By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It is not your ordinary day in the foreign-exchange market when the Russian ruble and the Mexican peso hits record lows while the Hong Kong dollar falls to its weakest level since 1999.

The major currencies saw continued losses but the greatest carnage is in emerging markets. In the past 3 weeks alone, the ruble lost close to 10% of its value and during this same period, the South African rand and Mexican peso lost more than 7%. Emerging-market countries bear the brunt of the selling because the slowdown in global growth and volatility in commodities causes significant economic damage for these countries. Falling currencies can be positive for export-dependent countries but when the exchange falls too far too fast, it can lead to economic instability and a crisis of confidence for foreign investors. In fact, Saudi Arabia, which saw 12-month riyal forwards jump to their highest level since 1996, banned speculators from betting against the currency. Countries such as Saudi Arabia and Hong Kong who peg their currencies to the dollar are coming under significant pressure to defend their exchange rates. If emerging-market currencies continue to fall, some central banks may turn to higher interest rates or monetary contraction as ways to prop up their economies and unfortunately these measures come with serious consequences for other parts of their economies.

Now Back To G10 Currencies!

Wednesday's big story was oil. The price of crude fell more than 6.5% Wednesday to its lowest level since March 2002. It is now within striking distance of $25 a barrel -- the next psychologically significant price point for the commodity. The latest decline was driven by the International Energy Association’s warning that the oil market could “drown in oversupply.” They predict that Iran could add 300,000 barrels of crude a day in the first quarter causing supply to far exceed demand. While this may be true, we believe that oil prices are nearing a bottom and would not be surprised if the EIA reports a decline in inventories on Thursday, providing a reason for oil to recover.

Unfortunately the Bank of Canada’s decision to leave interest rates unchanged overshadowed the fall in oil. While economists had not been looking for a change in policy, the sharp sell-off in USD/CAD indicates that investors felt otherwise. USD/CAD dropped more than 200 pips off its fresh 12-year high and now appears poised for a move below 1.44. Not only did the BoC leave rates unchanged, but Governor Poloz sounded relatively optimistic. He’s not worried about a global recession, expects China to stay on transition path and believes that the weak dollar will aid growth. Poloz is also encouraged by the economy’s resilience and flexibility and instead of lamenting about the currency’s rapid decline, he said a further fast fall could boost inflation. More importantly, he noted that “most of the oil shock was built into their October forecast.” In other words, he did not express any specific concerns about the weak loonie and oil below $30 a barrel. These less-dovish comments from Poloz should mark a top for USD/CAD.

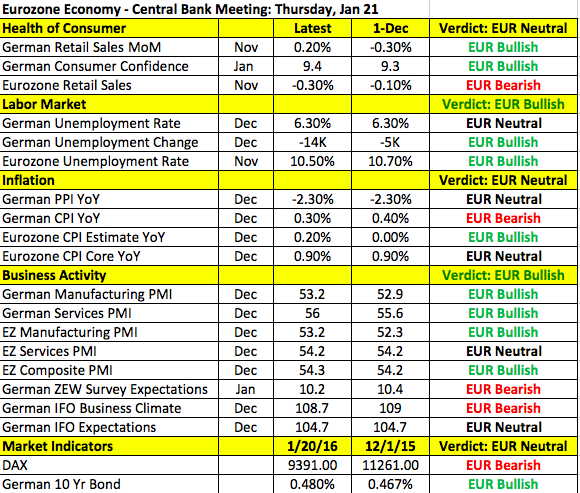

The focus now shifts to the European Central Bank. No changes are expected from the European Central Bank, but given how much oil prices have fallen since the beginning of the year, Mario Draghi has many reasons to remind investors that it is within the central bank’s mandate to increase QE because the drop in oil makes it more difficult for the central bank to meet the 2% inflation target. If there’s no recovery in oil prices before the March meeting, their inflation projections will have to be lowered in March. The question at this month’s meeting is whether the will to change monetary policy increased since the last meeting and while we certainly believe that it has, Draghi could also say that it is premature to draw any conclusions. According to the table below, there has been slightly more improvement than deterioration in the Eurozone economy since the last meeting. However since December, the EUR/USD is up over 3 cents and oil is down 35%. So the factors that contributed to stronger growth in December faded in January.

There were also big moves in USD/JPY overnight with the currency pair dropping to a 1-year low of 115.98. This decline took other yen crosses such as GBP/JPY, CHF/JPY, CAD/JPY and AUD/JPY to similar milestones. The sell-off in the yen overnight was driven by the meltdown in the Nikkei but threats of intervention from a Japanese government source turned the currency around. By the end of the North American trading session, USD/JPY recovered nearly 50% of its intraday losses thanks in part to the intraday rebound in U.S. equities. The Dow Jones Industrial Average was down over 400 points at one stage and ended the day down less than 250 points. U.S. data was weak with housing starts turning negative and consumer prices falling. It will be exceedingly difficult for the Fed to maintain a brave face in this current market environment. As such, we are looking for further losses in USD/JPY ahead of next week’s FOMC meeting.

Sterling traded higher against the U.S. dollar on the back of “better”-than-expected labor data. Jobless claims fell by 4.3k compared to a forecasted rise of 2.8k and the unemployment rate slipped to 5.1%. There’s no doubt that these numbers are good but the decline in wage growth is alarming. Average weekly earnings growth slowed from 2.4% to 2%, the weakest level since February. The slowdown in wages not only raises the risk of a downside surprise but also kills the chance of a rate hike this year.

Meanwhile the Australian and New Zealand dollars performed extremely well considering the decline in commodity prices, weaker data and general risk aversion. Australian consumer confidence fell sharply in January while New Zealand consumer prices dropped by the largest amount since 2008. New Zealand manufacturing PMI ticked up but it was a late-day report that cannot take credit for the currency’s rise during the North American session. Manufacturing activity expanded at its fastest pace in 14 months, which is hard to believe given the slowdown in China’s economy and the drop in dairy prices. The sustainability of this trend will be key. We believe that Wednesday’s rally in AUD and NZD amounts to nothing more than a dead-cat bounce.