US Federal Reserve Chair Jerome Powell made it clear at the recent Jackson Hole symposium that interest rates would remain elevated for as long as needed by stating, “we are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.” The clear indication is that rates will remain higher for a prolonged period and the continued upward trajectory of yields is likely to be top of mind for many investors going forward.

The ETF segments that had the greatest net fund flows for the month were Money Market Bonds ($6.34 bn), US Multi-Factor ($3.67 bn), Structured Products ($3.47 bn), US Government Bonds ($3.26 bn), and US Information Technology Sector ($ 3.23 bn).

A look at each Segment and ETF Flows

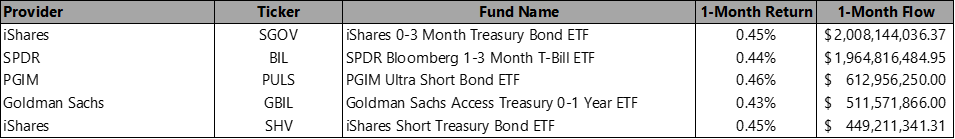

Money Market Bonds

With interest rates currently at an elevated rate, and the potential that they may go higher, money market instruments have continued to garner strong flows as investors are capitalizing on their compelling yields. While the performance of the top 5 funds is fairly similar, the iShares 0-3 Month Treasury Bond ETF (Ticker: SGOV) and SPDR Bloomberg 1-3 Month T-Bill ETF (Ticker: BIL) garnered sizable flows for the month. As evidenced from the data, the flow drop-off from the top two, to the remaining three is notable – but PGIM Ultra Short Bond ETF (Ticker: PULS), Goldman Sachs (NYSE:GS) Access Treasury 0-1 Year ETF (Ticker: GBIL), and iShares Short Treasury Bond ETF (Ticker: SHV) round out the group.

US Multi-Factor

The US Multi-Factor segment saw the second most flows for the month. This segment can be perceived as a safe haven for investors, given the diverse offering of investment strategies that investors can utilize within their portfolio. With equity markets having a negative performance for the month, the performance of all top 5 ETFs reflected this reality. The iShares Edge MSCI USA Quality Factor ETF (Ticker: QUAL) garnered the most flows for the month but had a marginally negative performance. Conversely, the Invesco S&P 500® Quality ETF (Ticker: SPHQ) – a Quality investment factor solution similar to QUAL – garnered the fourth most flows but delivered a slim positive performance for the month. The VanEck Morningstar Wide Moat ETF (Ticker: MOAT), a thematic solution that is focused on companies possessing sustainable competitive advantages, exhibited the worst performance of the group, despite having the third most flows for the month.

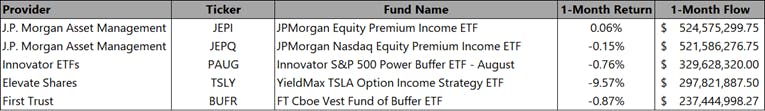

Structured Products

Though the performance of equity markets for the month has been negative, the trailing twelve-month returns have been positive across most sectors. Nevertheless, the structured products segment continues to garner flows as investors are still uncertain about the macroeconomic environment and its implications for the markets. The JPMorgan Equity Premium Income ETF (Ticker: JEPI) continues to be the top-of-mind solution for market risk mitigation by many investors, as evidenced by the strong inflows for the month and the modest positive performance. The JP Morgan (NYSE:JPM) Nasdaq Equity Premium Income ETF (Ticker: JEPQ) garnered the second most flows but had a negative performance. From a performance standpoint, the YieldMax TSLA Option Income Strategy ETF (Ticker: TSLY) had the worst performance of the group but garnered the fourth most flows.

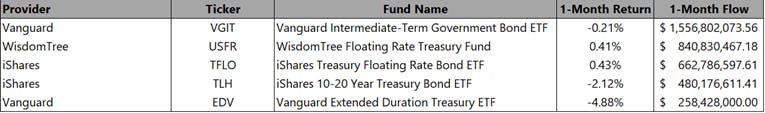

US Government Bonds

With interest rates remaining elevated, higher income from bonds has resulted in US Government Bonds remaining top of mind for investors. The Vanguard Intermediate-Term Government Bond ETF (Ticker: VGIT) garnered the most flows but had a negative performance for the month. The WisdomTree Floating Rate Treasury Fund (Ticker: USFR) and iShares Treasury Floating Rate Bond ETF (Ticker: TFLO) had the second and third most flows, respectively, and had a positive performance the month. Both of these ETFs are floating rate solutions that are tied to a short-term benchmark rate that adjusts periodically over time. The Vanguard Extended Duration Treasury ETF (Ticker: EDV) had the fifth most flows and had a negative performance for the month.

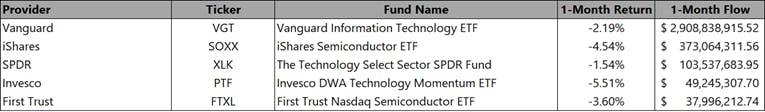

US Information Technology Sector

Though the technology sector had a negative performance for the month, but year to date its performance has been exceedingly strong and leads all other sectors. The Vanguard Information Technology ETF (Ticker: VGT) garnered the most flows for the month but had a negative performance. The iShares Semiconductor ETF (Ticker: SOXX) and First Trust Nasdaq Semiconductor ETF (Ticker: FTXL) had the second and fifth most flows, respectively, for the month. It is noteworthy to state that the Biden Administration announced expanding the restriction of exports of sophisticated Nvidia and Advanced Micro Devices (NASDAQ:AMD) artificial-intelligence chips beyond China to other regions including some countries in the Middle East during this month, which may have impacted the overall performance of the semiconductor industry.

This content was originally published by our partners at ETF Central.