- CrowdStrike has fallen out of favor as US Federal Reserve hikes interest rates

- CRWD is down 23.9% year-to-date amid ongoing growth stock selloff

- More short-term downside likely amid uncertain macroeconomic outlook

-

Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro+ get exclusive access to our research tools, data, and pre-selected screeners. Learn More »

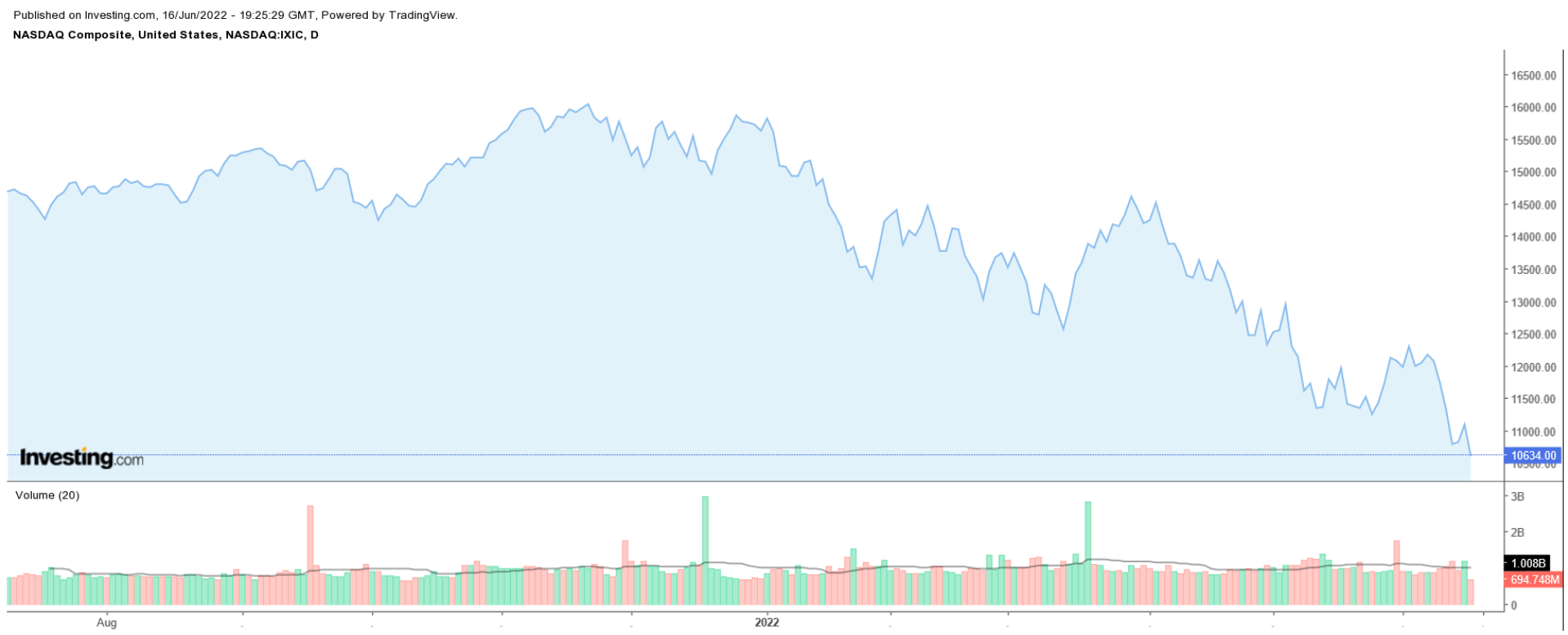

The NASDAQ Composite is currently on track for its worst year since 2008, losing 29% so far in 2022 as a toxic cocktail of rising rates, accelerating inflation, and slowing growth triggered an exodus from technology stocks with frothy valuations.

Companies in the software industry have been some of the hardest-hit year-to-date, with the sector’s two main ETFs lagging the comparable returns of the NASDAQ over the same timeframe.

The First Trust Cloud Computing ETF (NASDAQ:SKYY) and the Global X Cloud Computing (NASDAQ:CLOU) are down 37.6% and 38%, respectively, this year.

Despite the ongoing selloff, we believe that CrowdStrike’s stock is vulnerable to further losses amid the current environment.

CrowdStrike

- Year-To-Date Performance: -23.9%

- Percentage From ATH: -47.7%

- Market Cap: $36.3 Billion

Cyber security specialist, CrowdStrike (NASDAQ:CRWD) went public in June 2019. Since then, the cloud-delivered endpoint protection company has seen its stock endure some turbulence as fears over the Federal Reserve’s aggressive rate hike plans sparked a rout in many top-rated technology companies.

After rallying to a record high of $298.48 in November 2021, CRWD stock tumbled rapidly to a low of $130.00 on May 12.

CrowdStrike shares have since clawed back some losses, closing at $157.21 on Thursday, but they still stand roughly 48% below their all-time high.

At current levels, the security software provider, which recently moved its headquarters location from Sunnyvale, California, to Austin, Texas, has a market cap of $36.3 billion.

Headwind #1: Fed Rate Hikes

While CrowdStrike should benefit from several growth catalysts in the years ahead, investors should prepare for more potential downside in the short term as the US Fed plans to tighten monetary policy to tackle soaring inflation.

Rising interest rates and high inflation tend to weigh heavily on high-growth stocks with lofty valuations, as it could erode the value of their longer term cash flows.

In addition, if the Fed hikes rates too far too fast and tips the economy into a recession, enterprise cyber software spending growth could slow.

Headwind #2: The Stock Still Isn’t Cheap Enough

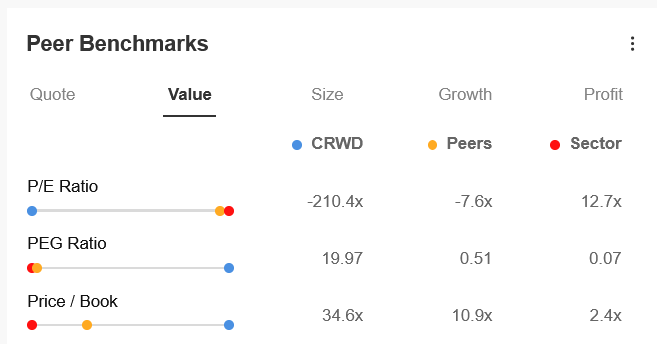

Despite suffering a months-long selloff that has seen its market cap shrink by almost two-thirds, CrowdStrike’s stock still isn’t cheap enough, making it vulnerable to more downside pressure.

With shares trading at more than 23 times this year’s sales, CrowdStrike is significantly overvalued compared to other notable high-growth cybersecurity software companies, such as MongoDB (NASDAQ:MDB), Fortinet (NASDAQ:FTNT), and Okta (NASDAQ:OKTA), which have price-to-sales (P/S) ratios of 19.1, 13.1, and 9.7, respectively.

For comparison, according to InvestingPro data, CrowdStrike’s peers trade at a collective P/S ratio of 13.5, while the sector median stands at just 2.1.

Source: InvestingPro

Bottom Line

Despite being widely considered as one of the best-in-class cybersecurity companies, CrowdStrike is likely to remain out of favor with investors in the near term as Fed-related turmoil continues to roil financial markets.

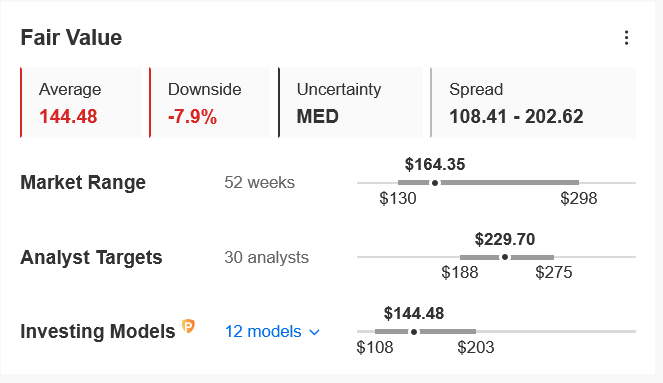

According to several valuation models, including P/S multiples or terminal values, the average fair value for CRWD stock on InvestingPro stands at $144.48, a potential 8% downside from the current market value.

Source: InvestingPro

Investors should probably hold off on buying the beaten down software name for now.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »