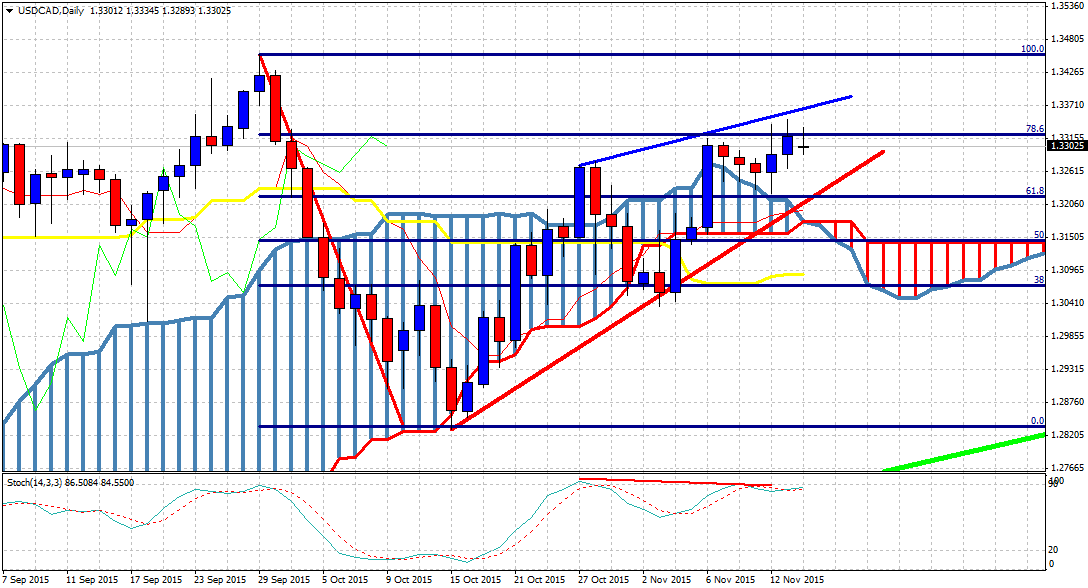

The Canadian Dollar and the price of Crude Oil per barrel are very closely related. USD/CAD is weakened (strong CAD) whenever we see OIL prices rise and vice versa. Recently we have seen Oil prices break below 42$ to just above 40$ but USD/CAD could not push above 1.3380. I would expect USD/CAD to be trading near 1.34 or higher but instead prices are captured inside a bearish wedge formation.

USD/CAD is trading above the Ichimoku cloud support but resistance at the 78.6% Fibonacci retracement remains still too strong to be broken. Price is above the important support trend line at 1.32 but despite the new short-term higher high the stochastic oscillator is providing a lower high, thus a bearish divergence.

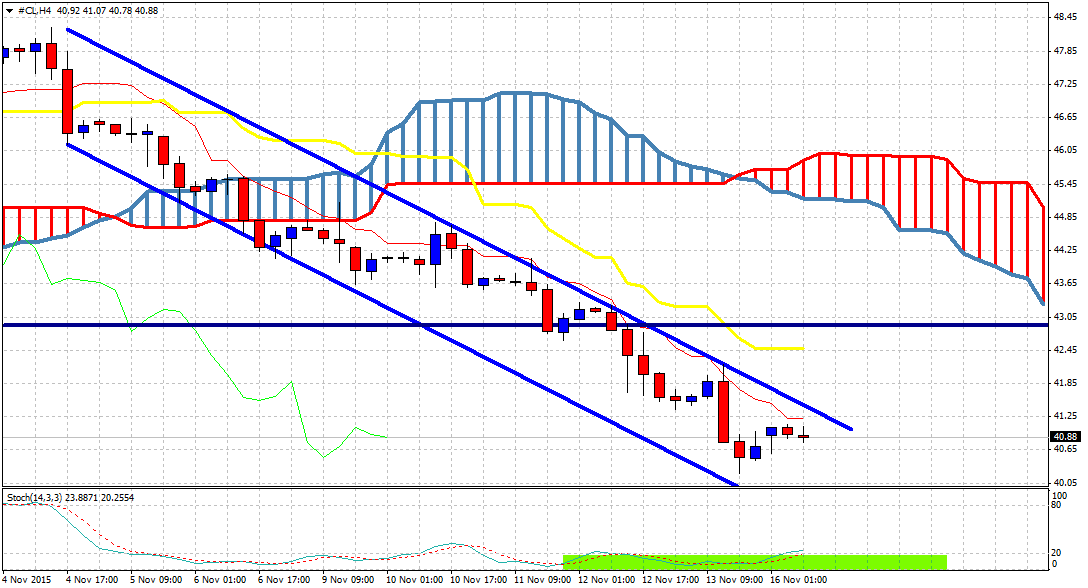

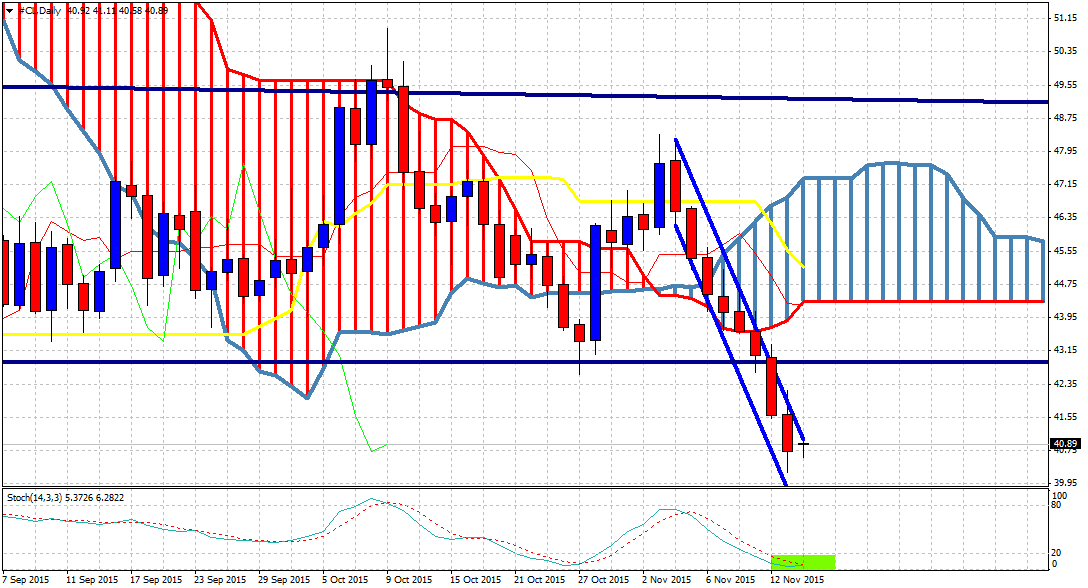

Oil remains in a clear bearish trend inside a bearish channel below the Ichimoku cloud resistance. Stochastic oscillators are very oversold in both the 4 hour and daily chart.

The Stochastic oscillator has reached price levels in the daily chart that signal a bounce will come soon. The bounce is at least expected to test the daily Ichimoku cloud at 44$ with many chances of a bigger upward bounce if we take into account that Oil prices could have finished 5 waves down from 113$ in August 2013. My focus now is on waiting for the next big move in these two products and will wait patiently for the reversal signals. My analysis tells me this is not the level to be long USD/CAD or short OIL.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.