The S&P 500 finished the day down 31 bps, with most losses coming in the final minutes. There was even a buy imbalance at 3:50 PM. Despite this, a lopsided 353 stocks were advancing in the index versus just 146 stocks declining; Nvidia's (NASDAQ:NVDA) shares falling by around 5% weighed on the overall index, resulting in a flat trading session. The Nasdaq 100 was solidly down on the day, though dropping by about 1.15 bps, while Bitcoin was hammered, falling nearly 6%.

This came as the Dow rallied to a one-month high, while the Nasdaq dropped over 1% as investors rotated out of AI-linked stocks like Nvidia and added some laggards to their portfolios, betting on Federal Reserve interest rate cuts this year.

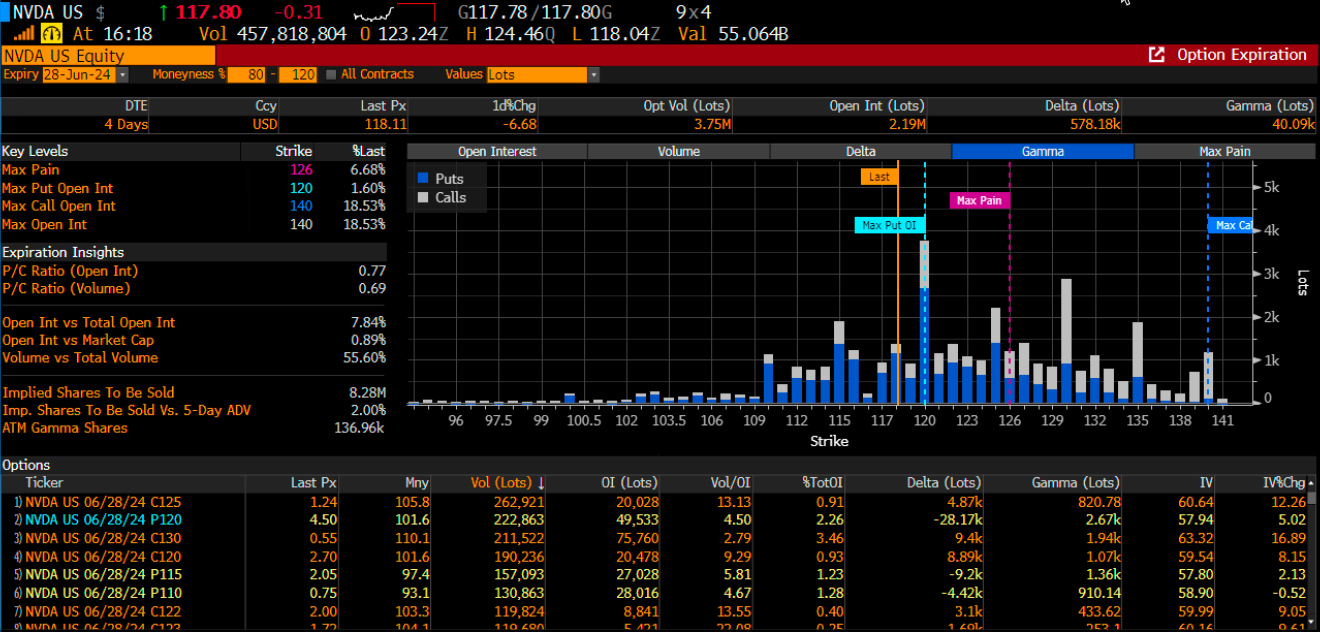

As noted over the weekend, now that gamma has reset, Nvidia lost that support level at $125, making the $120 region all the more critical for the shares. It is one reason the stock stabilized yesterday at around $120 for most of the day. However, the support gave way by day’s end, with the stock closing around $118.

However, the $120 level may now be gone, too, as the $120 puts for June 28 were among the most actively traded, and if puts were closed and new positions opened at lower levels, the support at $120 could be gone today, and that could allow the shares drift lower still. But we won’t know until open interest levels change in the morning.

(BLOOMBERG)

Technically, Nvidia broke the 20-day moving average, and the uptrend is now in the distance, suggesting a potential change in trend. In the past, the 20-day moving average has served as both support and resistance, with the lower Bollinger band down at $105 and a giant gap in the mid-90s wide open to be filled at some point.

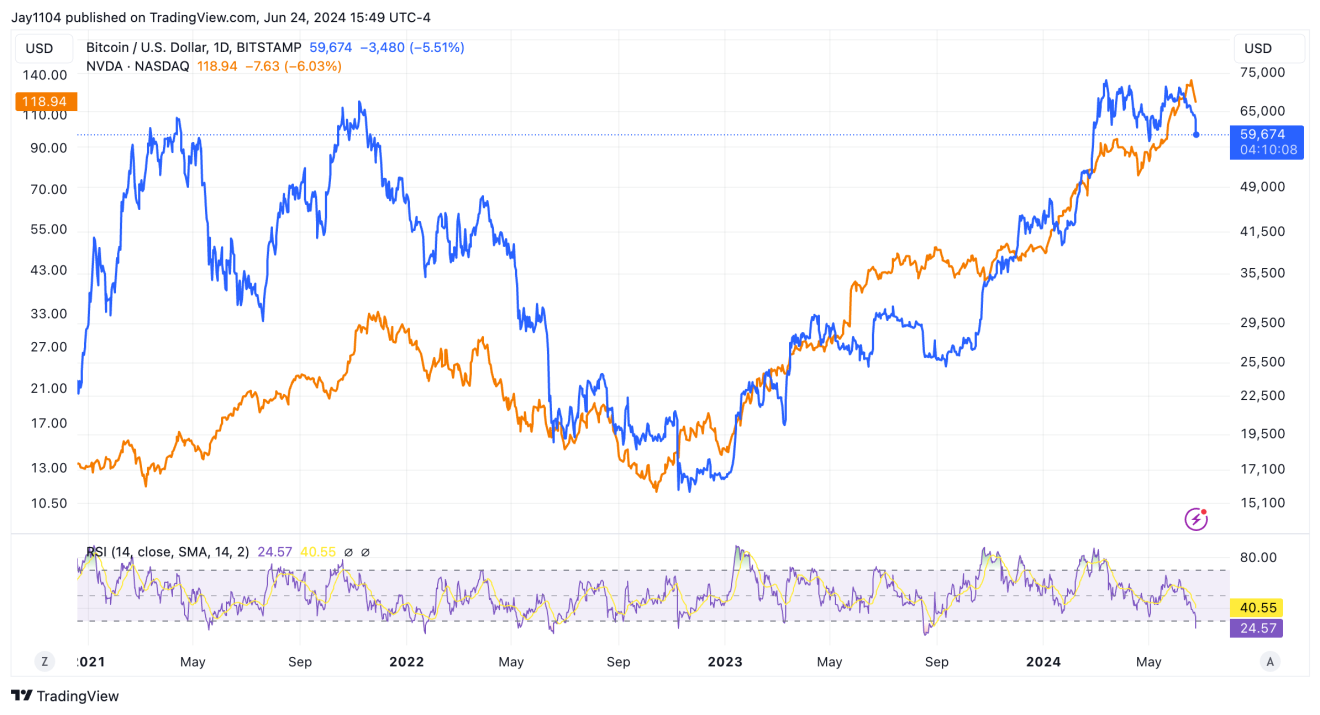

Interestingly, Bitcoin is down nearly 17% since that intraday high on May 21. It may not feel like it, but it is a notable drop, even for something as volatile as Bitcoin. The region around 60,000 seems essential because the last time we tested this region, Bitcoin snapped right back. If that doesn’t happen this time, then we will put in a lower low, and it could mean that Bitcoin has formed a double top, which opens a path to the 50,000 to 52,000 region.

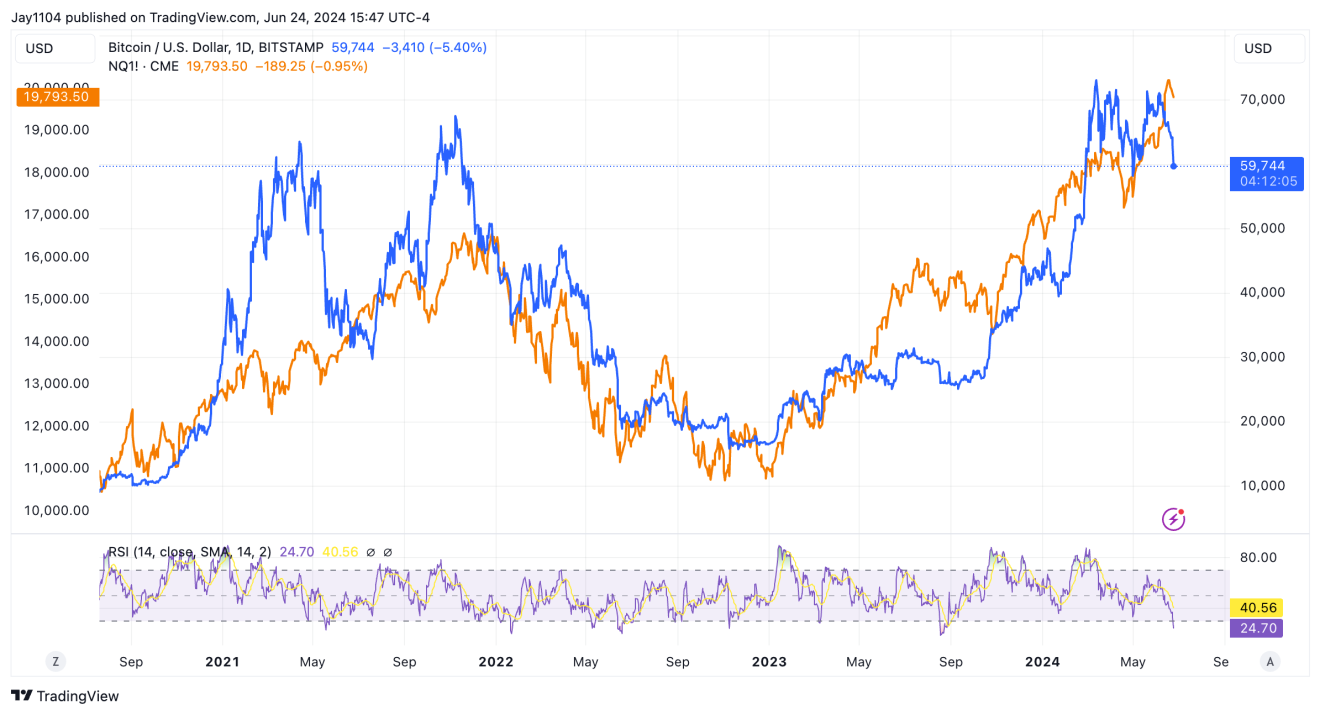

It used to be that Bitcoin could tell us where the NASDAQ was heading; now, Nvidia has changed all of that because the NASDAQ has not stumbled much compared to Bitcoin. Now, if Bitcoin serves as a liquidity gauge, then it would tell us that liquidity in the market is falling and that the Nasdaq 100 should eventually follow suit and move lower as well.

It may not be such a good sign for Nvidia, either, because Nvidia has tracked Bitcoin fairly well, too. It could be telling us that Nvidia’s rally has more to do with liquidity than it has with AI because I’m pretty sure that Nvidia, as a crypto trade, died sometime in 2018.

Oil keeps going higher, and yesterday, it rose by around 1.5% to around $81.60. It looks like a little bit of resistance is built up around this price, but if oil can clear that resistance spot, you could probably see $84ish, maybe even all the way back to $87.

Meanwhile, the IWM finished the day up around 40 bps, only reaching the 20-day moving average intraday and being rejected. This suggests that it remains in a downtrend.

The good news is that, for now, what AI can’t achieve, chicken wings can. Wingstop (NASDAQ:WING) is still holding on to a $12 billion market cap with estimates for $585 million in revenue for 2024, or roughly 21x times sales, and a 120 PE. For now at least, that rising wedge could be suggesting the end is near, even for chicken wings.