1: ConocoPhillips is one of the largest independent oil and gas producers.Houston-based energy giant ConocoPhillips (NYSE:COP) released its fourth-quarter 2024 results on February 6, 2025. This article updates my previous article on ConocoPhillips, published on June 20, 2024. The company is among the world’s largest independent oil and gas producers, operating in 15 countries. In 4Q24, the US lower 48 segment accounted for 59.9% of oil equivalent production, primarily from the three most productive basins: Permian, Eagle Ford, and Bakken, which produced 1,240 barrels of oil equivalent.

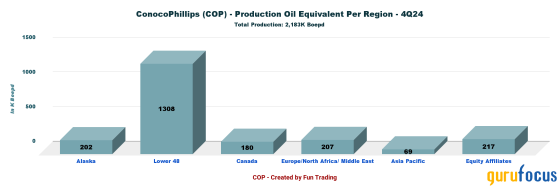

2: 2024-2025 Oil Industry Outlook: Relentless Consolidation.In November 2024, ConocoPhillips strategically acquired Marathon Oil (NYSE:MRO) for $22.5 billion, including $5.4 billion in assumed debt, thereby enhancing its portfolio with high-quality, low-cost supply assets. The chart below shows a significant improvement in oil equivalent production in 4Q24, with a total output of 2,183 Kboepd, including 1,308 Kboepd from the US lower 48.

In 2024, the U.S. oil industry saw significant consolidation, especially in the Permian Basin. This trend has continued into early 2025 as companies aim to improve operational efficiency and expand their resource portfolios. ExxonMobil, Occidental Petroleum (NYSE:OXY), Diamondback Energy (NASDAQ:FANG), EOG Resources (NYSE:EOG), and Chevron (NYSE:CVX) have already participated in this consolidation.

Diamondback Energy is now negotiating to acquire Double Eagle, a major crude oil producer in West Texas. Double Eagle owns 95,000 net acres in the Midland segment of the Permian Basin, and the deal could exceed $5 billion. While this amount is substantial, it is much smaller than ExxonMobil’s acquisition of Pioneer Natural Resources (NYSE:PXD) for $59.5 billion. While consolidation provides benefits like cost synergies and improved efficiency for the companies involved, I remain highly skeptical about its positive impact on shareholders, who typically bear the initial costs.

Let’s use Occidental Petroleum as an example. The company nearly faced bankruptcy after acquiring Anadarko. Despite several years of efforts to achieve synergies, it remains heavily indebted and pays only a fraction of the dividends it used to distribute before the merger. This situation has been detrimental to Occidental’s shareholders, except Warren Buffett, who has greatly benefited from it. If Buffett had not supported the stock by continuously buying shares and owning over 28% of Occidental, it’s uncertain how low the stock price would be now. Additionally, through Berkshire Hathaway (NYSE:BRKa), Warren Buffett (Trades, Portfolio) has received regulatory approval to acquire up to 50% of Occidental’s common stock. Still, he has stated that he does not intend to take control of the company.

The ongoing quest to become the largest producer in the U.S. is more about ego, primarily serving the interests of management rather than benefiting shareholders. In summary, being bigger is not necessarily better for shareholders. While most major U.S. producers have expanded their operations and reached record domestic production levels, their stock performance over the past few years shows little significant variation. A look at the two-year chart quickly leads to the conclusion that this growth was not worthwhile. COP is down 10% compared to two years ago and may fall even lower.

The outlook for oil prices in 2025 is expected to be negative, as supply is projected to exceed demand. The U.S. Energy Information Administration (EIA) forecasts that the average price of Brent will decrease from $81 per barrel in 2024 to $74 in 2025. Additionally, 2025 is anticipated to be highly volatile, with significant price fluctuations. This decline and fluctuations will likely exert additional downward pressure on stock performance, prompting investors to consider a Last In, First Out (LIFO) trading strategy. It is what I am doing, and it has paid off.

3: A critical analysis of the fourth quarter results: Uncertainty about 2025.3.1: Oil Equivalent Production for 4Q24: Record production achieved following the Marathon acquisition.

It is important to note that, unlike Chevron and ExxonMobil, ConocoPhillips does not generate revenue from downstream or chemical operations. Instead, it is exclusively an exploration and production (E&P) company that concentrates on upstream activities such as oil and gas exploration, development, and production.ConocoPhilips’ Oil equivalent production jumped significantly in 4Q24 with the Marathon oil production. Total output of 2,183 Kboepd, including 1,308 Kboepd from the US lower 48. US production represented 59.9% of the company’s total output. The different sub-regions where oil and gas come from in the lower 48 are shown below.

The Permian Basin is the main segment, producing 833 Kboepd as indicated in 4Q24. The production includes oil, natural gas liquids (NGL), natural gas, and bitumen, with oil accounting for 49% of the total output. The liquid-to-gas ratio of 83.4% is quite exceptional.

Oil and gas prices have been declining. In 4Q24, the global average per barrel of oil equivalent (Boe) reached $53.27, down from last year’s $58.21. The average realized price of crude oil was $71.04 per barrel, down from the previous year’s figure of $80.80. The average realized price of natural gas was $5.12 per thousand cubic feet, while the price of natural gas liquids was $23.93 per barrel.

ConocoPhillips is currently the third-largest producer of oil equivalent, with a total production of 2,183 Kboepd, including 1,308 Kboepd from the lower 48 states in 4Q24. The company’s production cost was $19.18 per barrel of oil equivalent (BOE) for the period, which resulted in a significant profit margin. This enabled COP to pay a quarterly dividend of $0.78 per share, reflecting a yield of 3.25%.

Chevron, including Hess (which has not yet received clearance), is expected to be the largest producer, slightly surpassing ExxonMobil. I have also mentioned Occidental Petroleum and EOG Resources, although their production figures for 4Q24 are not yet available. The total combined production for the six companies listed below is approximately 1.5 million barrels of oil equivalent per day.

3.2: 4Q24 results analysis.

ConocoPhillips (NYSE:COP) reported adjusted earnings per share of $1.98 in the fourth quarter of 2024, beating analysts’ expectations. However, this was significantly lower than the prior-year level of $2.40.ConocoPhillips’ quarterly revenues were $14.74 billion, down from $15.31 billion in the year-ago period. The better-than-expected quarterly earnings resulted from increased oil equivalent production, although they were partly offset by lower average realized oil equivalent prices and higher overall costs and expenses.

I often assess a company’s financial health by examining its free cash flow. The free cash flow was weak in the fourth quarter, totaling only $1.14 billion. This amount was less than half of what ConocoPhillips achieved in the previous quarter, which is concerning.

ConocoPhillips has announced a target to return $10 billion to shareholders by 2025. This plan includes $4 billion in dividends and $6 billion in share buybacks. In 2024, the company returned $9.1 billion to its shareholders, $5.5 billion of which came from share repurchases and $3.6 billion from ordinary dividends. This spending is well above what COP can spend based on free cash flow. We must see if COP can generate more free cash flow in 1Q25. At the pace of 4Q24, the company will generate less than $5 billion in 2025, barely covering the dividend. I encountered the same issue with ExxonMobil. The company will generate more free cash flow in 2025, alleviating my concerns. However, higher oil prices are crucial, and 2025 may not be strong enough.

COP’s long-term debt, including current liabilities, totals $24.324 billion, while its cash, cash equivalents, and marketable securities amount to $6.114 billion. The company’s debt significantly increased in 4Q24 after COP assumed $5.4 billion in debt from Marathon. Additionally, COP announced that it will divest certain assets in the Permian Basin for more than $1 billion. Like we said, We can’t have the cake and eat it too.

4: Technical Analysis. COP is weakening.

Note that the chart above has been updated to reflect dividends.

ConocoPhillips follows a descending channel pattern, with resistance at $101 and support at $95.50. The Relative Strength Index (RSI) is at 36 and is declining, indicating a bearish trend.

I suggest taking profits between $99.9 and $102 for a short-term trading strategy, with a possible higher resistance at $105.85, corresponding to the 200-day moving average. Conversely, I recommend accumulating shares between $96 and $95, with an additional lower support level at $92.5 or below, depending on the oil prices.

Adopting a short-term Last In, First Out (LIFO) strategy for 40% to 50% of your total position while maintaining a core long-term holding for potentially higher returns can be an effective approach. ConocoPhillips offers a solid dividend yield. Although there are short-term risks in the oil sector, your investment will likely yield substantial long-term gains if you remain patient. Therefore, keeping a significant portion of your position for the long term is important, even if you encounter temporary paper losses. The key to success is to invest in strong companies, and COP fits that description.

Note that the chart above should be updated regularly to remain relevant.

This content was originally published on Gurufocus.com