- Delta Air Lines is set to report Q3 earnings on Thursday

- The company has recently made moves to diversify revenue streams and spark long-term growth

- Despite that, geopolitical and economic uncertainties pose headwinds for the stock going ahead

- Can the Q3 earnings report ignite a trend reversal for the stock?

- Steadily increasing earnings per share.

- High shareholder returns.

- Expectations for growth in net profit.

- Being one of the major players in the airline industry.

- Poor performance in the last month.

- Short-term liabilities hovering above liquid assets, which can be considered a warning sign.

The travel industry started the week on the wrong foot as Hamas' terrorist attack on Israel raised concerns about the impact of soaring oil prices on the profitability of travel-related businesses. As a consequence, Delta Air Lines (NYSE:DAL) dropped by as much as 4% on Monday.

But while the short-term outlook appears risky amid the conflict's escalation, the longer-term perspective is certainly more promising, thanks to Delta's strategic measures aimed at enhancing profitability and diversifying revenue sources.

The airline has partnered with tourism-focused investors Certares and Knighthead, as well as private aviation services provider Wheels Up Experience, with the aim of strengthening its industry position and facilitating long-term growth.

Still, Delta faces several challenges, including rising fuel prices, expectations of reduced passenger traffic post-summer, and increasing aircraft maintenance costs.

What to Expect From the company's Q3 Earnings

Delta Air Lines is set to unveil its third-quarter earnings on Thursday, October 12. In its Q2 earnings report from July, the company surpassed expectations, boasting earnings per share (EPS) of $2.68, an 11.6% beat.

Quarterly revenue also outperformed, surpassing forecasts by 1.5%, coming in at $15.57 billion.

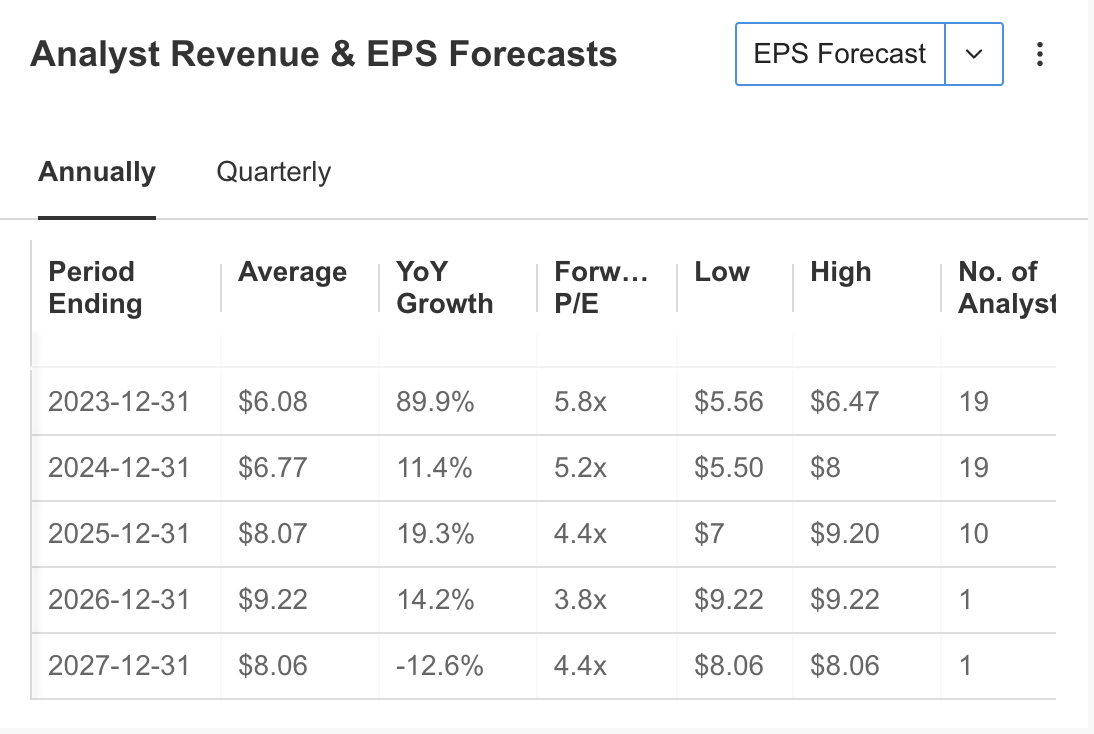

Source: InvestingPro

In the earnings report to be announced this week, InvestingPro estimates that EPS will be announced at $1.96, up 25% compared to last year.

However, the company's revenue is expected to be around $15.13 billion, up 13% compared to the same period of the previous year.

Source: InvestingPro

Despite the downward revision for Q3, Delta is expected to reach an annual EPS of $6 by the end of the year, up 90% year-on-year. Long-term guidance reflects moderate growth for the time being.

As we approach the release of Delta Air Lines' Q3 financial results this week, it's important to assess the company's key financial metrics leading up to this point.

Delta Air Lines: Fundamental View

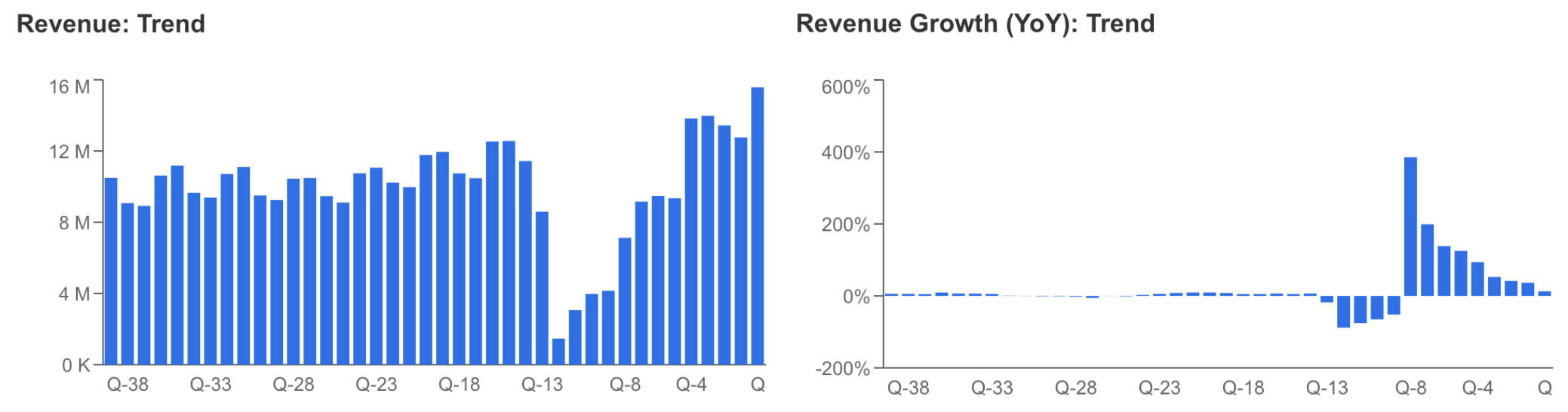

The company's revenue growth during the summer period compared to the previous year remains a positive highlight. The anticipation is that the 3rd quarter revenue will hover around the $15 billion mark.

It's worth noting that while quarterly revenue growth remains consistent, a natural deceleration in growth might occur due to the base effect.

Source: InvestingPro

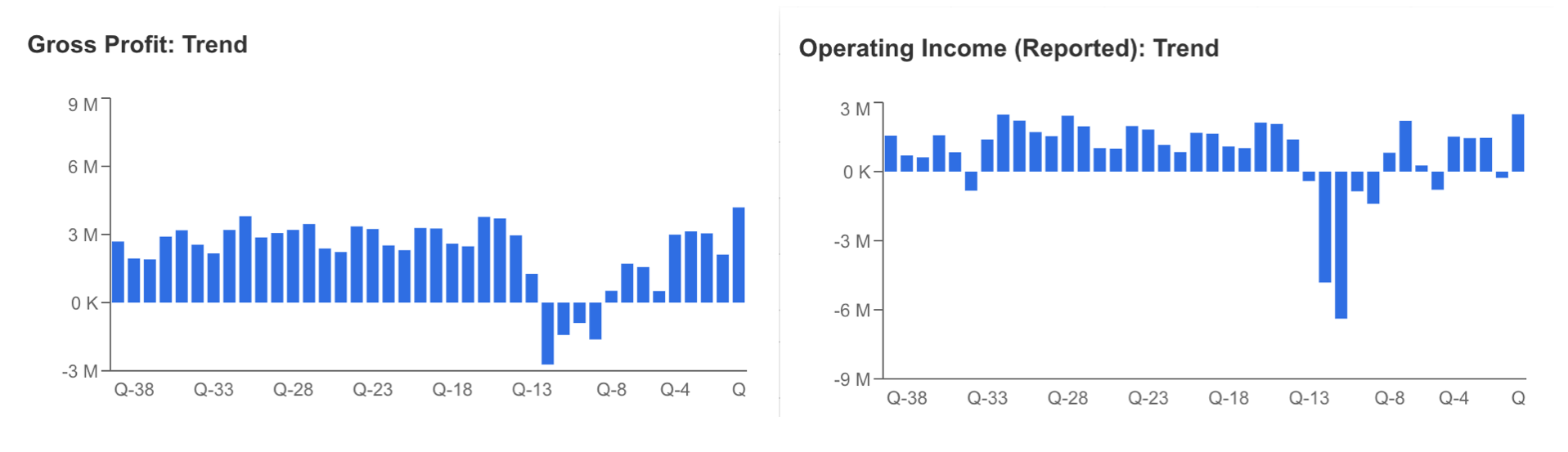

In addition, although the cost increase continued to negatively affect gross profitability, the revenue growth in the last quarter enabled gross profit to double compared to the previous quarter.

At this point, the fact that the operating profit recovered in the second quarter and came in at $2.5 billion after coming in negative in the first quarter had a great impact.

Source: InvestingPro

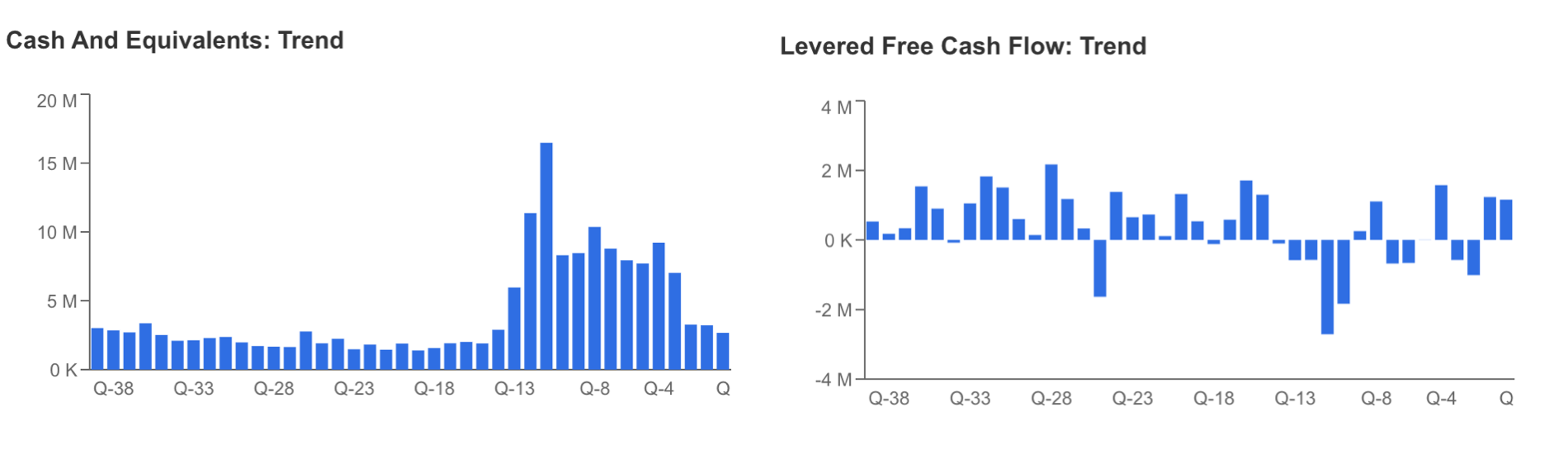

Although Delta Air Lines has seen an improving trend in the last 2 quarters, the 30% decline in free cash flow compared to last year can be seen as a problem.

In addition, the downward trend in cash and similar assets continued in the 2nd quarter results.

Therefore, in the earnings report to be announced this week, the development in cash and cash equivalents, which was $2.7 billion in the last quarter, will be closely monitored.

Source: InvestingPro

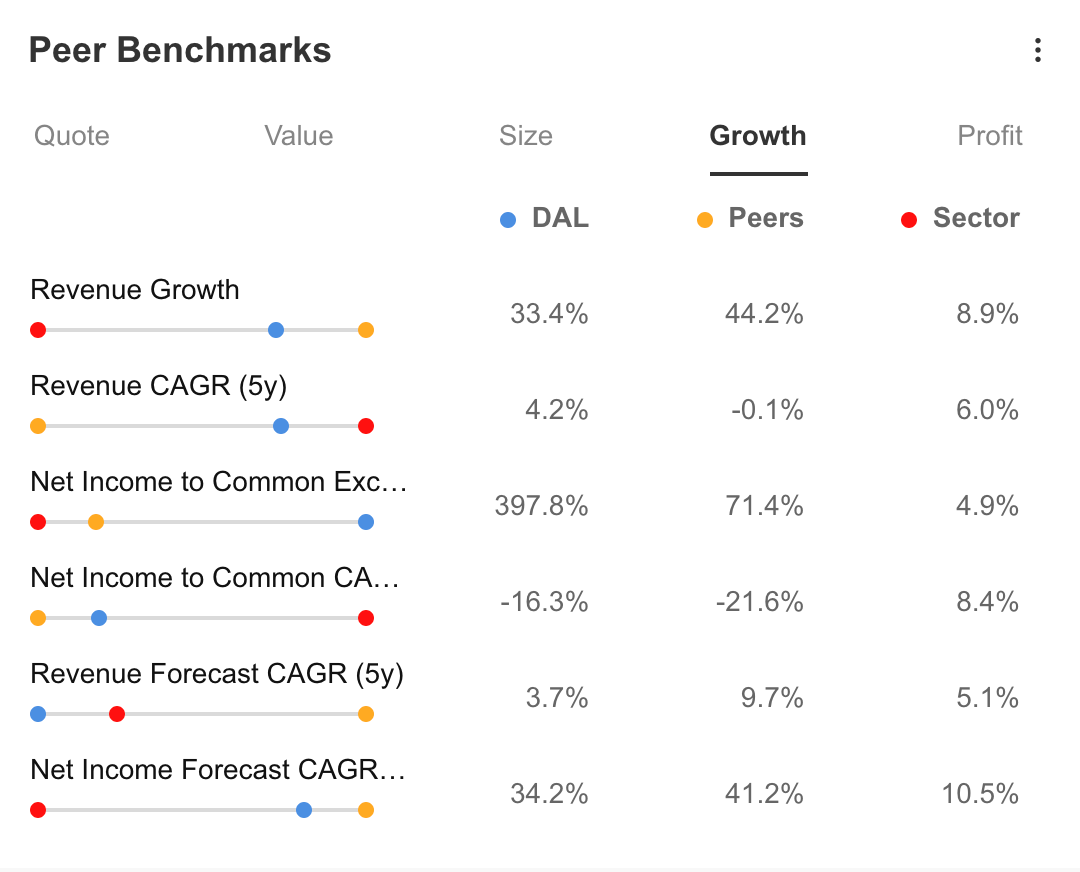

When we compare Delta Air Lines' growth performance over the past year to its peers and the industry, we can establish a general framework.

Based on the analysis conducted using the InvestingPro platform, Delta has exhibited a revenue growth rate surpassing that of the industry but falling short in comparison to its peers, with a 33% revenue growth.

The company maintains a positive compounded annual growth rate, averaging at 4%, while peers are experiencing negative growth.

Nevertheless, the 5-year growth forecasts for both revenue and net profit are lower than those of its peers, indicating areas for potential improvement.

Source: InvestingPro

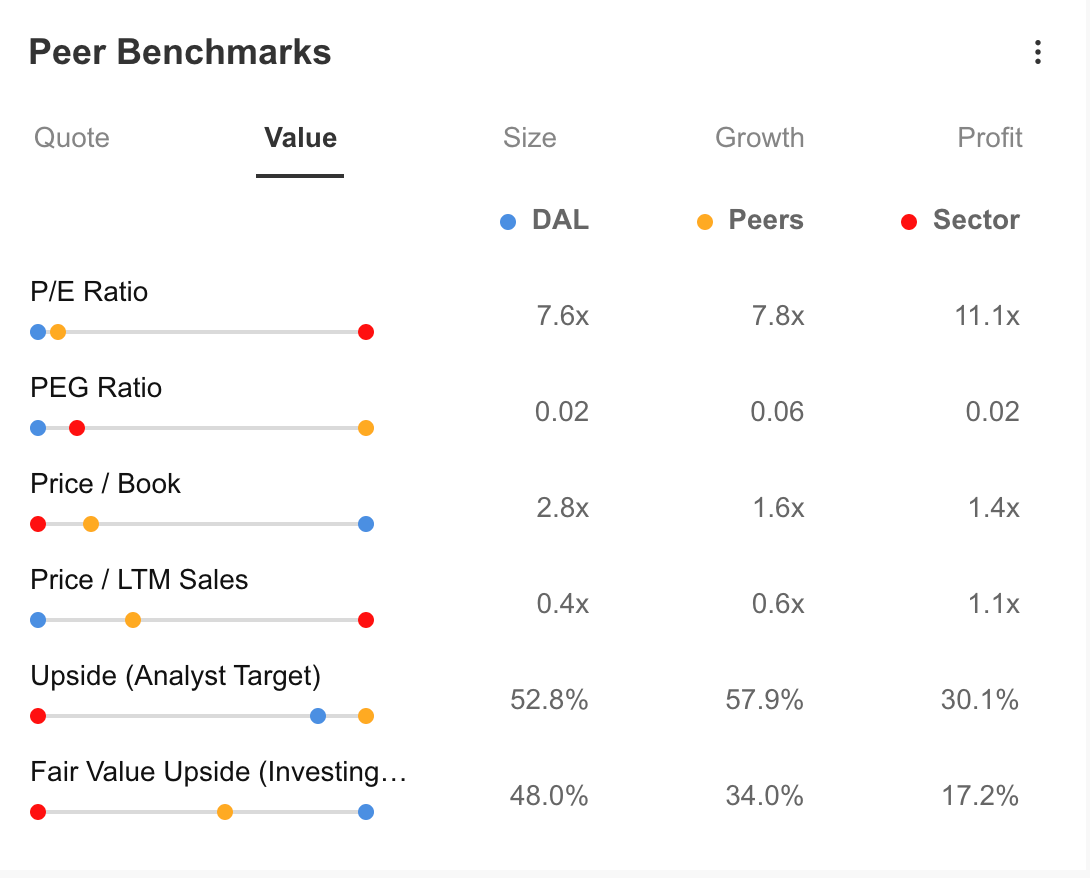

Analyzing the company's ratios, Delta currently boasts a Price-to-Earnings ratio of 7.6x, which is below the industry average of 11x but aligns with its peer companies.

Furthermore, the PEG (Price/Earnings-to-Growth) ratio of 0.02 places it in line with the sector and below its peer companies.

Despite the somewhat mixed financial outlook, DAL stock is anticipated to have a fair value with a 48% upside forecast, hinting at its potential to outperform its peer companies.

Source: InvestingPro

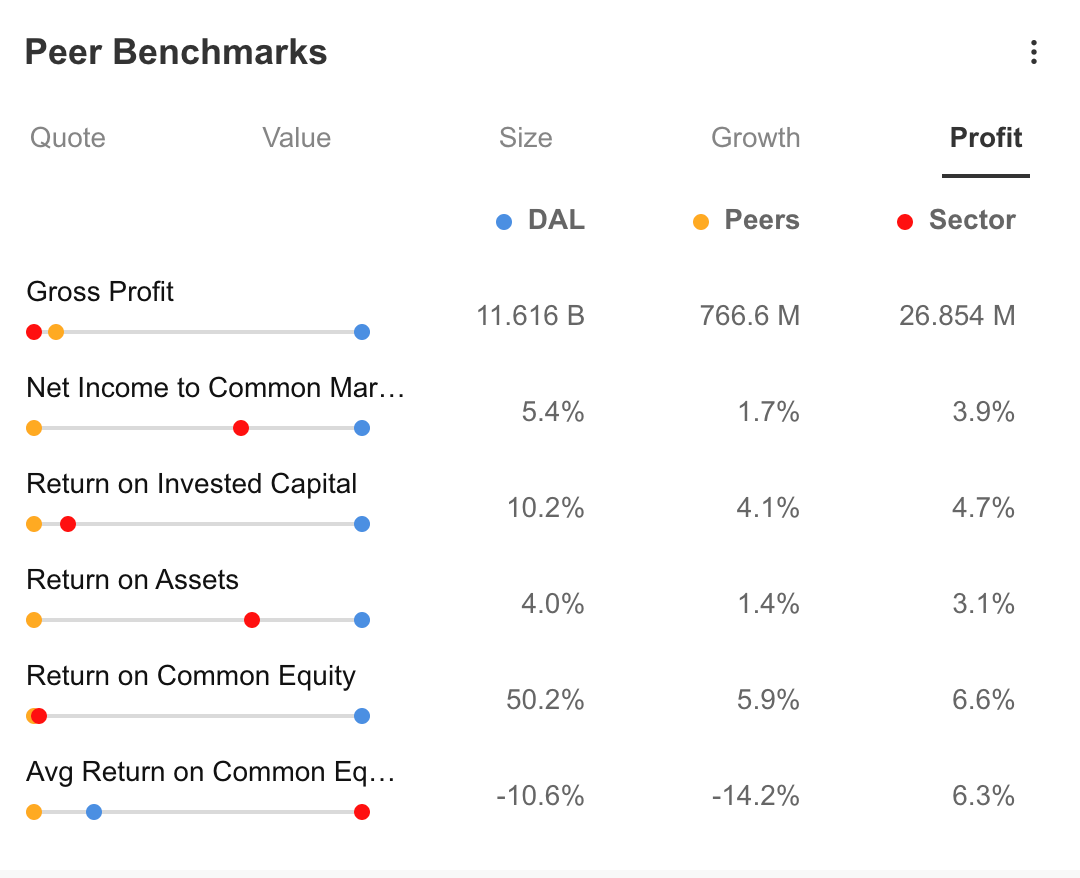

When analyzed in terms of profitability, Delta Air Lines continues to do quite well compared to peers and the industry in general.

Source: InvestingPro

In summary, InvestingPro highlights the positive aspects of Delta Air Lines as follows:

However, there are certain criteria that may pose disadvantages in the coming periods:

Delta Air Lines' overall financial performance is currently rated as average. While the company's growth outlook appears healthy, there is room for improvement in terms of cash flow and profitability. Additionally, the stock has underperformed over the past year.

Based on this information and the fair value analysis of Delta Air Lines (DAL), it is estimated that the stock could reach up to $52 with an upward potential of close to 50% over a one-year period.

The consensus among 19 analysts also points to an average price target of $55, aligning with the fair value assessment.

Delta Air Lines: Technical View

In the first quarter of the year, Delta Air Lines' stock exhibited a horizontal movement within a wide price range, followed by an upward trend in the second quarter.

However, in the same year, the stock, which reached its peak in the $49 region, initiated a significant correction starting in July.

From a technical perspective, based on the year's lows and highs, it appears that the current price of DAL at $35 corresponds to a potential support level (Fib 0.786).

If the recent risks have a limited impact and the Q3 financial results turn out positively, there is potential for the DAL stock to rebound towards the $40 range in the last quarter.

The price zone of $38 to $40 is a critical resistance area that must be surpassed for the upward trend to continue. Conversely, if the $35 support is breached, it may lead to a test below $30.

Conclusion

In conclusion, Delta Air Lines has taken significant steps toward long-term growth and profitability through recent collaborations, which is a positive development. However, challenges to profitability include mixed financial performance, cash flow weaknesses, and debt management concerns.

Additionally, geopolitical risks and economic uncertainties in the sector are factors that could pose challenges for the airline.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered investment advice.