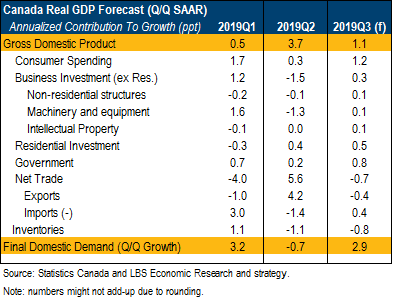

Statistics Canada will publish the 2019 Q3 real GDP figures on Friday, Nov. 29. We are forecasting 1.1% Q/Q SAAR. That is a tad lower than consensus and the Bank of Canada’s October MPR forecast, both pegged at 1.3%. This headline number would represent a major deceleration from the 3.7% gain registered in 2019 Q2 driven by a temporary increase in energy and non-energy exports. However, while the fundamental performance of the Canadian economy in 2019 Q2 was weaker-than-suggested by the 3.7% surge, 2019 Q3 is likely to be perceived as the opposite by market participants.

Our 1.1% forecast is underpinned by a strong 2.9% growth rate in final domestic demand, the sum of household consumption, government spending and business investment.

First, consumer spending is expected to have moderately picked up in 2019 Q3, contributing 1.2 ppt to real GDP growth, from an unusual multi-year low of 0.3% in 2019 Q2 given the strong pace of labour income growth (see table below).

Moreover, fast-growing household income and lower mortgages rates should provide a second consecutive tailwind to residential investment in 2019 Q3, led by a surge in MLS resale transactions and housing construction.

Business investment should stabilize after the sharp decline observed last quarter. Investment in the oil and gas industry should fall again but at a lesser pace than in 2019 Q2, offset by growth in engineering structures in Ontario and Quebec.

Real exports fell in 2019 Q3 in seven out of 11 categories, reflecting the broad-based weakness we have been observing in international trade activity since the beginning of the year. We already know that Canadian merchandise exports to markets other than the U.S. contracted by 22% in 2019 Q3, a fourth contraction over the last five quarters.

Finally, it is worth noting that inventories could shave 0.8 ppt from real GDP growth, a second quarterly subtraction. A stock liquidation by firms should bode well for production in late 2019 and early 2020 as U.S. demand remains healthy and international business sentiment stabilizes, absent of additional trade shocks.

Overall, in the face of trade tensions, the Canadian economy remains resilient. The economic slowdown currently happening in the second half of 2019 is mostly felt through commodity, trade channels as well as weaker nominal growth (expected only at 1.4% in 2019 Q3). However, as highlighted in the BoC’s business outlook survey, firms continue to expect moderate sales growth and investment intentions remain healthy. The domestic economy is doing well and the domestic U.S. economy, to which Canada exports the most, is trending along. Barring any large negative surprise on Friday (such as a real GDP growth figure below 1.0%), the BoC is unlikely to alter its monetary policy stance at the Dec. 4th decision meeting and keep rates on hold.