By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It doesn’t matter if you are trading equities, currencies, bonds or commodities – everyone’s focus right now is on oil. In the last 3 trading days, the price of the world’s most commonly traded commodity dropped over 12% to its lowest level in 7 years. Oil weakness is generally consistent with U.S. dollar strength but in the past few days there have not been broad-based gains in the greenback. While the dollar is strong versus commodity currencies it struggles to extend its gains against the euro and Japanese yen. Traditionally, many economists argue that low oil prices is good for the U.S. economy because it helps boost consumer consumption. But even though average gas prices are down 25% since the summer, we have not seen a big spark in spending. Retail sales are expected to rise in November but last month they increased a meager 0.1% and for most retailers, Black Friday was a disappointment. Recent data suggests that Americans are pocketing the extra cash, saving or paying down debt.

So if oil fails to provide a boost in spending, then the primary benefit of lower commodity prices goes out the window and we must focus on other ramifications. We believe that unless low oil prices are driven by a rapidly rising dollar (which it is not right now), it hurts more than it helps the currency. One of the greatest arguments against a rate hike in December is low inflation and the 12% drop in oil prices over the past 3 days only makes it all that more difficult for central banks to reach their inflation targets. We are still looking for the Fed to raise interest rates next week, but there could be a number of dissenting votes. Also, the decline in crude will make U.S. policymakers more eager to downplay the first hike by coupling it with dovish forward guidance. Of course the U.S. is not the only country affected by lower oil prices. Inflation around the world will remain muted in 2016 unless the trend in oil reverses and the price of the commodity climbs back above $50 a barrel.

Low oil prices are also bad news for the dollar if it fails to increase spending because then the main consequences will be lower profits for energy companies and layoffs in the oil industry. We’ve already seen shares of these companies decline and take the broader index lower. Eventually Americans will be more eager to spend their extra income. It is estimated that for every dollar saved at the pump, spending rises by 73 cents, which will translate into more income for the average household than the 2008 tax rebates. No U.S. economic reports were released Tuesday. The calendar remains quiet until Thursday.

Given the big moves in commodity prices, it should be no surprise that commodity currencies experienced the largest moves on Tuesday. USD/CAD climbed to a fresh high with no major resistance until 1.40. Although the lower Canadian dollar is easing some of the pain, the Bank of Canada won’t be happy with recent market moves especially as the Fed prepares to raise interest rates. In fact BoC Governor Poloz said on Tuesday that negative interest rates aren’t the only thing in its arsenal.” They could use forward guidance, QE or other measures to stimulate the economy. Weaker Chinese trade numbers and rumors of a VAT tax hike drove the Australian dollar lower.

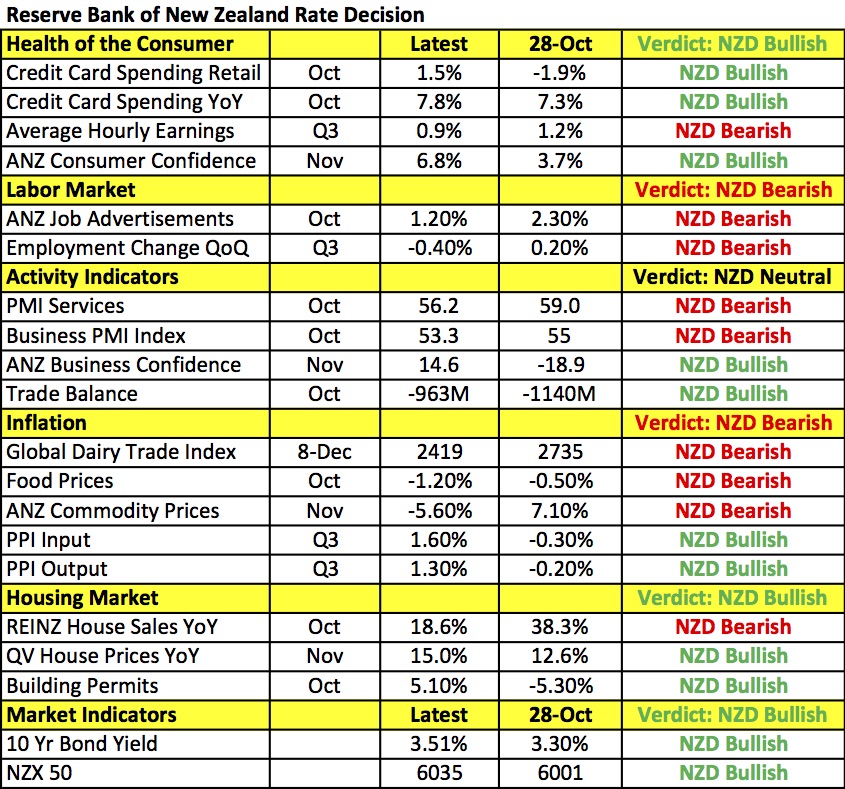

New Zealand dollar traders were more cautious ahead of Wednesday’s Reserve Bank meeting. Analysts are looking for the RBNZ to lower rates for the fourth time this year but according to the table below, the central bank has reasons to hold rates steady. Since their last meeting in October, the New Zealand dollar declined in value versus the Australian dollar, business and consumer confidence are up, spending increased, the trade deficit narrowed, housing market improved and market indicators moved up. However dairy prices have fallen, manufacturing- and service-sector growth slowed and most importantly labor-market activity deteriorated. So there are plenty of reasons for the central bank to lower rates or, at minimum, be very dovish. Last month, RBNZ Governor Wheeler said a sustained rise in the currency would require a lower rate path and some further reduction in interest rates seems likely.

Three Scenarios For Wednesday’s RBNZ

#1 – the central bank cuts rates and remains dovish, which would be very negative for NZD,

#2 RBNZ cuts but shifts to neutral, which would cause an initial spike lower in NZD followed by a quick recovery,

#3 RBNZ leaves rates unchanged but maintains their dovish bias, which would also be positive for the currency.

The euro rebounded Tuesday on the back of comments from Bundesbank head Weidmann who didn’t feel the recent easing was necessary. The OECD also said the outlook for the Eurozone economy is stable. Eurozone Q3 GDP numbers were unrevised at 0.3%. German trade numbers are scheduled for release Wednesday and despite softer industrial production numbers, euro weakness and a higher PMI manufacturing index should help boost trade activity.

We don’t talk about Japan often but it's important to note that Japanese Q3 GDP numbers were revised up 0.3% from -0.2%, which means the country did not technically fall into recession last quarter. The impact on the yen was limited but this validates the Bank of Japan’s reluctance to increase Quantitative Easing.

Sterling traded lower against the euro and U.S. dollar on the back of mixed data. House prices declined unexpectedly according to Halifax’s latest report and manufacturing production declined but industrial production increased. The main focus this week for the British pound is the Bank of England meeting, which now includes the minutes and while there have been improvements in the economy since the last meeting, chances are the decline in commodity prices will keep policymakers dovish.