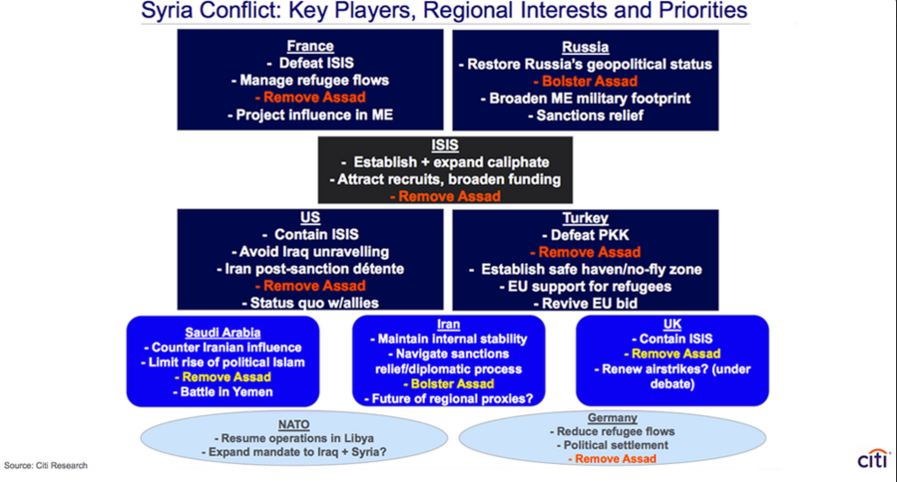

With all the mess that’s occurring in Syria it’s surprising that something worse (from a geopolitical standpoint) than Tuesday morning’s downing of a Russian fighter jet by Turkey hasn’t already happened. Here’s a graphic from Citi that hopes to explain what is a very murky situation in Syria.

Crude oil futures rallied more than $1/barrel Tuesday morning, catalyzed by the Turkish skirmish.

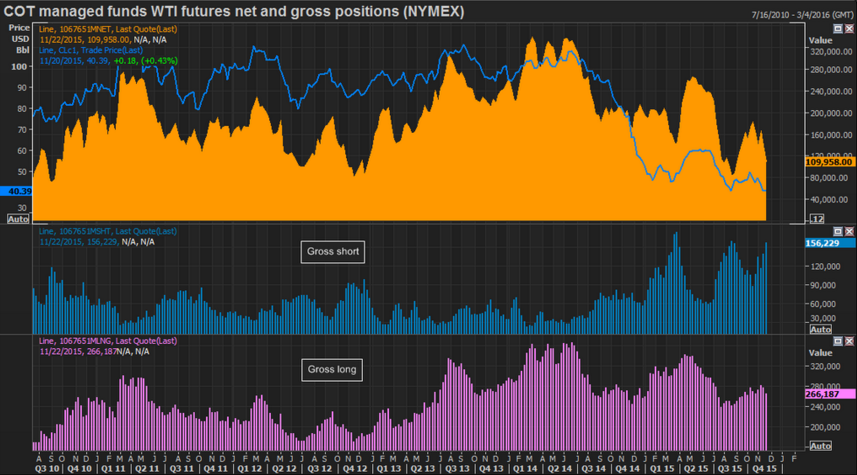

However, I would venture that crude oil was waiting for an excuse to ignite a short-covering rally in what has become a heavily shorted market.

The gross short position in WTI crude futures has jumped considerably in recent weeks.

What’s more interesting about crude's reversal is that crude usually makes a low at this time of the year and December is usually a good month for black gold.

$40/barrel is a crucial level for a number of reasons and it is no accident that every time price falls below this level for even a few hours it quickly reverses back above. There’s a good chance that crude oil made an important low and Turkey is spelled with a capital T this Thanksgiving.

Via Energy and Gold.com.