The beginning of the end for the current run of peak yields looks set to start tomorrow (Wed., Sep. 18) as the Federal Reserve is expected to roll out its first interest rate cut.

On the eve of regime shift it’s timely to take stock of where we are with trailing payout rates across the major asset classes, based on a set of ETFs.

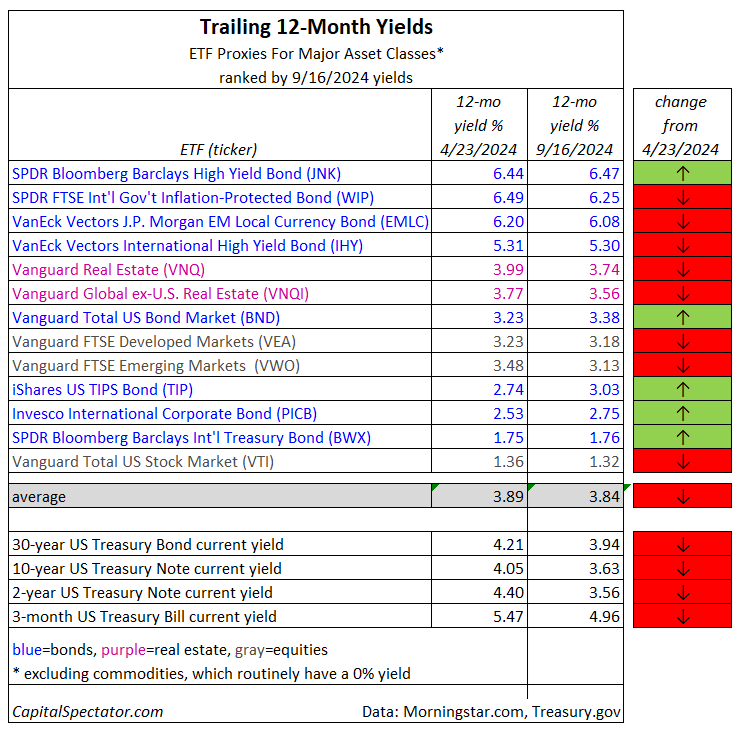

The average yield for global assets is 3.84%, which is only fractionally below the rate in our previous update in late April.

Presumably, the changes going forward will be substantially larger on the downside as we revisit conditions in the months ahead.

Risk Assets the Better Bet Going Ahead?

Meanwhile, the writing’s on the wall when it comes to comparing risk-free Treasuries vs. risk assets.

Back in April, US Treasuries offered substantial yield premiums over the average payout rate for global risk assets. Today, however, the opportunity to lock in a higher yield with government bonds is starting to crack.

A 3-month T-bill yields slightly more than the average risk asset, and if you go far out on the yield curve to a 30-year maturity a US Treasury Note provides more than a percentage point of yield premium.

But 2-year and 10-year Notes are now yielding slightly less than the average risk asset for global markets.

The tide, in short, is turning and, likely, government yields across the maturity spectrum will soon fall below risk asset payouts – perhaps substantially so.

It was nice while it lasted, at least for yield-hungry investors. But the yield cycle rolls on.

The standard caveats, on the other hand, are written in stone when evaluating the yields for the ETFs listed above. First, the trailing payout rates may or may not prevail in the future.

Unlike the opportunity to lock in current yields via government bonds, historical payout rates for risk assets by way of ETFs can be misleading in real time, due to changing payout amounts through time.

There’s also the ever-present possibility that whatever you earn in yields via ETFs fund could be wiped out, and more, with lower share prices.

That’s a reason to also consider total return expectations when evaluating yield opportunities.

For perspective on ex-ante performance, you can start with getting an overview on the long-term outlook for the major asset classes.