The surge in demand for demand Nvidia's (NASDAQ:NVDA) computer chips for artificial intelligence (AI) applications inspires some observers to claim that a new era for the economy is dawning.

AI, runs the thinking among the most optimistic minds in this realm, will reorder and solve any number of issues on the macro front.

Inflation and growth are at the top of challenges that will potentially fade as an AI-driven world emerges, advises AI expert Patrick Fan, professor of business analytics at the University of Iowa’s Tippie College of Business.

“The notion of a virtuous cycle—wherein improvements in one domain precipitate enhancements across others—is particularly salient,” he says.

“In the AI-economic nexus, elevated growth could beget higher employment and income levels, spurring increased consumer spending and investment and fueling further economic expansion.

This cycle has the potential to underpin sustained economic growth and broad societal welfare.”

The stock market appears to be all-in on the idea. Powered by excitement over Nvidia’s blowout results and the implications for growth in an AI-driven economy, the S&P 500 Index rebounded to a fresh all-time high yesterday.

“A whole new industry is being formed, and that’s driving our growth,” says Jensen Huang, Nvidia’s chief executive officer and co-founder.

The question is whether the rise of AI — and the potential for related developments in the economy overall – renders traditional estimates of the equity risk premium meaningless.

The Capital Spectator doesn’t have an answer, but the question is top of mind as some conventional equity risk premium metrics continue to fade.

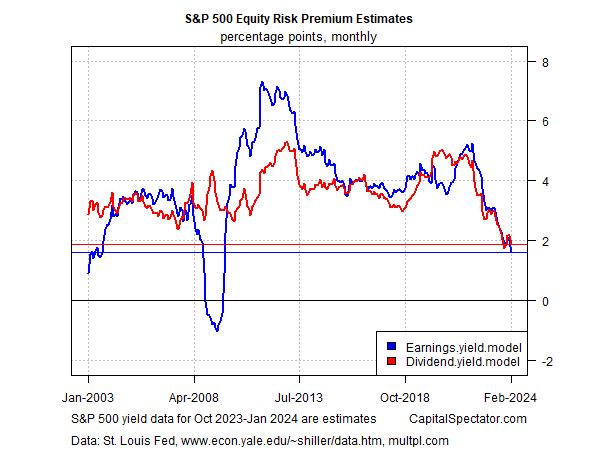

For example, a pair of workhorse models suggest that the market’s excess return over the “risk-free rate” has tumbled sharply in recent years (for details on these models, see this post).

A few weeks ago Matt Smith, investment director at Ruffer, a London-based investment management services firm noted that:

“The market is fearless at this point” and that “From a risk-reward perspective, US equities in particular are pretty unattractive. They have a lot of momentum, but they are expensive.”

History suggests that “expensive” translates into relatively low or possibly negative expected returns.

The question before the house is whether history still applies in an AI-driven world. Mr. Market probably knows the answer, but as usual, he’s not talking, at least not in real-time.