Coterra Energy (CTRA, Financial) has struggled with revenues and profits over the last couple of years as commodity prices have been weaker. Natural gas, in particular, has been a drag, so the company is shifting its focus to oil-heavy basins like the Permian and Anadarko and easing off the gas-heavy Marcellus Shale.

That is a very sensible move. While prices remained tough, Coterra still generates solid free cash flow and continues to hustle its aggressive capital return strategy. Its recent acquisitions give it a firmer standing in the Permian with high-quality assets having solid growth potential. Moreover, the balance sheet is solid, with low debt, and a lot of liquidity to fund expansion.

Further along in the analysis, you will find that there is plenty of upside left for this stock. Coterra is playing the long game, and it’s one worth watching.

Company overview

Coterra Energy is a U.S based oil and gas company formed from the 2021 merger of Cabot Oil & Gas and Cimarex Energy. The company operates in the Permian Basin, Marcellus Shale, and Anadarko Basin and is involved in natural gas, oil, and natural gas liquids (NGLs). Coterra has a strong balance sheet and disciplined capital spending, due to which it maintains steady cash flows. In 2023, the company produced about 600,000 barrels of oil equivalent per day. Currently, it is taking advantage of its highly diversified asset base and strong energy market fundamentals.Strong third-quarter performance with resilient cash flow

Coterra Energy put up a solid third-quarter, beating on production expectations while controlling costs. The company pumped out 669,000 barrels of oil equivalent per day (BOEPD), up 2% year-over-year (YOY). The standout is that oil production increased by 22% YOY to 112,300 barrels per day, while natural gas production was on the strong side at 2,682 million cubic feet (MMcf) per day.Revenue was steady at $1.36 billion, but most of that is due to lower natural gas prices offsetting higher production. That’s not ideal for the top line, but Coterra still had strong capital efficiency with operating cash flow at an amazing $755 million.

Net income also suffered a 22% YOY hit. However, Coterra was able to stick to its aggressive capital return strategy as its free cash flow (FCF) remained strong at $277 million. It also returned 96% of its FCF to shareholders, $111 million in share buybacks, and 21 cents per share dividend. This is a real commitment to shareholder value. On the bottom line, Coterra is proving that it can yield strong cash flow and return money to investors, even when commodity prices don’t cooperate.

Strengthening balance sheet and expanding growth opportunities

Coterra Energy’s strong financial position reflects disciplined capital management in commodity price volatility. In Q3 2024, total debt was $2.07 billion, but the company cut leverage by repaying $575 million of senior notes. It also enlarged its credit facility from $1.5 billion to $2 billion, which added to financial flexibility.Moreover, Coterra’s cash-to-debt ratio stands at 0.36 with $843 million in cash, which is not quite strong. Nevertheless, it maintains a healthy liquidity buffer in view of the company’s robust FCF. Furthermore, Coterra has a low net debt-to-EBITDAX ratio of 0.3 times, which indicates its conservative leverage profile. The company has a total liquidity of $2.8 billion, which is more than enough to support shareholder returns and pursue strategic growth opportunities.

Looking ahead, Coterra’s new LNG agreements will allow the company to grow into higher-margin international markets while continuing to pursue a disciplined financial approach.

Coterra Energy expands its footprint with strategic acquisitions

With $3.9 billion acquisitions of Franklin Mountain Energy and Avant Natural Resources, Coterra is making power moves. Strategically, the company is building its portfolio with high-quality assets that can potentially provide long-term value. The deal adds 49,000 net acres in Lea County, New Mexico, with 400 to 550 drilling locations to add in the Bone Spring formations. That’s a big deal, given that the well economics and growth potential in the region are strong.Why this matters?Coterra is already a diversified player in the Permian, Marcellus, and Anadarko basins. This acquisition paves the way for Coterra to build on its Permian foothold, especially in the Delaware Basin, where it has been improving its efficiencies and lowering costs. At around $50 per barrel for oil and $2.50 per MMBtu for natural gas, the company is in a good position to generate solid free cash flow in a choppy commodity price environment.

Hence, Coterra is not simply expanding for the sake of it. Franklin Mountain and Avant assets are well fit into its existing operations and offer operational synergies, lower costs, and a longer runway for production growth. At mid-cycle prices, the company expects to continue reinvesting about 50 to 70% of its cash flow in investment and keep tight control on its expenditures.

We’ll have a better picture of how these acquisitions fit into the company’s long-term strategy when 2025 guidance is released later in February.

Coterra Energy’s Strategic Strength and Value

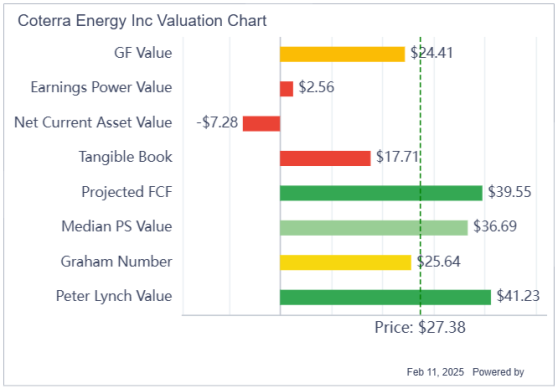

Coterra valuation provides plenty to unpack. The stock is currently trading at a price of $27.38 and seems to be undervalued when considering metrics such as a Projected FCF Value of $39.55 and Peter Lynch Value of $41.23. These figures give the impression of a very attractive upside, assuming the company keeps grinding out growth and cash flow. However, more conservative measures like the Graham Number and GF Value imply that the stock may be slightly overpriced for more cautious investors. It’s no surprise that a capital-intensive energy company has a negative Net Current Asset Value of $7.28, as long-term assets and cash flows lead the story here. Yes, while earnings power and tangible book values don’t standout here, Coterra’s FCF and acquisitions position it to be a long-term success.When we consider the overall performance of the company using the radar chart, Coterra is a strong performer with a GF score of 93/100. This shows that there is a complete and balanced profile of the company. While the GF Value indicator is weaker than the company’s other strengths, operational efficiency and strategic growth initiatives make up for it. It’s clear that Coterra is cashing in on its strengths.

Coterra Energy’s earnings rebound could unlock significant upside

The P/E ratio of Coterra starts to look more attractive from 2025 as it’s projected to fall to 9.11 times, from its elevated level of 17.9. It further declines to 7.67 by 2026 and stabilizes at 7.77 through 2027. This trend suggests that earnings are going to increase significantly, making the stock look ever more undervalued on the basis of forward earnings.This narrative is supported by the Consensus EPS Growth Rate which shows a dramatic 93.36% expected surge in 2025 and 18.74% in 2026. In 2027, growth moderates from the boom of the past twelve months but the company is in a much stronger earnings position than before. This suggests that Coterra is ready to make a major earnings comeback based on higher commodity prices, greater production efficiency, and the integration of recently acquired assets.

From an investment standpoint, this setup offers great upside potential for the stock. If a company’s P/E is declining and earnings are rising, that’s talking of undervaluation and Coterra is a great opportunity for earnings growth and long-term value-creating investors. If the company executes well, the market may eventually re-rate the stock higher based on its improved fundamentals.

Analysts’ forecast and promising growth potential

Looking at the price forecast of Coterra from various analysts, Coterra’s stock has a lot of upside potential. The analysts gave it a 12-month price target of $34.26, which is around 20% higher than what it is currently at. That is a pretty interesting range for the forecast, with a high end of $41, which is bullish if execution and market conditions go right. The fact that the stock is trading below its fair value is further corroborated by the average target of $33.10. The downside risk sits at $28, but Coterra’s FCF and strategic acquisitions mean the odds are for growth. This could be a solid play for value-focused investors if oil and gas prices remain stable.Not only that, Coterra’s stock price increased 11.2% over the past year and a solid 91% over the past half-decade, aligning with its strong performance overall.

Given all positive aspects, I would give Coterra a 12-month price target of $35$38, which equates to a 28% to 39% upside. As already emphasized, if commodity prices continue to be steady and execution stays strong, the stock could rally to the upper end of this target.

Risks to my thesis

While Coterra has a lot going for it, there are definitely some risks to be aware of.Commodity price volatility is the biggest one. No matter how efficiently the company cuts its costs or increases production, if oil and gas prices go down over a long period of time, revenue and cash flow will start to suffer. While Coterra has been moving to more oil-heavy basins, gas still comprises a major portion of the company’s production, and gas prices have been weak. Overall profitability could be weighed if that trend continues.

There’s also the risk of execution with its recent acquisitions. Although it makes strategic sense spending $3.9 billion to boost its Permian footprint, doing so smoothly is the key. Returns could be dragged on if costs get higher than expected or production falls short.

Your takeaway

With all things considered, Coterra Energy seems like a strong long-term play with a lot of moving parts. They are making smart decisions: They have shifted to oil-heavy assets, they’ve expanded in the Permian, and they’ve got LNG contracts. Even with some price pressures, it is still able to pony up modest FCF and reward investors with dividends and buybacks. That’s exactly what you want to see from a well-managed company.Of course, there are risks, but you’ve got a strong balance sheet, disciplined capital management, and a big earnings rebound expected in 2025, so there’s a lot to be optimistic about. Coterra is definitely a stock to keep an eye on if you want to get something that balances growth, value, and resilience.

This content was originally published on Gurufocus.com