This article was written exclusively for Investing.com

- New highs in copper and a correction, gold joins the party

- Aluminum hits new highs; nickel and other base metals hit multi-year peaks

- Oil moves towards new all-time high, oil products soar

- Signs of hyper-inflation

- 3 reasons commodity bull continues to roar

During the first half of 2020, commodity prices fell with all other asset classes as the global pandemic gripped markets. After making multi-year lows, prices stabilized and began to recover. Central bank liquidity and government stimulus primed the global financial system, and raw material markets began aggressive rallies. In August 2020, gold became the first commodity to reach a new all-time high, and many others followed in 2021.

The U.S. central bank, Treasury Department and many elected officials blamed rising prices, which was causing inflation, on pandemic-inspired supply-chain bottlenecks. In May 2021, copper, palladium and lumber prices rose to new all-time highs. In late 2021, the Fed and others finally admitted that inflation was a lot more structural than “transitory” and began outlining plans to increase short-term interest rates and end asset purchases by March 2022.

In late February 2022, Russia invaded Ukraine, sparking the first major war on European soil since WW II. Russia is a leading commodity producer. Sanctions, embargoes and supply-chain issues created by the war in Eastern Europe only increase inflationary pressures. The Russian invasion and sanctions have caused commodity prices to soar. Over the past days, copper, gold, nickel, coal, wheat and many other raw materials have moved to new record highs. The bull market in commodities started before the war in Ukraine, which only pours fuel on an inflationary fire.

New Highs In Copper And A Correction, Gold Joins The Party

Russia invaded Ukraine on Feb. 24, starting a humanitarian tragedy. The U.S., Europe and other allied countries slapped sanctions on Russia. Russia retaliated with export bans. The war and trade barriers create a new round of price dislocations in raw materials markets, impacting supplies. Inflationary pressures have already caused the commodities asset class to experience a bullish relay that began in 2020 and continued through 2021 and the first months of 2022. The war only turbo-charged the price appreciation in many raw material markets.

Source: CQG

The monthly chart shows that copper moved from the March 2020 low of $2.0595 to a record high of $4.8985 in May 2021. After a correction that took the price below $4, copper’s price consolidated. The war in Ukraine and inflation put upward pressure on all commodity prices, and copper was no exception. The price rose to a new record peak at $5.01 per pound in March 2022 before pulling back to the $4.60 level.

Gold was the first commodity to reach a record peak in the wake of the global pandemic. The precious metal rallied to an all-time high of $2,063 per ounce in August 2020.

Source: CQG

The monthly chart shows that after gold spent 19 months digesting the move to the August 2020 peak and consolidating, it made a marginal new high in March 2022 at $2,078.80 per ounce, $15.80 higher than the 2020 peak. Gold pulled back to the $1,912 level on March 16, but the long-term bullish trend remains intact.

Aluminum Hits New Highs; Nickel And Other Base Metals Hit Multi-Year Peaks

Base metal prices followed copper, with aluminum, tin and nickel prices moving to new record highs over the past weeks.

Source: Barchart

The chart shows that three-month aluminum forwards on the LME rose to a high of $4,073.50 per ton this month, eclipsing the 2008 all-time high of $3,380.20.

Source: Barchart

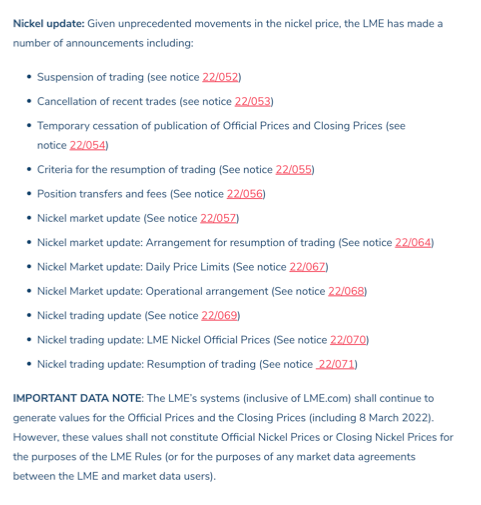

Three-month LME nickel forwards blew through the 2007 record high of $51,700 per ton like a hot knife through butter, reaching $101,365 per ton this month. The price move was so dramatic it cost a Chinese nickel producer billions in losses. The LME suspended trading in nickel while it sorted out the debacle. The LME posted this notice on its website in the wake of the volatility in the nickel market:

Source: LME

The Chinese nickel producer worked with the exchange and a consortium of banks to arrange financing and avoid a default. LME nickel forwards reopened for trading on March 16, but the market continues to experience issues.

While inflationary pressures and increasing demand and falling supplies because of climate change initiatives have been pushing prices higher over the past months, the war in Ukraine caused explosive rallies, as Russia is a leading aluminum and nickel producer.

Source: Barchart

Meanwhile, tin, the most illiquid metal that trades on the LME, also rose to a new record high this month. Three-month tin forwards reached $51,000 per ton. The previous high was $33,600 in 2011.

While lead and zinc did not follow copper, aluminum, nickel and tin to new record highs, they moved to multi-year peaks.

Oil Moves Towards New All-Time High, Oil Products Soar

Crude oil is the energy commodity that powers the world. Crude oil fell to lows in April 2020, with the nearby Brent futures reaching the lowest price this century, at $16 per barrel, and landlocked NYMEX WTI futures falling below zero to -$40.32 per barrel.

Russia is a leading oil producer and an influential non-member of the international oil cartel. This month, crude oil prices exploded to the upside.

Source: CQG

The quarterly chart shows the rally that took nearby NYMEX crude oil futures to $130.50 per barrel, the highest price since 2008, when the WTI futures reached an all-time high of $147.27 per barrel. While the price pulled back to below the $100 level, it remains at the highest price in years.

Source: CQG

Brent crude oil reached $139.13 during the recent rally. The record high in the pricing benchmark for two-thirds of the world’s oil production and consumption was set in 2008, at $147.50 per barrel.

While crude oil did not reach a new record high, oil products were another story. NYMEX gasoline and heating oil futures rose to record highs at $3.8904 and $4.6709 per gallon wholesale, respectively. The heating oil futures are a proxy for other distillates, including jet and diesel fuels.

Coal prices rose to a record high, and natural gas in the U.S. remains elevated, while in Europe and Asia, it hit record peaks. Since energy is a critical ingredient in all commodity production, it puts upward pressure on all raw material prices.

Signs Of Hyper-Inflation

Russia and Ukraine export one-third of the world’s annual wheat supplies, along with corn and other agricultural products. The war in Ukraine has turned a wide area of Europe’s breadbasket into battlefields, threatening worldwide food supplies.

Nearby CBOT wheat futures recently rose to a new record high, at $13.40 per bushel on the continuous futures contract. Corn and soybean futures are trending towards a test of the 2012 record higher, with corn reaching $8 per bushel and soybeans $17.65.

Commodity prices have been rising because of the tidal wave of central bank liquidity and tsunami of government stimulus that stabilized the global economy during the pandemic. The war in Ukraine has poured fuel on an already inflationary fire.

Inflation erodes money’s purchasing power, and liquidity and stimulus lit the fuse.

The war, sanctions and retaliation could cause a worldwide recession, which would cause stagflation in the current environment. Meanwhile, if prices keep rising, hyper-inflation is possible, and hyper-stagflation could be on the horizon if the current trends continue.

3 Reasons Commodity Bull Continues To Roar

Bull markets rarely move in straight lines; corrections can be swift and brutal. Over the past week, we have already seen the first round of corrective price action in the commodities asset class. However, the prospects for rising prices and new highs remain for at least three reasons:

- The first major war in Europe since World War II comes in the wake of the global pandemic. Sanctions, retaliation and war distort most commodities’ supply-and-demand equations and create supply-chain bottlenecks as ports, and shipping lanes become dangerous. Relations between the U.S. and Europe, and Russia and China will remain tense, interfering with trade over the coming years.

- The Federal Reserve and worldwide central banks are far behind the inflationary curve. With the latest U.S. CPI reading at 7.9%, it would take 32 25-basis point short-term rate hikes to push rates into positive territory. Moreover, each 25-basis point increase in the Fed Funds rate costs the U.S. $75 billion each year to service its $30-trillion debt. The central bank is in a challenging position, and the war and rising geopolitical tensions could make monetary policy shifts useless in fighting inflation.

- Labor shortages, rising input prices and increasing raw material demand make inflation a challenging cycle as it feeds on itself. The trend is always your best friend in markets across all asset classes. In commodities, the trend remains higher in March 2022.

Commodities have been in a bullish relay race since 2020, when they found bottoms. Over the past two years, the baton has passed from one raw material market to the next. The first commodity to reach an all-time peak was gold, and the precious metal recently took the bullish baton back and posted a new record peak. The trend in raw materials remains higher, and the relay race looks set to continue over the coming months and years.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI