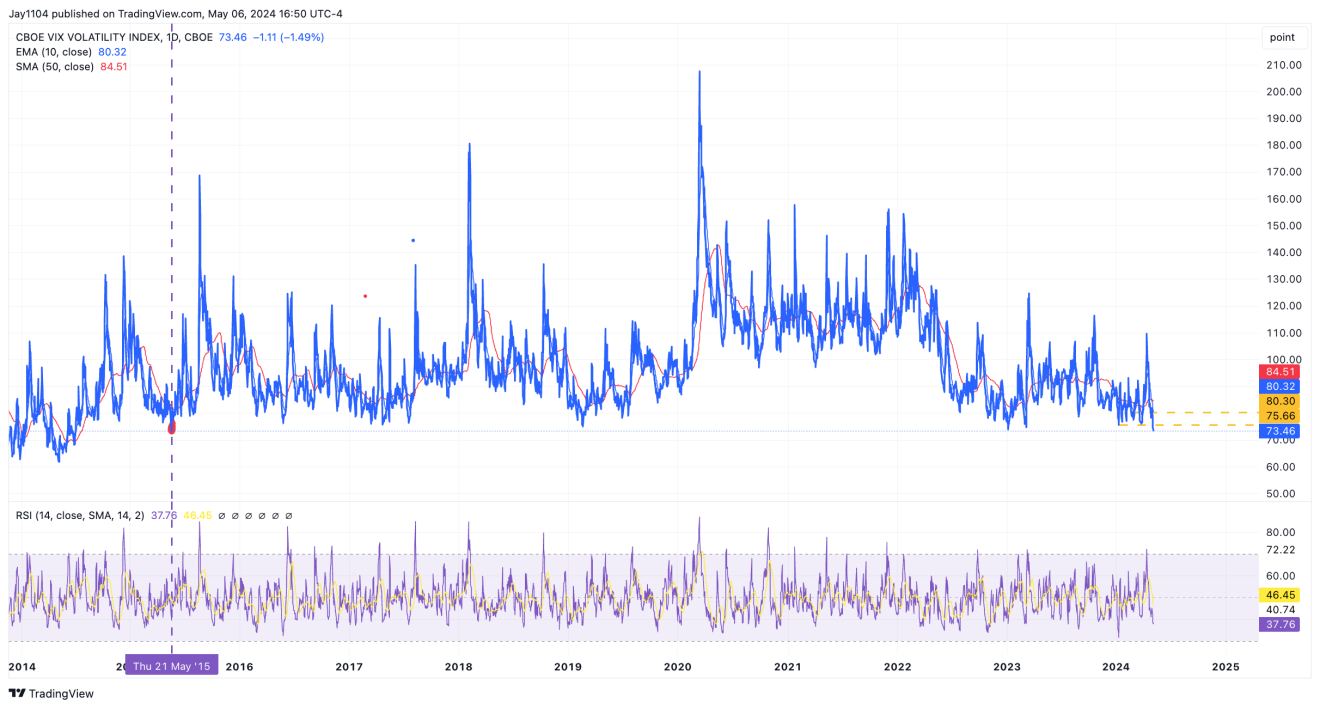

Oddly, the VVIX, which measures vol of VIX, closed yesterday at 73.46, its lowest close since May 2015. I guess buying puts right now is pretty cheap. But then again, why do you need options that expire in 30 days when you have S&P 500 options that expire every day? Why pay for the time you do not need?

The S&P 500 looks content to fill the gap left behind at 5,200.

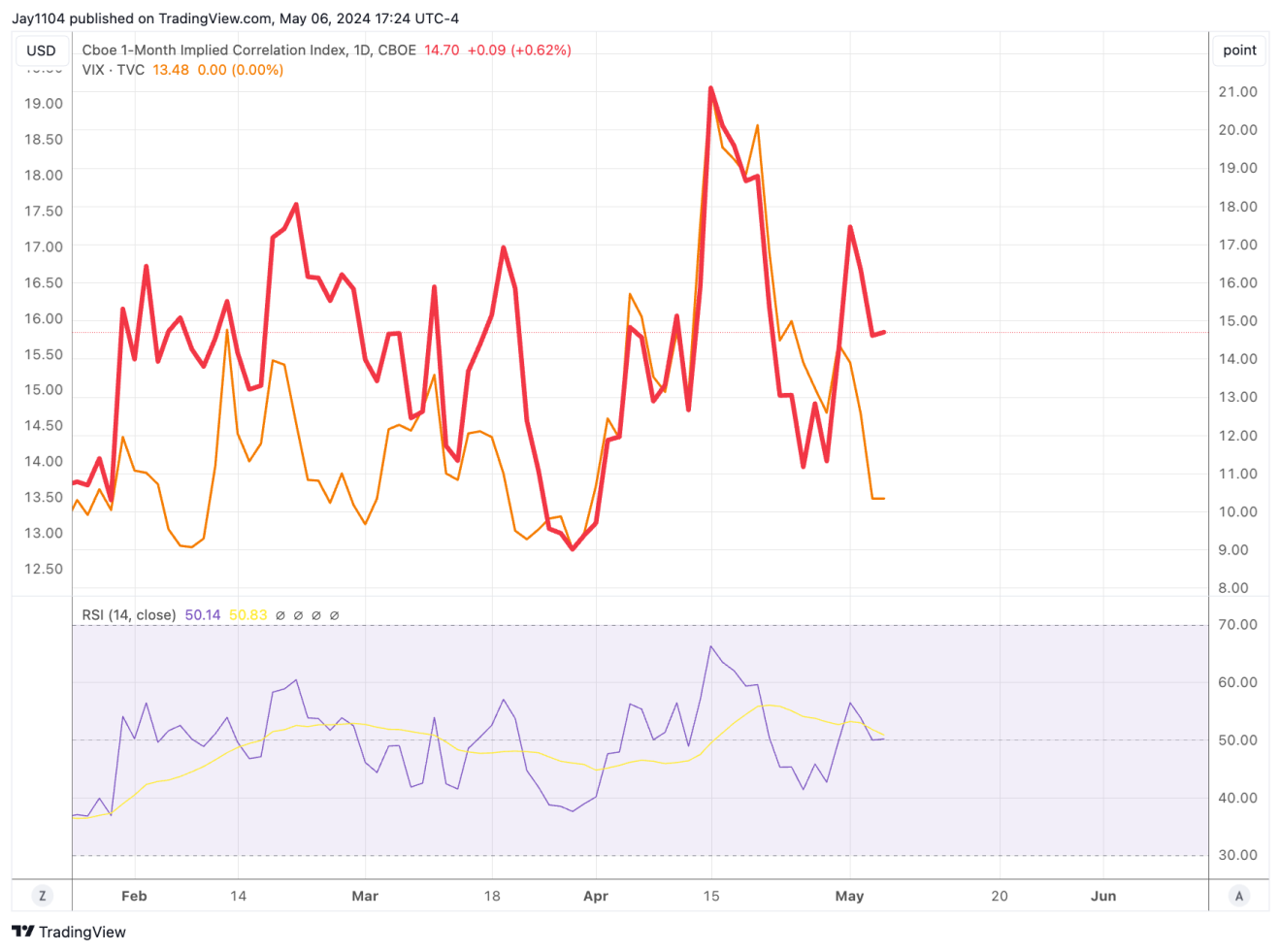

Despite the S&P 500 rising and VVIX hitting its lowest point in a year, the one-month implied correlation and VIX index finished higher and flat, respectively. This is kind of odd. One would think with the S&P 500 up about 1% on the day, the VIX and 1-month implied would have been down.

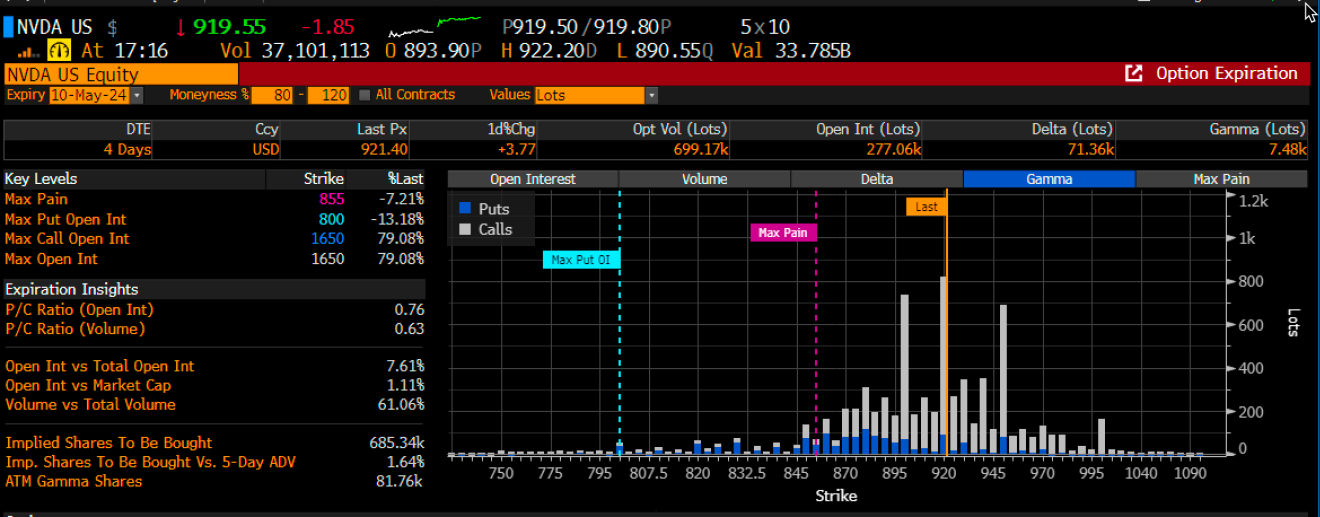

NVIDIA (NASDAQ:NVDA) still has a lot of gammas to overcome over the next couple of days if it is to make it to $950. It would not be easy.

It will be particularly difficult if IV starts moving back up to 65% as well because that tends to be the upper limit for the stock price. Options probably just become too expensive for traders to profit from once the IV hits 65%.